Localization of pneumatic devices in the 1980s... Hyundai and Kia as '40-year' clients

Motion control as a new growth engine... "50% sales share within 3 years"

Mass production of 3D bioprinters started this March... Aggressive sales expansion in China

[Asia Economy Reporter Junhyung Lee] Pneumatic devices such as pneumatic cylinders and pneumatic actuators are core components of automation equipment. They control the direction and movement of machines by regulating compressed air inside tubes. Although domestic companies have pursued localization since the 1980s, Japan still holds over 60% of the market share. The market leader, Japan's SMC Pneumatics, occupies nearly 50% of the market. This is because most domestic manufacturers applied Japanese pneumatic devices when building automation equipment.

TPC Mechatronics is a frontrunner in the domestic pneumatic device market. Established in 1979, the company succeeded in localizing pneumatic devices in the early 1980s, a time when manufacturing powerhouses like Japan and Germany monopolized the market. From the early 1980s, the company secured Hyundai Motor Company and Kia Motors as clients. Even after 40 years, TPC Mechatronics' pneumatic devices are used at Hyundai's Ulsan and Asan plants and Kia's Hwaseong plant. The company has also supplied major conglomerates such as LG Electronics, LG Chem, Samsung Electronics, and Hyundai Mobis. Its market share in the domestic pneumatic device market is about 10%.

Development of Motion Control

Motion control is another growth area for the company. Motion control performs the same functions as pneumatic devices but operates using electrical control signals instead of air and pressure. Representative motion control devices include servo motors, linear motors, and Cartesian robots. Because of their precise control capabilities, demand is high in advanced industries such as semiconductors and secondary batteries. TPC Mechatronics acquired Cartesian robot company CN Motion Tech and linear motor company Nano Motion Technology consecutively 10 years ago and began mass production of motion control devices in 2013. Clients include LG's Production Research Institute (PRI), equipment companies Cham Engineering, SFA, and AP Systems. As of 2020, motion control accounted for about 22% of sales.

The company is led by second-generation owner Vice Chairman Jae-yoon Eom. Vice Chairman Eom personally designated motion control as the company's future growth engine, anticipating that the pneumatic device market would be reshaped alongside smart factories, which require precision control systems. He explained, "Motion control is a substitute for pneumatic devices but is about 40-50% more expensive, so demand for pneumatic devices remains high. However, due to high market growth potential and to expand the product portfolio, we started the motion control business." Vice Chairman Eom expects the sales proportion of motion control to rise to 50% within three years.

Accelerating 3D Printer Business

The company is also focusing on its new 3D printer business. In 2019, it invested about 1 billion KRW in 3D bioprinter venture company Clisel and formed a strategic partnership to produce and distribute Clisel's 3D bioprinters. During the technology development phase, Clisel verified the performance of its 3D bioprinters at Seoul National University Hospital, Korea University Guro Hospital, and major pharmaceutical companies. Last month, Clisel completed product development and released the final prototype.

This is not TPC Mechatronics' first attempt at the 3D printer business. In October 2013, the company acquired 3D printer firm Anyworks and pursued related business. The following year, it launched the 3D printer 'Finebot' with ambitions to compete against the market leader MakerBot in the U.S. This indicates that the company has accumulated know-how related to 3D printers. Since motion control is necessary for 3D printers, there is potential for the company's core products to be applied.

The 3D bioprinter 'U-FAB,' developed by Clisell last month. TPC Mechatronics is responsible for the production and distribution of the Clisell 3D bioprinter.

The 3D bioprinter 'U-FAB,' developed by Clisell last month. TPC Mechatronics is responsible for the production and distribution of the Clisell 3D bioprinter. [Photo by TPC Mechatronics]

The company plans to mass-produce 3D bioprinters by the end of March this year. Vice Chairman Eom stated, "The new product is a high value-added device capable of culturing cancer cells using 3D printing technology," adding, "We are also considering spinning off the bio business division."

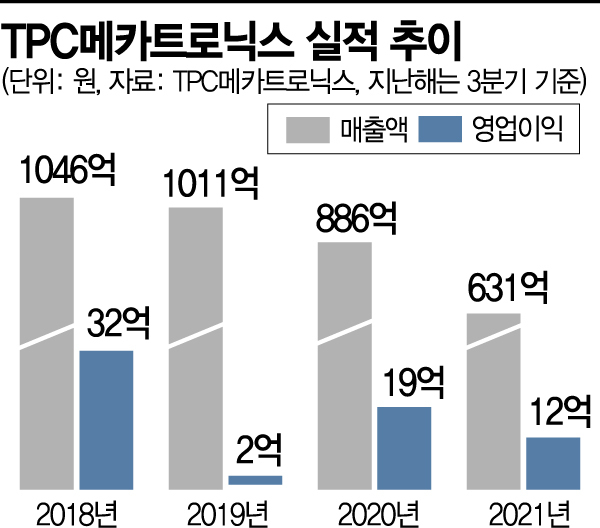

Regarding its core pneumatic devices, although the company has become the number one domestic supplier, Vice Chairman Eom notes that the market share is still in the 10% range, indicating many potential customers. The company completely reorganized its sales organization in the second half of last year. Vice Chairman Eom said, "Our goal this year is to achieve a 37% sales growth rate by securing new customers in advanced industries such as semiconductors and secondary batteries," and added, "We also plan to aggressively expand sales at our China subsidiary, where a 20% sales growth rate is expected this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)