Reuters, Citing Sources... Release Scale Likely to Be Determined by Oil Prices

[Asia Economy Reporter Lee Hye-young] Reuters reported on the 14th (local time) that China has agreed with the United States to release strategic petroleum reserves around the Spring Festival (Chinese New Year) holiday to stabilize international oil prices.

According to Reuters, multiple anonymous sources revealed that China agreed with the United States at the end of last year to release an unspecified amount of crude oil depending on the level of international oil prices.

One source stated regarding the release volume, "China decided to release a relatively large amount if the oil price exceeds $85 per barrel, and a smaller amount if it is around $75."

The timing of the release is expected to be around the Spring Festival. This year, China's Spring Festival holiday is from the 31st of this month to the 6th of next month. However, Reuters reported that China's National Grain and Material Reserve Administration has not yet commented on related inquiries.

This measure is part of the international cooperation led by the United States among major oil-consuming countries to stabilize international oil prices. In November last year, U.S. President Joe Biden ordered the release of 50 million barrels of reserves as oil prices soared to record highs amid inflationary pressures. India, Japan, and South Korea also participated in the reserve release.

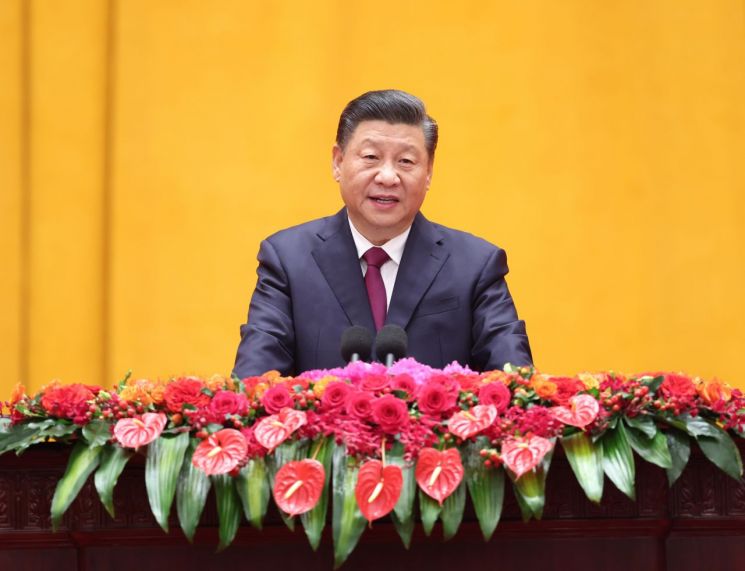

Zhao Lijian (趙立堅), spokesperson for the Chinese Ministry of Foreign Affairs, stated at the time regarding the U.S. proposal, "China will arrange the release of reserves according to actual conditions and demand."

Subsequently, the Hong Kong South China Morning Post (SCMP) reported in December last year that a meeting between U.S. and Chinese energy ministers regarding the release of reserves was being discussed.

China has not disclosed the size of its reserves since 2019, but it is estimated to be around 220 million barrels (about fifteen days' worth).

Earlier, in September last year, China sold strategic crude oil reserves to the private sector through an auction for the first time, citing domestic industrial needs.

Reuters reported that oil prices have rebounded recently due to supply disruptions in oil-producing countries such as Libya and Kazakhstan, a decrease in U.S. crude oil inventories, and expectations of increased fuel demand in Europe following the easing of COVID-19 restrictions. On this day, West Texas Intermediate (WTI) and Brent crude prices were trading in the $82 and $84 per barrel range, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.