Commercial Banks Likely to Maintain Additional Interest Rates Starting from Low 3% Range

Possible to Keep Rates Stable

[Asia Economy Reporter Kiho Sung] As the Bank of Korea raised the base interest rate, attention is focusing on whether internet-only banks' unsecured loans will also be affected. The interest rates of internet banks have risen close to 10%, reducing their competitiveness, while the five major commercial banks have recently strengthened their operations by offering lower interest rates and simpler loan procedures. However, variables such as loan extension demand and adjustments to additional interest rates at internet banks still remain.

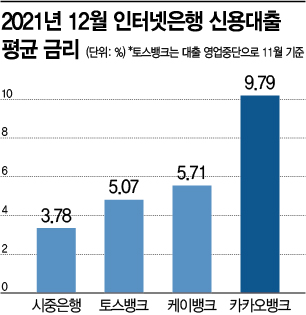

According to the financial sector on the 17th, KakaoBank's unsecured loan interest rate in December last year was 9.79%, already approaching the 10% level. K Bank's rate was 5.71%, and Toss Bank, which stopped loan operations immediately after opening, had a rate of 5.07% as of November last year. Considering the Bank of Korea's recent base rate hike last week, it is estimated that internet banks' interest rates will exceed 10% this month.

In comparison, commercial banks' interest rates remain relatively competitive. The average interest rate of commercial banks in December was 3.78%, and considering various preferential rates, the minimum annual rate is in the low 3% range.

The high interest rates at internet banks are due to their focus on loans to low- and middle-credit borrowers in the second half of last year. By attracting financial consumers with credit scores (based on KCB) of 820 or below, loan interest rates have risen. In the case of KakaoBank, it is temporarily suspending high-credit loans this year to expand loans to low- and middle-credit borrowers.

According to the Korea Federation of Banks, the proportion of new unsecured loans with interest rates above 10% at KakaoBank in November last year was 11.1%. Loans with rates between 9-10% accounted for 9.30%, and those between 8-9% were 9.70%. More than one-tenth of newly issued loans are approaching the level of secondary financial institutions. An official from an internet bank stated, "As loans to low- and middle-credit borrowers expand, the average loan interest rate inevitably rises," adding, "We are continuously enhancing the Credit Scoring System (CSS) to lower interest rates."

However, it is expected that borrowers will not massively leave internet banks. Since the base interest rate hike has generally increased interest rates across the financial sector, borrowers who have already obtained unsecured loans and overdraft accounts at reasonable rates in advance may find it advantageous to extend their existing internet bank loans. There is also speculation that internet banks will not raise additional interest rates for the time being to retain customers. Eun-gap Kim, a researcher at IBK Investment & Securities, explained, "Although the rise in loan interest rates partly reflects the expansion of loans to middle-credit borrowers by internet banks, overall, their interest rate competitiveness has weakened compared to large banks," adding, "Unlike commercial banks, internet banks can adjust additional interest rates more flexibly, so they may strategically choose not to raise loan interest rates for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)