Producer Price Index Rises 9.7%

59% of US CEOs Say "Inflation Will Continue Rising"

Inflation Concerns Weigh on Companies

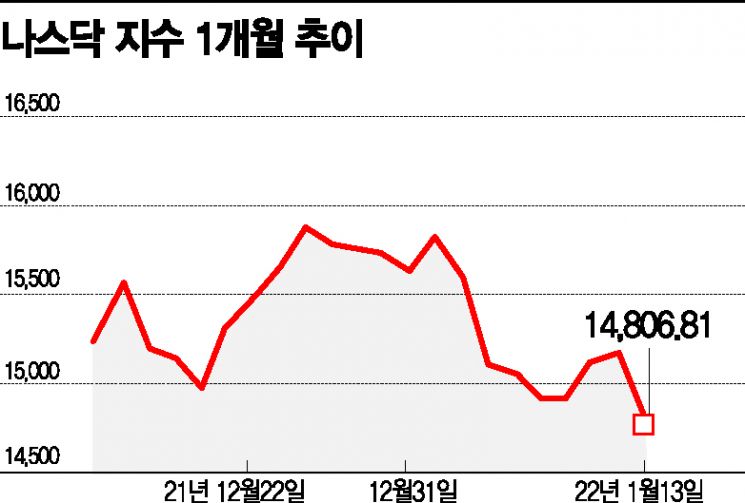

[Asia Economy New York=Correspondent Baek Jong-min] The Nasdaq index on the U.S. New York stock market failed to continue its rebound and plunged by 2.5%. This was due to the Federal Reserve (Fed) senior officials signaling four interest rate hikes this year amid the ongoing high inflation in the U.S. Concerns are also growing that interest rate hikes to curb inflation could worsen corporate management.

On the 13th (local time), the Nasdaq index closed down 2.51% on the New York stock market. The decline was more pronounced compared to the Dow Jones Industrial Average (0.49%) and the S&P 500 index (1.42%).

This is interpreted as a result of inflation fears swelling after the Consumer Price Index (CPI) announced the previous day rose by 7%, followed by the Producer Price Index (PPI) rising 9.7% on the same day. The sharp rise in the PPI, which is considered wholesale prices, is seen as a factor that could lead to an increase in retail prices.

Fed senior officials’ consecutive hawkish remarks also dampened investor sentiment.

Lael Brainard, the Fed Vice Chair nominee who was regarded as a dove favored by the progressive camp, emphasized at the Senate confirmation hearing that curbing inflation is the Fed’s top priority. Brainard pointed to March, when tapering (asset purchase reduction) ends, as the timing for interest rate hikes.

Other Fed officials also stoked expectations for four interest rate hikes within the year. Charles Evans, President of the Chicago Fed, mentioned that 2 to 4 rate hikes would be necessary this year, and Patrick Harker, President of the Philadelphia Fed, also anticipated the possibility of four rate hikes within the year. The Chicago Mercantile Exchange’s FedWatch tool estimated a 53.5% chance of four rate hikes this year.

Although the possibility of an accelerated pace of rate hikes increased, the U.S. 10-year Treasury yield fell to as low as 1.695% during the day, dropping below 1.7%. This was a reversal from the previous surge to 1.8%. CNBC interpreted that the Treasury yield seemed to have priced in inflation concerns in advance.

One day earlier, the 10-year Treasury auction attracted strong demand with a bid-to-cover ratio of 2.51. The decline in long-term Treasury yields is interpreted as investors still anticipating that the economy could decline due to the impact of rate hikes.

Jim Vogel, Investment Strategist at FHN Financial, explained, "It seems that the demand for Treasury purchases, which had been postponed after the CPI announcement, has spread."

Rising prices and the resulting interest rate hikes are also becoming a burden for companies.

According to a business outlook report released on the same day by the U.S. nonprofit economic research organization Conference Board, which surveyed 917 global CEOs, inflation concerns ranked second as a risk factor this year, following COVID-19. In the same survey last year, inflation concerns ranked only 22nd.

82% of CEOs responded that they are facing price pressure. While 55% of all surveyed business executives expected inflation to remain high until mid-2023 or later, 59% of U.S. CEOs anticipated continued inflation. When inflation rises alongside wage increases, companies have no choice but to raise prices. Especially, U.S. CEOs expressed a proactive stance on raising prices.

Companies are also worried that this vicious cycle could lead to economic deterioration. In the Conference Board survey, the possibility of a recession ranked sixth among threats to business management this year.

Darius Adamczyk, CEO of Honeywell International, expressed concern to The Wall Street Journal, saying, "If the brakes are applied too hard to stop inflation, a recession could occur."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.