[Asia Economy Reporter Lee Seon-ae] Applications for establishing real estate investment company (REITs) asset management companies (AMCs) by real estate trust companies and asset management firms are flooding in. The number of approvals obtained last year nearly tripled compared to the previous year, and many are still in progress this year. Accordingly, expectations are rising for the activation of investment in the listed REITs market.

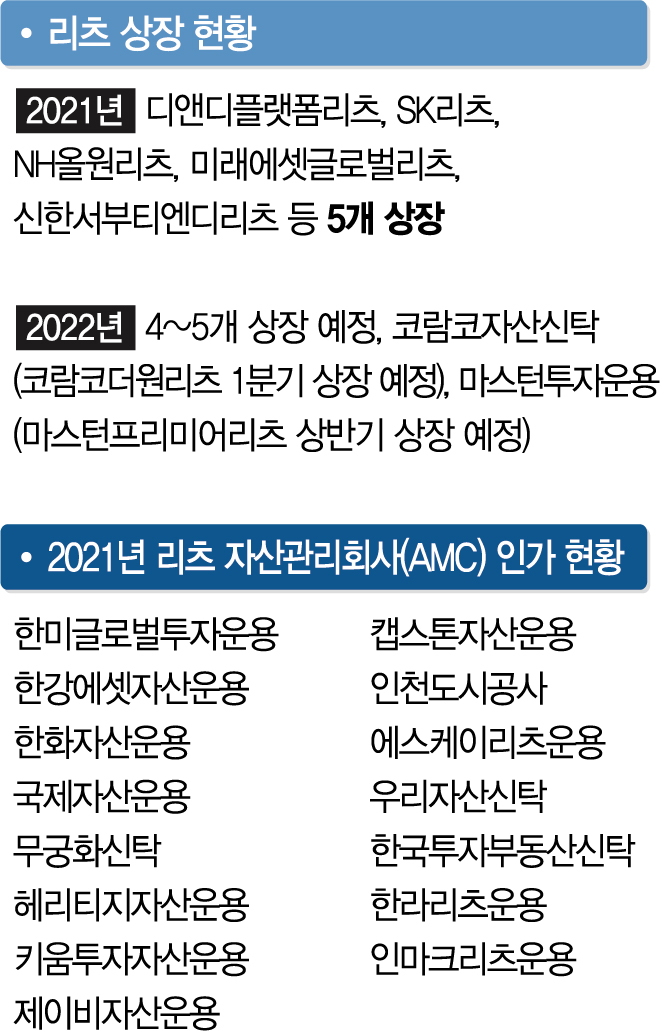

According to the Ministry of Land, Infrastructure and Transport on the 11th, a total of 16 companies received approval to establish REITs AMCs last year. Compared to 6 approvals in 2020, this is an increase of nearly three times, with 7 companies obtaining REITs AMC approval in the fourth quarter of 2021 alone. The most recent approvals were granted to Hanwha Asset Management, Hanmi Global Investment Management, Hangang Asset, Kookje Asset Management, Mugunghwa Trust, and Heritage Asset Management. According to the financial investment industry and the Korea REITs Association, as of this year, more than 9 companies are pursuing approval to establish REITs AMCs.

Approvals for establishing REITs AMCs were limited to only 1 to 3 companies annually. Since the Ministry of Land, Infrastructure and Transport revised the Enforcement Decree of the Real Estate Investment Company Act in 2016 to allow concurrent operation of REITs AMCs, asset management firms have actively entered the market, which is expanding. REITs AMCs generate income by investing in and managing real estate assets that are leased out to earn revenue. This differs from sales where ownership of assets is transferred. They are mainly applied to rental housing and income-generating rental properties.

A representative from an asset management company that received REITs AMC approval said, "In the past, real estate funds with simpler procedures were preferred, but now demand for REITs, which can secure investors and generate stable income, is growing, and many are using REITs AMCs as a stepping stone to enter the leasing business." They added, "REITs products are expected to be actively launched as they can be used not only for physical assets such as offices, retail, and logistics centers but also for various development projects."

The activation of the listed REITs market is also anticipated. The first listed REIT of the new year is expected to be 'Koramco The One REIT,' which holds the Hana Financial Investment Building, managed by Koramco Asset Trust. Koramco Asset Trust plans to submit a securities registration statement this month and begin the public offering process in earnest. After demand forecasting for institutional investors and general public subscription, it is scheduled to be listed in March. The listing is underwritten by Hana Financial Investment and Samsung Securities. The next listing will be 'Mastern Premier REIT' by Mastern Investment Management. It is a sub-indirect REIT with assets including the Crystal Park Building in Paris, France, two Amazon logistics centers, and the Incheon TJ Logistics Center. Following the new listings of five REITs last year, including SK REITs and Shinhan Seobu TND REITs, 4 to 5 REITs are expected to be listed this year as well.

Lee Kyung-ja, a researcher at Samsung Securities, said, "With five REITs listed in 2021, REITs have emerged as one of the major assets," adding, "About five REIT listings are expected this year, and growth potential is anticipated as large-scale expansion will proceed not only through new listings but also through capital increases and asset incorporations of existing REITs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)