Card Companies' Auto Installment Financing Assets Reach 9.7949 Trillion Won

Aggressive Asset Expansion with Low Delinquency Rates

Card Industry Faces Profitability Challenges

Auto Installment Financing Strategy Expected to Accelerate This Year

[Asia Economy Reporter Ki Ha-young] Seong Min-jeong (35, pseudonym), an office worker planning to purchase a Hyundai Avante for commuting, decided to buy the car through a credit card installment plan. With a waiting period of 4 to 5 months until vehicle delivery, she was looking for ways to secure funds and was attracted by the card company's low interest rate of 2.2% (based on 30% cash purchase ratio and 36 months). Seong said, "The card installment plan has a low interest rate and no early repayment fees," adding, "I also liked that it is not considered a loan."

The scale of automobile installment financing handled by credit card companies has approached 10 trillion won. This clearly shows the dominance of credit card companies in the automobile installment financing market, which was traditionally the domain of capital companies. As the business environment surrounding the card industry worsens, an active offensive in the automobile installment financing market is expected this year, making competition even fiercer.

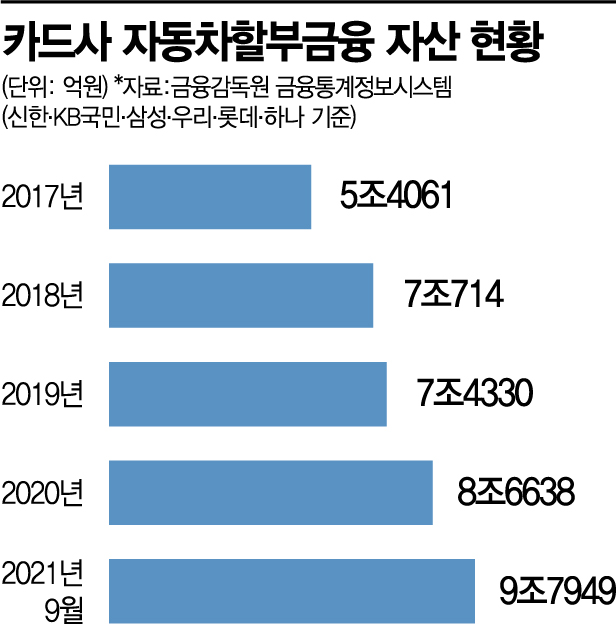

According to the Financial Supervisory Service's Financial Statistics Information System on the 13th, the automobile installment financing assets of six credit card companies (Shinhan, KB Kookmin, Woori, Samsung, Hana, and Lotte Card) reached 9.7949 trillion won at the end of the third quarter last year. This is an increase of 1.1311 trillion won (13.1%) from 8.6638 trillion won at the end of 2020.

The automobile installment financing assets of credit card companies have nearly doubled in the past four years. They grew from 5.4061 trillion won in 2017 to 7.0714 trillion won in 2018, 7.433 trillion won in 2019, and 8.6638 trillion won in 2020, maintaining an annual growth rate of over 10%.

As credit card companies entered the automobile installment financing market, the outstanding balance of automobile installment financing also increased by more than 10 trillion won over the past four years. According to the Credit Finance Association, the outstanding balance of automobile installment financing, which was 27.0267 trillion won in 2017, rose by 38% to 37.2852 trillion won in the second quarter of last year. The increase in automobile installment financing assets by credit card companies directly contributed to the overall market expansion. Consequently, the market share of credit card companies in new car financing nearly doubled during the same period, reaching close to 30%.

Although assets have increased, delinquency rates are being managed at low levels. A representative from Card Company A said, "Delinquency rates in automobile installment financing are being stably managed," adding, "Most customers using automobile installment plans are economically stable people in their 40s and 50s." A representative from Card Company B also explained, "Even if there is delinquency in automobile installment financing, there is collateral in the form of the vehicle," and "This is why card companies can aggressively expand assets while offering low interest rates."

Going forward, credit card companies are expected to accelerate their pursuit of the automobile installment financing market. This is because automobile installment financing is the area generating profits, excluding merchant fees that are running at a loss and long-term card loans (card loans) that have been compensating for those losses. An industry insider predicted, "As profitability is expected to deteriorate this year, aggressive moves by credit card companies in the automobile financing market are likely to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)