Expectations for China's Economic Stimulus

Profit Growth Forecasted Due to Oil Price Stabilization

[Asia Economy Reporter Minji Lee] On the 16th, an opinion emerged that it is worth increasing interest in chemical stocks, which had shown sluggish stock performance due to weak demand and concerns over capacity expansion. This is because supply chain concerns are gradually being resolved, and cost burdens are expected to decrease with the stabilization of oil prices.

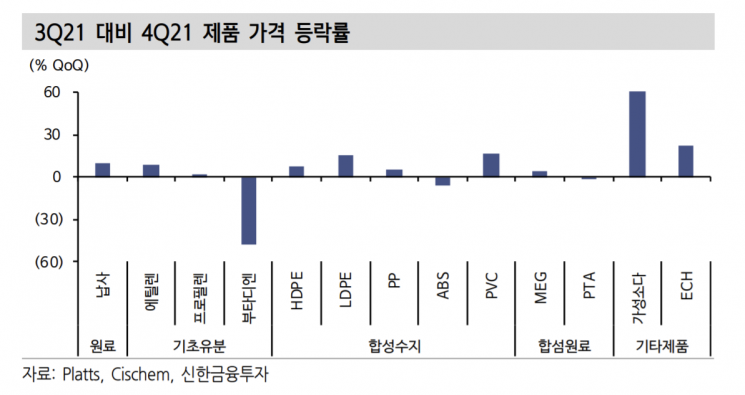

In the fourth quarter of last year, the combined spread of chemical products continued to decline, maintaining a sluggish market condition. Except for PVC, caustic soda, and ECH, which saw sharp price increases due to China's power shortages and strong coal prices, most product prices recorded lower growth rates compared to rising costs. In particular, butadiene prices plunged 48% due to demand slowdown and the impact of capacity expansion. The main factors for the spread decline are strong costs, weak demand, and the capacity expansion cycle in the Asia region.

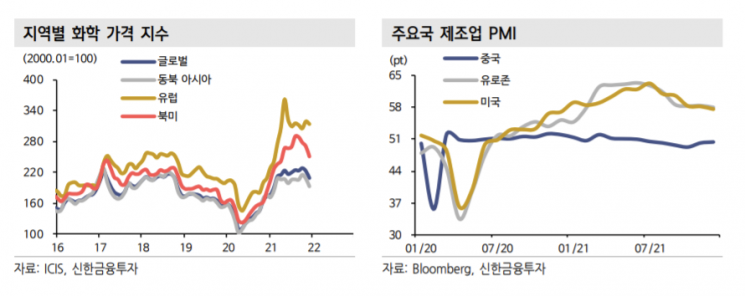

Naphtha prices rose 10% due to strong international oil prices, intensifying cost burdens following the third quarter. China's manufacturing sector slowed down due to power shortages and the resurgence of COVID-19, and advanced countries' manufacturing also showed sluggish trends due to various bottlenecks. Jinmyung Lee, a researcher at Shinhan Financial Investment, analyzed, "On the other hand, supply burdens have increased due to new capacity expansions centered in China," adding, "China's PE and PP production volumes have continuously increased, while imports have continued a negative growth trend since April last year."

According to Shinhan Financial Investment, major chemical companies such as Lotte Chemical, Daehan Petrochemical, and Hyosung Chemical are expected to record earnings below market expectations. In the case of Lotte Chemical, all business divisions are expected to report poor results due to product spread slowdown and one-time costs from regular maintenance. Daehan Petrochemical is forecasted to record a significant profit decline due to weak market conditions for its main products and negative lagging effects. Hyosung Chemical is expected to see a 38% profit decrease compared to the previous quarter due to spread contraction from strong propane prices and the impact of regular maintenance at its Vietnam facility. Hyosung TNC is projected to experience a 12% profit decline due to spread decreases caused by raw material price increases despite steady spandex selling prices.

Hyosung Advanced Materials, Hanwha Solutions, and SKC are expected to meet market expectations, while Kolon Industries is predicted to record earnings below market expectations. Hyosung Advanced Materials is likely to see a slight profit decline due to reduced sales volume from customer inventory adjustments, offset by price increases in tire cords. Hanwha Solutions is expected to see earnings growth due to improved chemical performance from strong PVC and caustic soda prices and reduced losses in Q CELLS. SKC is anticipated to experience reduced profits due to bonuses and expansion-related costs despite strong performance in mobility materials and chemical sectors. Kolon Industries is forecasted to report poor results due to decreased subsidiary earnings and one-time costs such as bonuses, despite strong performance in tire cord and fashion sectors.

However, stock price increases are expected as the chemical industry outlook improves after the first quarter. This is due to anticipated demand recovery following the Chinese Winter Olympics, expectations for economic stimulus measures, gradual resolution of bottlenecks, and cost burden relief from the downward stabilization of oil prices.

Researcher Jinmyung Lee stated, "In pure chemicals, I recommend Hyosung Chemical, which can achieve significant earnings growth with cost burden relief, and Lotte Chemical for bottom-fishing targeting an industry rebound," adding, "In hybrid chemicals, Hanwha Solutions and Hyosung Advanced Materials, which hold tightly supplied chemical products and have potential for earnings improvement in growth businesses, are promising."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.