Global Market Volatility Intensifies as an Opportunity

Accumulate ETFs for Long-Term Investment Opportunities

Plans to Launch Various Thematic ETFs Including Cybersecurity ETFs

[Asia Economy Reporter Junho Hwang] "This year is the right time to buy Exchange-Traded Funds (ETFs)."

Namgi Kim, Head of the ETF Management Division at Mirae Asset Global Investments, which is vying for the top spot in ETFs this year, stated, "The increased volatility in the global market is actually an opportunity."

He noted, "If approached short-term, it is difficult to replicate an exceptionally high return year like last year." However, he analyzed that "for those investing long-term, such as through pension accounts, this year should be one to increase their holdings." Last year, the annual returns of the Nasdaq and S&P 500, converted to Korean won, reached 40%. Abundant liquidity raised the market temperature. However, tightening measures are expected this year, and shocks to the stock market are anticipated. In such times, adopting a strategy of steadily accumulating ETFs can create a year of opportunity from a long-term perspective, according to him.

Kim said he plans to respond to such market conditions by launching a wider variety of products. He explained, "The ETF market, which started with leverage and inverse ETFs, has transformed into a long-term investment market through thematic ETFs," adding, "We will strengthen the diversity of themes and provide opportunities to broaden the investment spectrum." This year, Kim plans to proactively launch ETFs with more diverse themes, such as a ‘Cybersecurity ETF.’ Following last year’s launch of the ‘U.S. Nasdaq 100 ETF,’ he aims to expand investors’ choices by introducing a product that invests in the Nasdaq 200.

Kim cited a frequently asked question recently: "Since prices have risen a lot, is it still okay to buy more ETFs?" He responded, "If you are just holding cash, you need to consider how to cope with the declining value of money," and added, "ETFs are easy to trade like direct investments but are indirect investment products that invest in specific themes or indices, making stable returns achievable." He also mentioned that he personally accumulates ETFs such as ‘Nasdaq 100,’ ‘S&P 500,’ ‘Philadelphia Semiconductor Nasdaq,’ ‘U.S. Tech Top 10,’ and ‘China Electric Vehicle SOLACTIVE’ through his pension account.

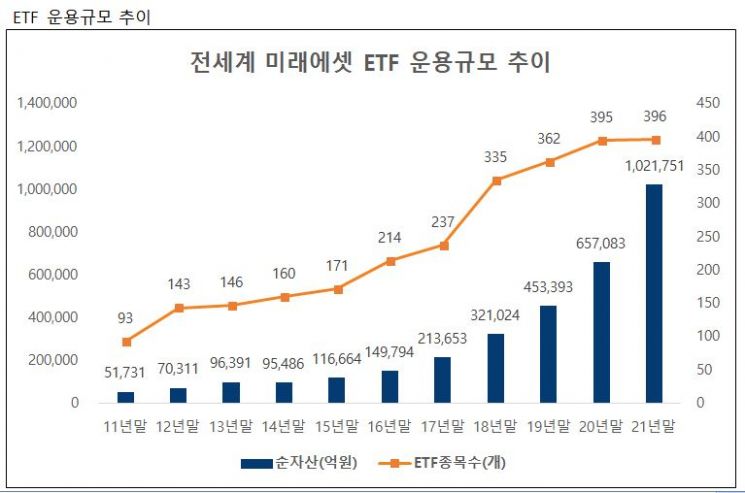

Meanwhile, Mirae Asset operates 134 ETFs under the ‘TIGER’ brand as of the end of last year. Its net asset size is 26.2 trillion KRW, securing a 35.5% market share of the domestic market. Additionally, by acquiring Canada’s Horizon ETFs and the U.S.’s Global X, it manages assets totaling 100 trillion KRW across 10 countries including Korea, the U.S., Canada, Hong Kong, and Japan. The total size of the domestic ETF market is approximately 74 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.