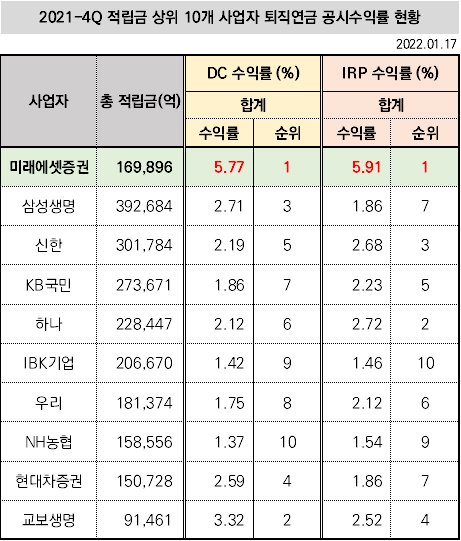

Top 10 Retirement Pension Fund Managers as of Q4 2021: DC and IRP Yield Ranked 1st for 7 Consecutive Quarters

[Asia Economy Reporter Song Hwajeong] Mirae Asset Securities announced on the 17th that it ranked first among the top 10 major retirement pension providers by reserve funds in terms of the one-year publicized yield of retirement pensions as of the fourth quarter of 2021, recording a 5.91% return on Individual Retirement Pension (IRP).

The Defined Contribution (DC) yield also recorded 5.77%, ranking first among the top 10 major retirement pension providers by reserve funds, marking the first place in both systems for seven consecutive quarters.

Mirae Asset Securities attributed its excellent yields to diversified investments through global asset allocation. Through local subsidiaries in the US, Europe, and Asia, Mirae Asset Securities quickly secures market trends and investment information in each region, identifies various global investment opportunities, and supports stable pension asset management by proposing rational asset allocation and optimal portfolios tailored to investment preferences. In addition, while discovering high-performing products, it actively rebalances underperforming products to improve the long-term operational performance of pension assets.

Based on these excellent retirement pension yields, Mirae Asset Securities’ pension reserves increased by more than 6 trillion KRW in 2021, achieving 170 trillion KRW in retirement pensions and 74 trillion KRW in personal pensions, respectively. This represents an approximately 33% increase compared to the 180 trillion KRW reserves at the beginning of the year, and more than 4 trillion KRW was added in just eight months after surpassing 200 trillion KRW in pension assets for the first time in the securities industry in April last year.

Looking only at DC and IRP, Mirae Asset Securities accounted for about 20% of the reserve fund increase among all 43 retirement pension providers, showing the largest increase, surpassing major banks and insurance companies.

Choi Jongjin, Head of the Pension Division at Mirae Asset Securities, said, “It is important to diversify investments into differentiated global quality products and systematically manage risks while increasing long-term yields through regular portfolio changes in pensions.” He added, “We will strive to contribute to practical retirement preparation by providing successful investment experiences to pension customers and increasing long-term yields through excellent product recommendations and differentiated professional consulting.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)