Moral Hazard in Debt Relief... Controversy Over Fairness with Diligent Repayers

[Asia Economy Reporter Kwangho Lee] Large-scale debt forgiveness policies, which are repeated during every regime change, are becoming increasingly bold. The government claims these are part of inclusive policies to protect financially marginalized groups hit hard by COVID-19, but there are concerns that they could lead to moral hazard among debtors and fairness issues for those who repay their debts diligently. Especially with the presidential election approaching, frequent debt forgiveness measures have drawn criticism for undermining the principles of the financial system.

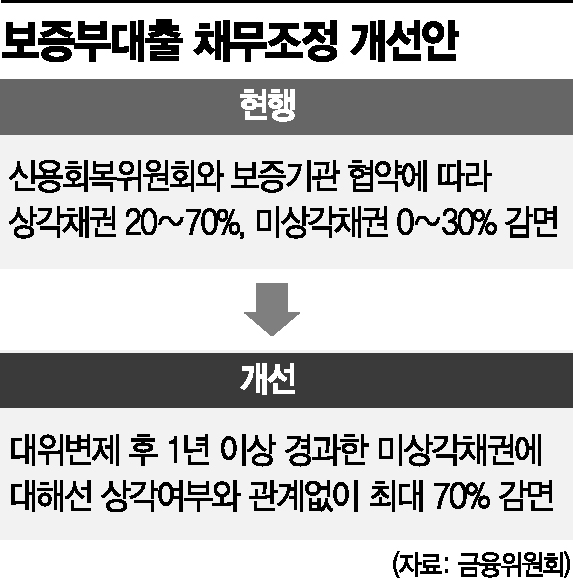

According to financial authorities and the financial sector on the 13th, the Financial Services Commission and the Credit Recovery Committee are preparing to improve the debt adjustment criteria for guaranteed loans. Currently, written-off debts are reduced by 20-70%, and non-written-off debts by 0-30% of the principal. With the new improvements, the reduction rate for non-written-off debts that have passed more than one year after subrogation payment will be expanded to the level of written-off debts (0-70%), regardless of whether they are written off. The prerequisite period will also be expanded from one year after subrogation payment to six months, and the plan is to apply this starting next month.

Earlier, the Financial Services Commission extended the application period of the ‘Strengthening Support Measures for Vulnerable Individual Debtors’ until the end of June this year. This includes special debt adjustment by the Credit Recovery Committee, special pre-workout arrangements by individual financial companies, and the Korea Asset Management Corporation (KAMCO) personal delinquent debt purchase fund. This policy has been implemented to prevent individual debtors who have experienced income reductions due to unpaid leave or loss of work caused by COVID-19 from facing disadvantages in financial use due to household loan delinquencies. This is already the third extension. The deferred individual debt amounts to about 1 trillion won.

The special pre-workout arrangement allows for a maximum one-year deferment of principal repayment on credit loans and policy financial loans if, since February 2020, monthly income excluding living expenses has become less than the monthly debt repayment amount.

KAMCO’s purchase of delinquent debts has also been extended by six months and will be implemented until the end of June. During this period, if an individual financial company deems it unavoidable to sell personal delinquent debts for internal soundness management, KAMCO will prioritize purchasing those debts. After purchase, KAMCO exempts delinquency interest for a certain period and supports repayment deferment for up to two years, debt reduction, and long-term installment repayment.

In November last year, measures were also introduced to support principal and interest reduction for youth student loans and financial loans. When applying for student loan debt adjustment, the debt adjustment fee of about 50,000 won is waived, and up to 30% of the principal can be reduced. All delinquency interest is waived, and the installment repayment period can be extended up to 20 years.

Criticism of Principle Breakdown Ahead of Presidential Election

These measures are evaluated as policies to embrace financially marginalized groups struggling due to COVID-19. However, since financial institutions repay debts on behalf of individuals, fairness controversies are inevitable. Some argue that these are populist policies aimed at winning votes ahead of the presidential election.

A financial sector official said, "If the reduction rate for non-written-off debts improves next month, debtors who abuse the system may emerge, causing moral hazard," adding, "As the government approaches this with political logic under the pretext of protecting the vulnerable, market functions are being distorted." In response, a Financial Services Commission official stated, "Along with improving debt adjustment criteria, we plan to implement supplementary measures to prevent undermining the recovery rate of guarantee institutions or causing moral hazard."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)