Ryu Young-jun Appointed as Kakao CEO, Retains Kakao Pay CEO Position

Future of 480,000 Stock Options Uncertain

No Company-Level Measures Such as Recurrence Prevention

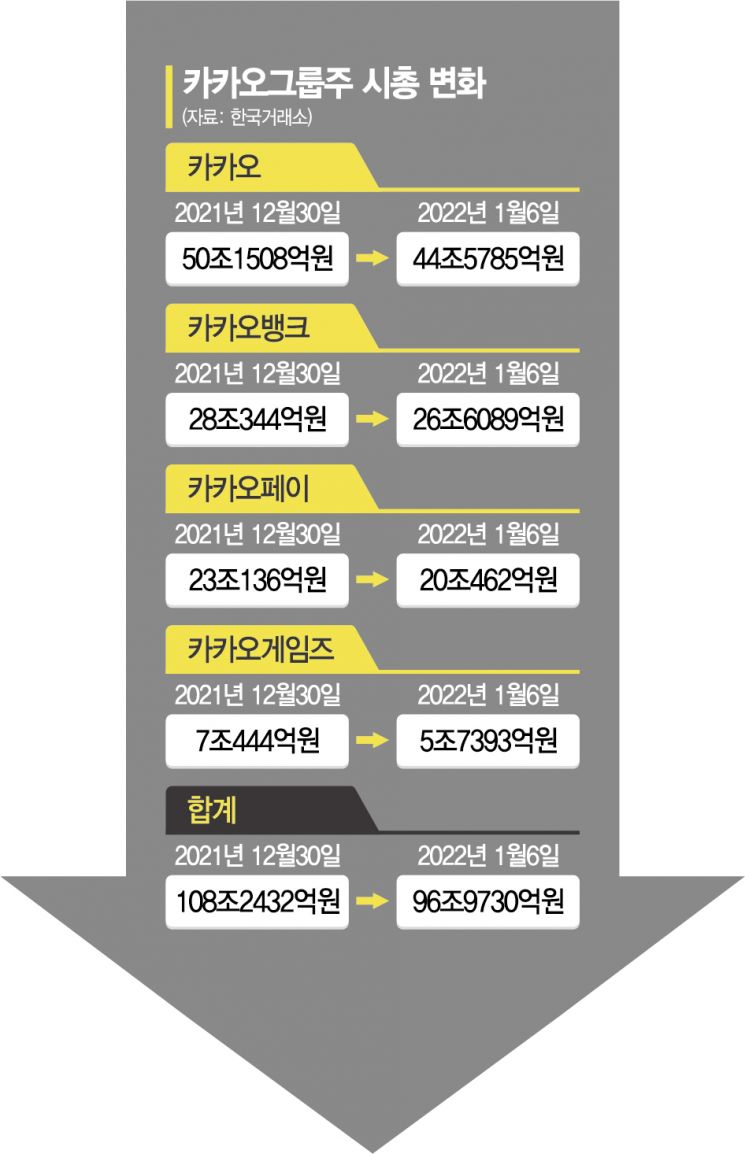

Risk of Insider Stock Sell-Off Leads to Market Cap Overtaking by Traditional Financial Stocks

Ryu Young-jun, CEO of Kakao Pay, is striking the drum at the Kakao Pay KOSPI listing ceremony held on the 3rd at the Korea Exchange in Yeouido, Seoul. Photo by Kang Jin-hyung aymsdream@

Ryu Young-jun, CEO of Kakao Pay, is striking the drum at the Kakao Pay KOSPI listing ceremony held on the 3rd at the Korea Exchange in Yeouido, Seoul. Photo by Kang Jin-hyung aymsdream@

[Asia Economy Reporter Junho Hwang] What will happen to the 480,000 stock options held by Ryu Young-jun, CEO of Kakao Pay?

On the 10th, Ryu Young-jun, the designated CEO of Kakao and the central figure in the controversy over 'CEO self-serving stock sales,' announced his resignation from the appointment. However, Kakao Group's stock plummeted like falling leaves in the market. The uncertainty surrounding the 480,000 stock options he holds caused the stock price to drop.

KB Financial Returns to No.1 Among Financial Stocks

According to the Korea Exchange on the 11th, Kakao Pay closed at 148,500 won, down 3.26% from the previous day. Kakao fell 3.40%, showing a larger decline, while Kakao Bank plunged by as much as 7.09%.

On the previous day, financial stocks soared as if they had wings. The KOSPI 200 Financial Index rose 2.45%. While Kakao Group affiliates' stock prices were weighed down by CEO risk, financial stocks surged, changing the market capitalization rankings.

As of the previous day, Kakao Pay's market capitalization was 19.0585 trillion won, losing the 19th place to Shinhan Financial Group, which increased to 19.915 trillion won (up 2.39%). This marked a drop from 13th place in market capitalization on December 10 last year, when the self-serving stock sale incident occurred, to the 20th rank within a month.

Kakao Bank, which had held the top spot among financial stocks, also lost first place to KB Financial Group. As of 10 a.m. that day, KB Financial's market capitalization reached 24.699 trillion won, surpassing Hyundai Mobis (24.3999 trillion won) and Kakao Bank (23.5679 trillion won), climbing to 12th place in market capitalization. While Kakao Bank fell more than 7% the previous day, KB Financial rose 3.77%, and on this day, Kakao Bank dropped 2.94% while KB Financial increased 2.77%, reversing their market cap rankings. The market cap difference between Kakao Bank and KB Financial the previous day was only 247 billion won.

Will CEO Risk Persist in Kakao Financial Affiliates?

On the 3rd, attendees are taking a commemorative photo after the KakaoPay KOSPI listing ceremony held at the Korea Exchange in Yeouido, Seoul. From the left: Song Young-hoon, Deputy Director of the Korea Exchange's KOSPI Market Headquarters; Ahn Sang-hwan, Chairman of the Korea IR Association; Jung Hyung-jin, Korea Representative of Goldman Sachs Seoul Branch; Lim Jae-jun, Director of the Korea Exchange's KOSPI Market Headquarters; Son Byung-doo, Chairman of the Korea Exchange; Ryu Young-joon, CEO of KakaoPay; Kim Joo-won, Vice Chairman of Kakao; Jang Seok-hoon, President of Samsung Securities; Park Tae-jin, Head of JP Morgan Securities Korea; Jung Woo-yong, Vice Chairman of the Korea Listed Companies Association Policy Committee. Photo by Kang Jin-hyung aymsdream@

On the 3rd, attendees are taking a commemorative photo after the KakaoPay KOSPI listing ceremony held at the Korea Exchange in Yeouido, Seoul. From the left: Song Young-hoon, Deputy Director of the Korea Exchange's KOSPI Market Headquarters; Ahn Sang-hwan, Chairman of the Korea IR Association; Jung Hyung-jin, Korea Representative of Goldman Sachs Seoul Branch; Lim Jae-jun, Director of the Korea Exchange's KOSPI Market Headquarters; Son Byung-doo, Chairman of the Korea Exchange; Ryu Young-joon, CEO of KakaoPay; Kim Joo-won, Vice Chairman of Kakao; Jang Seok-hoon, President of Samsung Securities; Park Tae-jin, Head of JP Morgan Securities Korea; Jung Woo-yong, Vice Chairman of the Korea Listed Companies Association Policy Committee. Photo by Kang Jin-hyung aymsdream@

The financial investment industry analyzes that the 'CEO risk' of Kakao Pay weighed down the stock price. It is also expected that this negative factor will not easily dissipate. For now, since CEO Ryu will maintain his position as Kakao Pay CEO for the existing term, he has gained time to dispose of the 480,000 stock options he holds.

Kakao Pay explained, "CEO Ryu will lead Kakao Pay until the procedure to appoint a new CEO is completed at the March shareholders' meeting." However, regarding the fate of the 480,000 stock options he holds during this period, they drew a line by saying, "The decision to dispose of stock options is a personal decision," and "Nothing has been decided yet."

CEO Ryu also stated his intention to sell Kakao Pay stock options to assume the Kakao CEO position. In a recent employee meeting, he said, "To prevent misunderstandings about conflicts of interest due to moving to the parent company (to perform Kakao CEO duties), I plan to exercise and sell all stock options within the first half of the year."

Some argue that maintaining CEO Ryu's term is a move to quell the controversy. Kakao has not disclosed the status of Shin Won-geun, the designated next CEO of Kakao Pay (who has 6.1 billion won in cashable assets), following Ryu's move to Kakao CEO. Furthermore, it is unclear what level the recurrence prevention guidelines that Kakao plans to announce will be.

Meanwhile, on December 10 last year, the day Kakao Pay was included in the KOSPI 200 index, CEO Ryu and executives sold 90 billion won worth of Kakao Pay shares through a block deal. CEO Ryu personally cashed out 46.9 billion won. One month after being appointed Kakao CEO, he settled his stock options, becoming the center of the self-serving stock sale controversy. It is estimated that if he disposes of all 480,000 shares he currently holds, the total cash he will receive will reach approximately 120 billion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.