Governor Lee Ju-yeol's Retirement and Presidential Election Overlap Mark End of Q2, Full-Scale Activity Expected from Second Half

Bank of Korea Governor Lee Ju-yeol is striking the gavel at the Monetary Policy Committee plenary meeting held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 14th. (Provided by Bank of Korea) [Image source=Yonhap News]

Bank of Korea Governor Lee Ju-yeol is striking the gavel at the Monetary Policy Committee plenary meeting held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 14th. (Provided by Bank of Korea) [Image source=Yonhap News]

[Asia Economy Reporter Minwoo Lee] The Bank of Korea's Monetary Policy Committee has raised interest rates twice in a row for the first time in 14 years. As the domestic economy continues its fundamental recovery and the expansion phase is expected to persist into the second half of the year, there is a strong possibility that interest rate hikes will continue.

On the 15th, Korea Investment & Securities made this forecast regarding the future movement of the base interest rate. The day before, the Bank of Korea's Monetary Policy Committee raised the base rate by 25 basis points (bp; 1bp=0.01%) as expected at its first rate-setting meeting of the year, from 1% per annum. With this second rate hike since November last year, the base rate has returned to pre-COVID-19 levels. This is the first time in 14 years since August 2007 that the Monetary Policy Committee has raised the base rate twice consecutively.

Yein Kim, a researcher at Korea Investment & Securities, explained, "The upward trend in international raw material prices shows no signs of stopping, strengthening the focus on price stability in policy operations," adding, "Governor Lee Ju-yeol hinted that in next month's revised economic outlook, the consumer price inflation forecast for this year will be presented at a minimum of 2.5%, significantly exceeding the Bank of Korea's target of 2%."

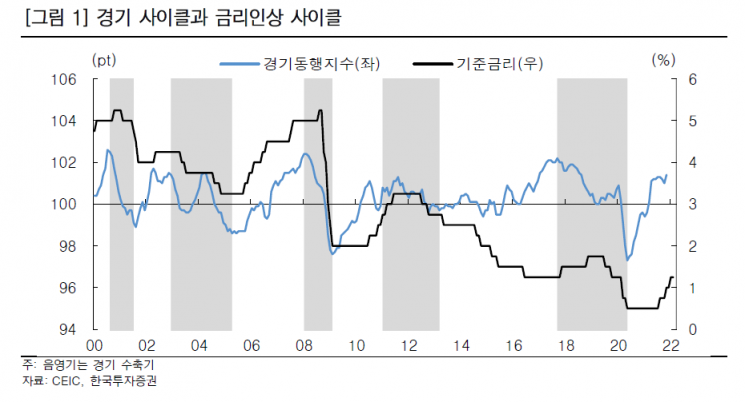

Accordingly, monetary policy normalization is expected to continue during the expansion phase in the second half of the year. First, due to the March presidential election and Governor Lee Ju-yeol's retirement, a monetary policy pause is inevitable in the second quarter. Therefore, it is anticipated that the interest rate hike cycle will fully commence from the second half of the year. Researcher Kim stated, "As the export cycle slows down while the domestic economy fundamentally recovers, the expansion phase is expected to continue into the second half," adding, "During this process, demand-side inflationary pressures and the ripple effects of rising raw material prices will combine, sustaining underlying inflationary pressures."

Except for the period after 2012 when the global economic recession structurally lowered the potential growth rate, historically, interest rate hike cycles tended to continue during expansion phases characterized by fundamental economic recovery and inflationary pressures. Researcher Kim analyzed, "Although Governor Lee Ju-yeol considers the decline in the neutral interest rate due to the drop in potential growth, he fundamentally decides the base rate based on economic and inflation trends, so there is a strong possibility that the interest rate hike cycle will continue during this expansion phase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)