Declining Trend in Small and Medium-Sized Company Principal Insurance Premiums

Big 4's Market Share Approaches 85%

[Asia Economy Reporter Oh Hyung-gil] Despite expectations that auto insurance would return to profitability for the first time in four years last year, some non-life insurance companies have been strategically reducing their auto insurance sales. This cautious stance reflects the view that the temporary profits were due to the unique circumstances caused by the COVID-19 pandemic. As a result, the so-called ‘Big 4’ in the non-life insurance industry saw their market share in auto insurance soar to an all-time high.

According to the insurance industry on the 11th, the gross written premiums for auto insurance of small and medium-sized non-life insurers such as Hanwha, Lotte, MG, AXA General Insurance, and Heungkuk Fire & Marine Insurance all declined.

Hanwha General Insurance’s gross written premiums for auto insurance stood at 557.9 billion KRW as of the third quarter last year, down 7.8% from 605.6 billion KRW in the same period the previous year. This was due to lowering the proportion of auto insurance by improving the product portfolio and strengthening underwriting after being placed under management control. Hanwha General Insurance had consistently held the 5th position in the auto insurance market following the ‘Big 4’ until 2020, but was overtaken for the first time last year by Meritz Fire & Marine Insurance, which recorded 591 billion KRW.

Lotte General Insurance has also seen a decline in auto insurance sales since its acquisition by JKL Partners in 2019. The gross written premiums dropped from 341.2 billion KRW in 2019 to 188.7 billion KRW in 2020, and further down to 142.4 billion KRW last year, shrinking by nearly half in just two years. The company adopted a strategy of selecting underwriting targets based on accident frequency and mileage to accept only high-quality customers, thereby increasing loss ratios and reducing sales volume.

AXA General Insurance, whose sale process was halted last year, also saw a slight decrease in gross written premiums for auto insurance to 523.7 billion KRW as of the third quarter, compared to 524.5 billion KRW in 2020. During the same period, Heungkuk Fire & Marine Insurance’s premiums fell 11.0% year-on-year to 107.5 billion KRW. MG General Insurance, which is undergoing management improvement efforts, also reduced its auto insurance gross written premiums by 25.3%, from 31.5 billion KRW in 2020 to 23.5 billion KRW last year.

Excluding digital non-life insurers Hana General Insurance and Carrot General Insurance, most small and medium-sized companies appear to be retreating from the auto insurance market.

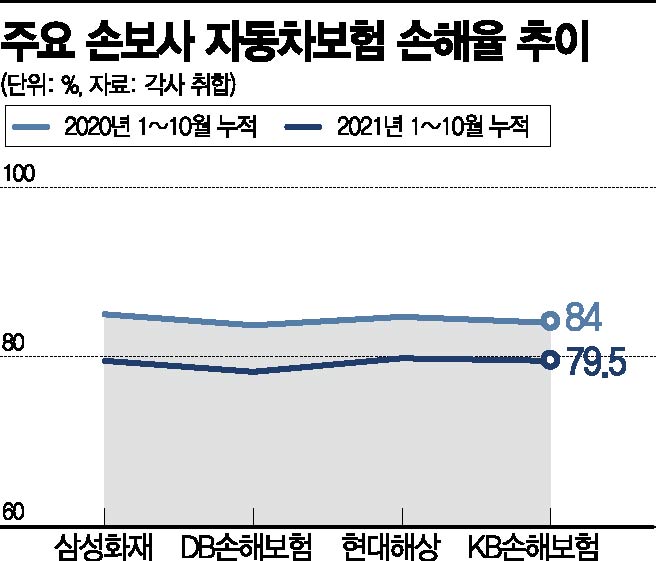

As small and medium-sized insurers exit the auto insurance market, large companies such as Samsung Fire & Marine Insurance, DB Insurance, Hyundai Marine & Fire Insurance, and KB Insurance have increased their market shares.

As of the third quarter last year, the Big 4’s gross written premiums for auto insurance reached 12.7864 trillion KRW, accounting for 84.4% of the market share. Since surpassing 80% for the first time in 2018, their market presence has steadily grown.

Some voices have raised concerns that as the auto insurance market becomes more concentrated around the ‘Big 4,’ losses in auto insurance could become more concentrated as well. The cumulative deficit in auto insurance over the past three years from 2018 to 2020 reached 2.7 trillion KRW.

An industry insider said, "Auto insurance losses temporarily decreased after the COVID-19 outbreak," but added, "Expanding sales involves many strategic considerations, so the trend of restructuring around large companies is expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)