Foreigners and Institutions, POSCO, Hyundai Glovis Lead Net Buying Trend

Hana Financial Investment: "It's Too Early to Declare Growth Stocks Defeated"

[Asia Economy Reporter Ji Yeon-jin] Since the beginning of the year, as the US Federal Reserve's (Fed) 'tightening wave' has swept through, value stocks delivering stable earnings have been gaining attention.

According to the Korea Exchange on the 11th, the KRX Insurance Index recorded the highest return, rising 11.99% so far this year until the previous day, followed by KRX Steel at 7.25%. During this period, the KOSPI fell by 1.71%. The stocks most commonly purchased by both institutional and foreign investors since the beginning of the year were POSCO and Hyundai Glovis.

The minutes of the US Federal Open Market Committee (FOMC) released last month suggested that the Fed's quantitative tightening (QT) could occur earlier than expected, freezing investor sentiment. In particular, growth stocks, which surged significantly last year, experienced large declines. The KRX Media and Entertainment Index dropped by 12.06%, while KRX Semiconductor and Healthcare retreated by more than 5%. This was due to foreign and institutional investors realizing profits mainly on stocks with high corporate valuations.

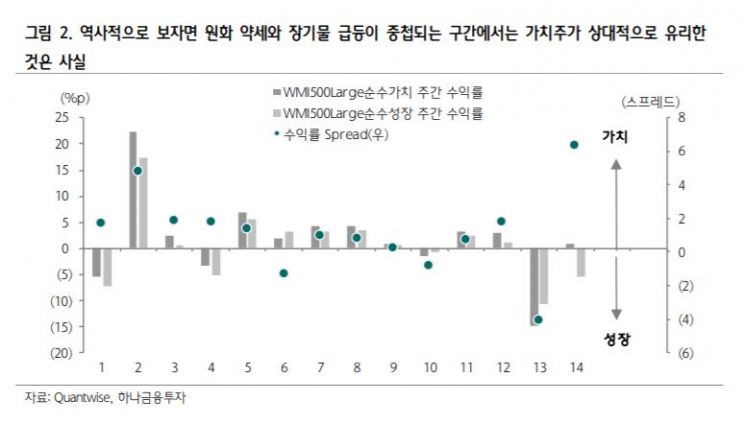

Hana Financial Investment explained in a report published on the same day that in past periods where the Korean won weakened and interest rates surged simultaneously, value stocks were relatively advantageous. Since 2008, there have been a total of 14 periods, including this year, when the USD/KRW exchange rate exceeded 1,190 won and the US 10-year Treasury yield rose sharply by 15 basis points on a weekly basis; value stocks outperformed growth stocks in 11 of those periods (over 80%). Researcher Lee Jae-sun of Hana Financial Investment said, "The fact that foreign and institutional investors show a buying preference for sectors with low price-to-earnings ratios (PER) is also in a similar context."

However, they advised that growth stocks with valid earnings momentum should be selectively invested in even during periods of interest rate hikes. The market forecast for combined operating profits of KOSPI and KOSDAQ this year is 268 trillion won, with the decline in profits narrowing. For growth stocks, the proportion of operating profits has been increasing since December last year. Researcher Lee said, "It is premature to declare an early defeat for growth stocks just because we have entered an interest rate hike period," adding, "The impact on earnings in the media and gaming sectors has been observed since October."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.