Kwon Kwang-seok Led the Way... Profitability and Soundness Also Ranked 1st

3Q Record-Breaking Growth Rate... Core Profitability Indicators at Their Best

[Asia Economy Reporter Kwangho Lee] Woori Bank is expected to achieve an unprecedented growth rate last year, surpassing the three major banks (KB Kookmin, Shinhan, and Hana Bank), and is projected to record a net profit of over 2 trillion won since its establishment. It is also expected to leap from 4th to 1st place in terms of soundness, including profitability.

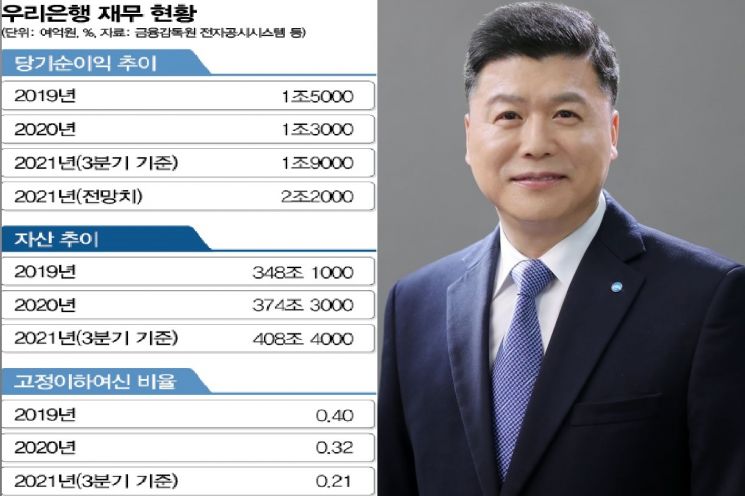

According to financial information provider FnGuide on the 17th, Woori Bank's net profit last year is expected to reach about 2.2 trillion won. This means it is on the verge of joining the '2 trillion club' based on annual performance.

Woori Bank's net profit in the third quarter of last year was 1.9867 trillion won, a 71% increase compared to the same period last year. This growth rate is overwhelmingly higher than that of Kookmin Bank (16.9%), Shinhan Bank (20.7%), and Hana Bank (17.7%).

Total assets are also expected to increase significantly. Woori Bank's total assets exceeded 400 trillion won, rising from about 348.1 trillion won in 2019 to about 374.3 trillion won in 2020, and about 408.4 trillion won in the third quarter of last year.

Key profitability indicators are also at the highest level among domestic banks. Woori Bank's return on assets (ROA) increased from 0.40% in 2019 to 0.37% in 2020, and 0.68% as of September 2021. Return on equity (ROE) also soared from 7.0% in 2019 to 5.95% in 2020, and 11.17% as of September 2021. Both indicators rank first among the four major banks. The non-performing loan (NPL) ratio, a major soundness indicator, improved from 0.40% in 2019 to 0.32% in 2020, and 0.21% as of September 2021. During the same period, the coverage ratio for loan loss provisions increased from 121.8% to 154.0%, and 193.4% in the third quarter of last year.

Thanks to these achievements, Woori Bank accomplished the feat of having its credit rating upgraded by international credit rating agencies: Standard & Poor's (S&P) raised it from A to A+, and Fitch upgraded it from A- to A. The industry views this credit rating upgrade as having contributed to the full privatization of Woori Financial Group.

In particular, the role of Kwon Kwang-seok, President of Woori Bank, is analyzed to have been significant. President Kwon actively participated in privatization as the head of Woori Bank's External Cooperation Division. He was appointed head of the External Cooperation Division, newly established in 2016 when privatization was being actively promoted, and focused on promoting the bank's value to investors, analysts, and general customers through domestic and international investor relations (IR). Recognized for his abilities, he also served as Vice President of the Investment Banking (IB) division. Since President Kwon's inauguration in early 2020, Woori Bank has not only laid the groundwork for a new leap through organizational restructuring but also achieved remarkable results in both profitability and soundness.

President Kwon is putting his life on digital transformation this year. As big tech platforms, emphasizing convenience and innovation, break down industry boundaries and expand their influence in the financial ecosystem, he plans to transform Woori Bank into a customer-centric number one financial platform company. This year's management strategy is set as ▲ strengthening platform dominance ▲ innovating core business competitiveness ▲ expanding the foundation for sustainable growth.

However, to achieve his goals, President Kwon must pass the subsidiary CEO candidate recommendation committee later this month. Since the candidate recommendation committee was newly formed due to privatization, a blueprint for the next president is expected to emerge. A financial industry official said, "President Kwon is evaluated as having diligently performed on results and tasks," adding, "Above all, since Woori Bank is the core of Woori Financial Group, there is a strong view that the president's term should align with the banking sector's usual 2 to 3 years for management continuity."

Meanwhile, the CEO terms of eight subsidiaries of Woori Financial Group, including Woori Bank, Woori Comprehensive Financial, and Woori Asset Trust, will expire in March this year. CEO appointments for Woori Financial Group's subsidiaries are decided by the candidate recommendation committee, which currently consists of five members (Chairman Sohn Tae-seung and four outside directors). In particular, with the recent addition of two new outside directors expected to join the committee, decision-making centered on outside directors is anticipated to be further strengthened.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)