[Asia Economy Reporter Lee Seon-ae] Recently, there has been a flood of opinions from the securities industry advocating an increase in investment weight for Hyundai Motor Company. The common investment view is that now is the time to increase weight, highly valuing the medium- to long-term growth expectations.

On the 15th, Hanwha Investment & Securities analyzed that although Hyundai Motor's fourth-quarter earnings are expected to fall short of market expectations, considering the medium- to long-term growth prospects, it is time to gradually increase investment weight. The investment opinion was maintained as Buy, with a target price of 300,000 KRW.

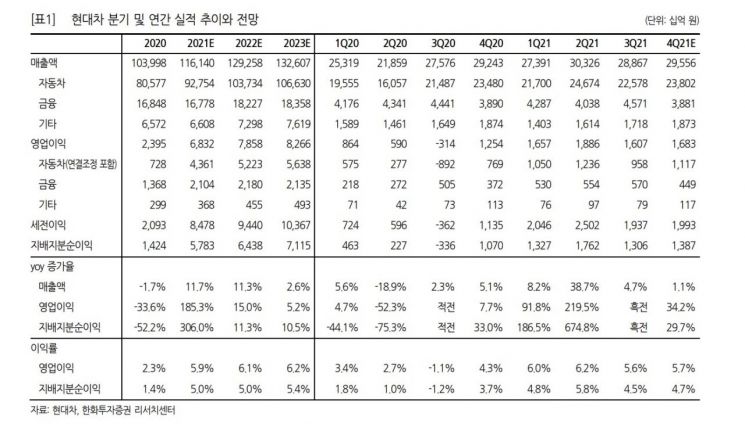

Last year's fourth-quarter Hyundai Motor sales and operating profit are expected to record 29.6 trillion KRW and 1.68 trillion KRW, up 1.1% and 34.2% year-on-year, respectively. Kim Dong-ha, a researcher at Hanwha Investment & Securities, explained, "Although the performance was good in terms of price, the global wholesale sales slump due to semiconductor shortages and the rise in raw material prices negatively affected the results, causing them to fall short of market expectations."

This year, growth is expected to continue through increased volume. Hyundai Motor's global wholesale sales target for this year is 4.323 million units, an 11% increase from the previous year. Consolidated sales for this year are projected to increase by 11.3% to 129.3 trillion KRW, and operating profit is expected to rise by 15% to 7.86 trillion KRW.

Researcher Kim emphasized, "The stock price will be re-evaluated thanks to future earnings improvements and medium- to long-term growth expectations," adding, "The expansion of overseas electric vehicle production capacity and the upward revision of medium- to long-term electric vehicle penetration targets can act as catalysts for stock price increases once materialized."

Hi Investment & Securities also maintained a Buy rating and a target price of 320,000 KRW for Hyundai Motor, advising an increase in investment weight.

Researcher Shin Yoon-chul estimated that Hyundai Motor's fourth-quarter sales last year were 30.5 trillion KRW, a 4.3% increase from the same period last year, and operating profit was 1.83 trillion KRW, up 44.0%.

Researcher Shin analyzed, "Although Hyundai Motor's fourth-quarter performance seems to fall short of market expectations, the overall earnings trend is favorable," adding, "The automotive division's performance slightly improved year-on-year due to expanded Genesis sales."

He emphasized, "Hyundai Motor will find it difficult to completely escape the impact of vehicle semiconductor shortages this year as well, but the fourth-quarter results confirmed that the automotive division has bottomed out, and there is anticipation as the Ioniq 6 is scheduled to be released in the first half of this year."

He further stressed, "Hyundai Motor will actively present the results of progress in future mobility business to the market this year and resolve valuation discounts," emphasizing the increase in Hyundai Motor's investment weight.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)