[Asia Economy Reporter Ryu Tae-min] A transaction cliff is appearing in the Seoul villa (townhouse/multi-family) sales market, which heated up last year. This is interpreted as the burden of financing for buyers increasing due to interest rate hikes and strengthened loan regulations, and a strong wait-and-see sentiment ahead of the presidential election.

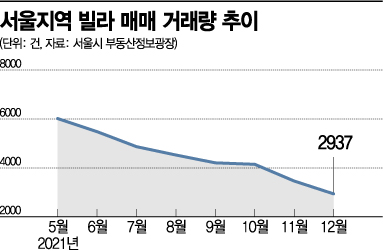

According to the Seoul Real Estate Information Plaza on the 18th, the number of villa transactions in Seoul in December last year was recorded at 2,937. This is only about half compared to May last year (6,019), which had the highest transaction volume. It is also the lowest level in 2 years and 9 months since February 2019, when there were 2,165 transactions.

The transaction cliff trend is also clear in the new year. As of this day, the number of reported sales in January is 485, which is about one-sixth of the transaction volume in December last year. Although the reporting period is still ongoing, industry insiders expect that the volume may not even reach that of December last year based on the current trend.

Last year, the Seoul villa sales market recorded an unprecedented boom. The volume greatly increased, surpassing apartment transactions, with an average monthly transaction volume of over 5,000 from January to October.

More Sellers than Buyers... Price Increase Rate Also Slows Down

The contraction in transactions is also confirmed by the sales supply-demand index. Like apartments, there are more sellers than buyers. According to the Korea Real Estate Board’s nationwide housing price trend survey, the villa sales supply-demand index in December last year was 97.5, falling below the baseline of 100 for the first time in 17 months since June 2020. The supply-demand index quantifies the proportion of demand and supply on a scale from 0 to 200, and a value below the baseline of 100 means there are more sellers than buyers.

As transactions dry up, the price increase trend is also slowing. According to the Korea Real Estate Board, the sales price increase rate for Seoul’s multi-family housing in December last year was 0.25%, down 0.23 percentage points from the previous month (0.48%). Over the course of last year, Seoul’s multi-family housing sales prices rose sharply by 4.13%.

Experts analyze that the transaction volume is sharply declining as buying demand weakens due to price fatigue from rapid house price increases, interest rate hikes, and the presidential election. Yeokyung Hee, Senior Researcher at Real Estate 114, explained, "Due to loan regulations and interest rate hikes, the atmosphere of real demand has recently decreased. In addition, since the rights assessment dates for redevelopment projects such as public redevelopment and urban public housing complex projects vary, there is an increased risk of cash settlement if purchased incorrectly, which has reduced investment demand compared to before."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.