Decision to Postpone Corrective Measures Until 2027

Capital Expansion Burden... Insurance Companies Breathe a Sigh of Relief

[Asia Economy Reporter Oh Hyung-gil] With the introduction of the new solvency regime (K-ICS) scheduled for next year, securing financial soundness has become a key issue in the insurance industry. This is because the new system will evaluate liabilities at market value, causing the solvency (RBC) ratio to drop significantly. However, since sanctions are expected to be deferred until 2027, insurance companies have been able to breathe a sigh of relief for now.

According to the financial industry on the 14th, the Financial Supervisory Service recently released a provisional plan for the introduction standards of K-ICS. The biggest difference between this provisional plan and the previous one (K-ICS 4.0) is the application of transitional measures.

K-ICS, introduced in accordance with the new International Financial Reporting Standards (IFRS17), is a new capital regulation different from the existing RBC ratio, with its most notable feature being the calculation of solvency based on market value. Solvency refers to whether an insurance company holds reserves exceeding the insurance payments it must make to policyholders. Under the current Insurance Business Act, it is mandated to maintain this ratio at 100% or higher.

Solvency is calculated by dividing available capital by required capital. Under K-ICS, capital is evaluated based on market value rather than the previous cost basis, meaning it will be revalued at current interest rate levels. From the insurers’ perspective, this means they need to accumulate more available capital.

Accordingly, the provisional plan recognizes hybrid capital securities issued under the existing RBC system as basic capital up to 15% of total required capital for all insurers during the transitional period. Additionally, the portion of hybrid capital securities exceeding the basic capital limit and subordinated bonds will be recognized as supplementary capital, reducing the burden on insurers to increase capital.

Furthermore, for insurers who submit prior notifications, a buffer period has been established allowing them to gradually recognize the increase in reserves due to market value evaluation of liabilities and the burden related to insurance, equity, and interest rate risks during the transitional period. This transitional measure will be applied for 10 years, from January 1, next year, to December 31, 2032.

In particular, even if the solvency ratio under K-ICS falls below 100%, if the solvency ratio under the existing RBC standard exceeds 100%, the prompt corrective action will be deferred. The deferral period is about five years, until the end of December 2027. However, during this period, the relevant insurers must enter into management improvement agreements with the Financial Supervisory Service and report on their compliance.

The insurance industry evaluates that this transitional measure has eased the regulatory burden associated with the introduction of the new system. Previously, Basel III for banks and Solvency II in Europe were successfully introduced based on transitional measures lasting up to 10 and 16 years, respectively.

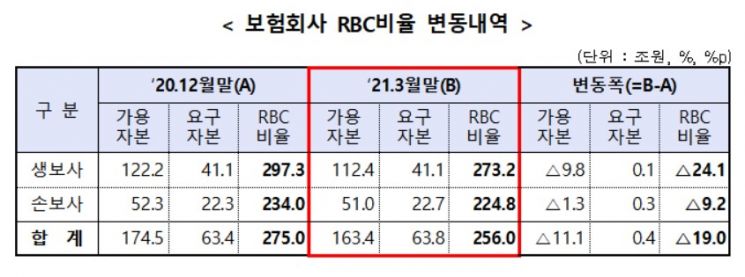

Meanwhile, recently, insurers’ RBC ratios have been on a downward trend due to rising interest rates and falling stock prices. As of the third quarter of last year, the average RBC ratio of domestic insurers was 254.5%, down 6.4 percentage points from the end of the previous quarter.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)