IBK Industrial Bank Retirement Pension Reserves and Yield Rates (Financial Supervisory Service)

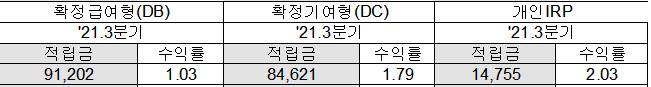

IBK Industrial Bank Retirement Pension Reserves and Yield Rates (Financial Supervisory Service) (Unit: 100 million KRW, %)

[Asia Economy Reporter Park Sun-mi] IBK Industrial Bank of Korea will enable trading of retirement pension exchange-traded funds (ETFs) within the first half of the year. There is great expectation that the retirement pension returns, which are currently lower than those of commercial banks, will improve.

According to the financial sector on the 11th, IBK is currently working on building a system with the goal of launching the retirement pension ETF trading service within the first half of this year. The bank plans to add ETF products to retirement pension assets to build a diverse portfolio and allow customers to directly instruct ETF product management through the bank’s application (app) i-ONE Bank’s non-face-to-face service. It expects to enhance pension returns through direct ETF investment by retirement pension subscribers and secure business competitiveness by strengthening product offering capabilities.

Among commercial banks, Hana, Shinhan, and Woori Banks have already launched retirement pension ETFs, while KB Kookmin and NH Nonghyup Banks are developing systems and plan to start services within the first half of the year. Following the stock market boom after the spread of COVID-19, customer interest in direct investment in retirement pensions has increased, creating an atmosphere where banks are rushing to enter the retirement pension ETF market.

According to the Financial Supervisory Service, as of the end of the third quarter this year, IBK’s defined benefit (DB) and defined contribution (DC) retirement pension reserves amount to KRW 9.1202 trillion and KRW 8.4621 trillion, respectively. Both are the third largest compared to commercial banks, reflecting the bank’s strength in holding the highest market share (22.9%) in the small and medium enterprise loan market.

However, the individual-type IRP reserves, which are contributed by individuals, stand at KRW 1.4755 trillion, the lowest among commercial banks. While the low proportion of individual customers is a factor, IBK’s retirement pension management returns over the past year for DB, DC, and individual IRP are all at the lowest level in the banking sector, ranging from 1.03% to 2.03%. From IBK’s perspective, expanding the retirement pension product lineup and improving returns are urgent to prevent customers from moving to other banks and securities firms.

An official from a commercial bank explained, "Even though the DC type retirement pension contributions are made by businesses, individuals can manage the investments, so expanding the retirement pension product lineup has become important. Retirement pension ETF products in the banking sector are trust-based and do not allow real-time trading, but banks are rushing to build trading systems to broaden options."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)