The prolonged COVID-19 pandemic has deepened the struggles of small business owners and self-employed individuals. A closed store in Myeongdong, Seoul. Photo by Mun Ho-nam munonam@

The prolonged COVID-19 pandemic has deepened the struggles of small business owners and self-employed individuals. A closed store in Myeongdong, Seoul. Photo by Mun Ho-nam munonam@

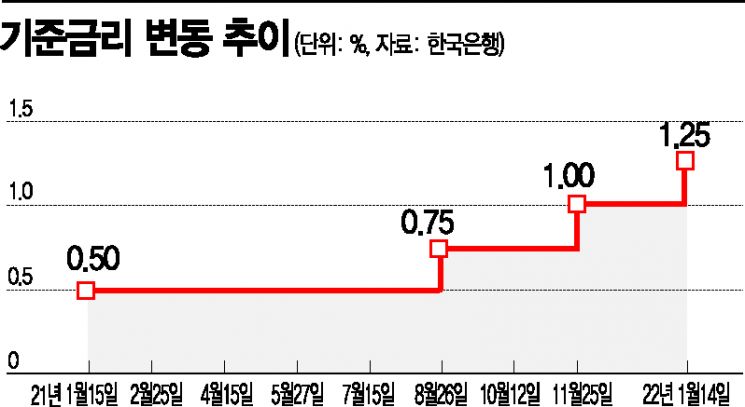

[Asia Economy Reporter Junhyung Lee] Small business owners expressed concerns after the Bank of Korea's Monetary Policy Committee raised the base interest rate by 0.25 percentage points from 1% to 1.25% on the 14th.

The Korea Federation of Small and Medium Business stated in a commentary on the same day, "The Bank of Korea has decided to raise the base interest rate by 0.25 percentage points," adding, "The loan interest burden on small business owners, who have been directly hit by the COVID-19 crisis, is bound to intensify." They continued, "The three base rate hikes since August last year are inevitably perceived as sharp increases by small business owners," and added, "This will be a fatal blow to small business owners who are surviving by borrowing to repay existing debts."

In fact, the loan interest burden on self-employed individuals is higher than that of non-self-employed individuals. According to the Bank of Korea, the outstanding loans of self-employed individuals in the third quarter of last year amounted to 887 trillion won, a 14.2% increase compared to the same period the previous year. The average loan amount per self-employed person was 350 million won as of the end of September last year, about four times higher than that of non-self-employed individuals (90 million won). Additionally, the debt service ratio (DSR) for self-employed households last year was 37.1%, 6.1 percentage points higher than that of non-self-employed households (31.0%). The Korea Federation of Small and Medium Business criticized, "Continuing to push for interest rate hikes, which should be implemented only after a visible recovery in the small business economy, imposes an additional burden on small business owners," and said, "This is an action that does not deeply consider the situation of small business owners."

The Federation also called for follow-up measures. They stated, "Apart from the base interest rate hike, the government should suppress increases in low-interest policy funds for small business owners and further expand the supply of policy funds," and strongly urged the financial authorities to "significantly extend the loan maturity extension and interest repayment deferral policies, which are set to end at the end of March this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)