Bank Branches Hit Hard by COVID-19

98 Locations Closed in Seoul Last Year

Rural Areas with Many Elderly Also Face Closures

Need for Alternatives for Digitally Disadvantaged Groups

[Asia Economy reporters Kwangho Lee, Kiho Sung, Sunmi Park] The area around Gangnam-gu Office, known as the luxury commercial district mecca of Seoul, ranked 70th among the ‘Top 100 Commercial Districts Nationwide’ last year. It dropped 13 places compared to the previous year due to the direct impact of COVID-19. This was the largest ranking decline among major commercial districts in Seoul. As the floating population sharply decreased, major brand stores closed, and bank branches began to withdraw. Only near Gangnam-gu Office, Shinhan Bank (Gangnam-gu Office branch), Woori Bank (Eonju Station branch), and NH Nonghyup Bank (Hakdong Station branch) disappeared last year.

In the Dongnae Station area, a central commercial district representing Busan, four bank branches withdrew last year. Hana Bank Sajik Central branch and three local bank branches closed. The Dongnae Station commercial district (60th → 73rd) was one of the places with a significant ranking drop last year among the top 100 commercial districts nationwide, along with the Busan Station commercial district. Due to regional hollowing out and commercial district decline, store profits decreased, placing banks on the ‘closure hit list.’

Last year, amid rapid consolidation and closure of bank branches, the phenomenon of branch closures was particularly evident in declining commercial districts. In areas where the floating population noticeably decreased, customer accessibility to each branch declined, leading to deteriorating branch profitability.

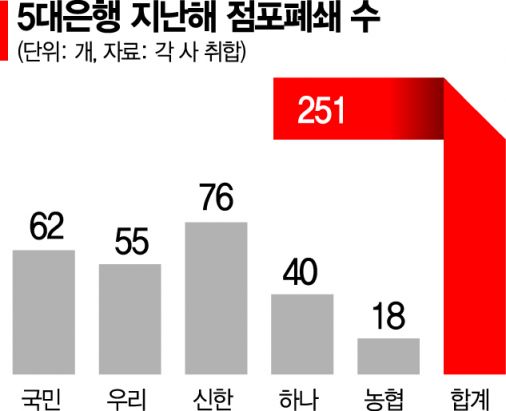

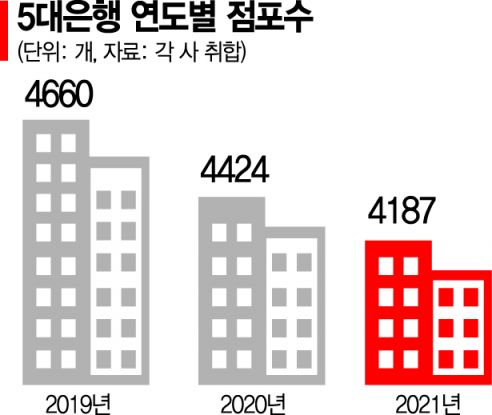

According to the financial sector on the 10th, the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?closed or merged a total of 251 branches last year. This exceeded the 222 branches planned for closure reported to the Financial Supervisory Service in August of the same year.

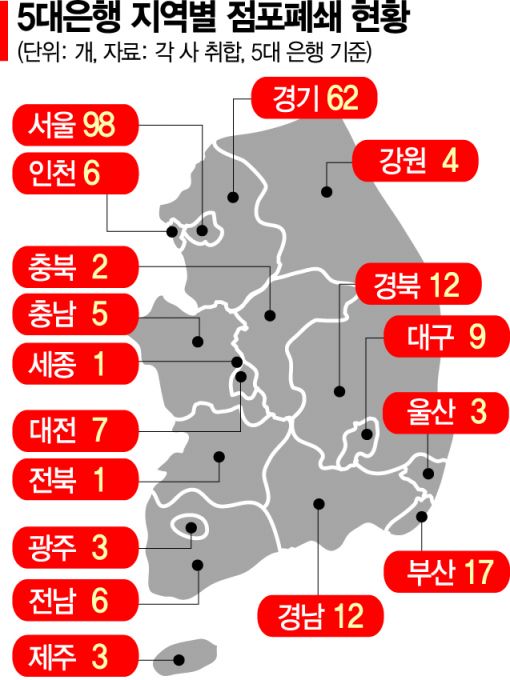

By region, Seoul saw the largest reduction with 98 branches closed. In Gyeonggi, the most populous region nationwide, 62 branches closed, followed by ▲Busan 17 ▲Gyeongbuk 12 ▲Gyeongnam 12 ▲Daegu 9. The regions with the fewest closures were Jeonbuk and Sejong, each with one branch closed.

Bank branch closures mainly occurred in areas where local commercial districts declined or economic viability deteriorated. This is also confirmed by commercial district analysis statistics. According to SK Telecom’s big data analysis platform ‘GeoVision,’ among the ‘Top 100 Commercial Districts in Korea 2021,’ 11 places dropped more than 10 ranks compared to the previous year. Seoul had the most with six, followed by Gyeonggi with two, Busan with two, and Jeonnam with one. The decline in local commercial districts showed a similar trend to the reduction in bank branches. In fact, in Busan, where many bank branches disappeared after the metropolitan area last year, only one of the nine ‘Top 100 Commercial Districts’ (Beomil-dong) saw a ranking increase. Three maintained the same ranking as the previous year, and five declined.

The situation is not much different in Gyeongbuk and Gyeongnam. In Gyeongbuk, where 12 bank branches disappeared, only two places made it to the ‘Top 100 Commercial Districts.’ Even these were ranked low overall at 89th (Jungang-dong, Gyeongsan City) and 99th (Sangdae-dong, Pohang City). Notably, Gyeongnam did not have any place listed among the ‘Top 100 Commercial Districts.’

A bank official said, "Bank branch closures are decided considering profitability, cost efficiency, and commercial district decline." Another bank official added, "Even in metropolitan cities with relatively high population density, the rise and fall of commercial districts vary. Branch closures are expected to increase in rural areas with high aging rates and low digital accessibility."

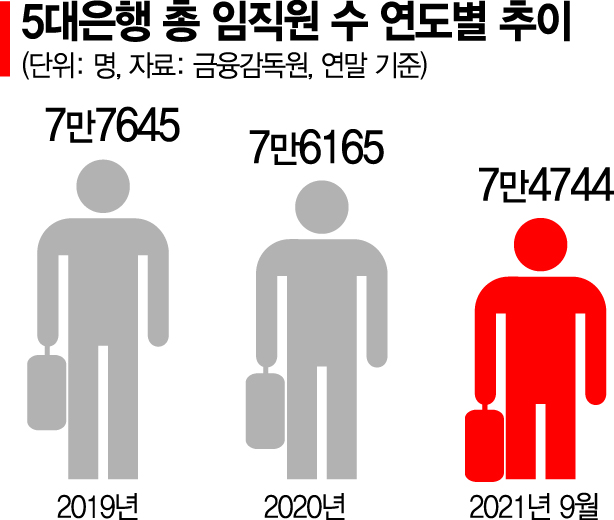

Meanwhile, bank branch consolidation and closure are expected to accelerate further this year. The five major banks plan to close 110 branches in the first quarter alone, which is about half of last year’s total closures. A bank official said, "As digital transformation accelerates, branch closures are inevitable for survival."

Though a survival strategy... only ‘conflicts’ grow without alternatives

While banks close hundreds of branches annually under the pretext of operational efficiency, realistic alternatives have not been prepared. Banking services for the elderly, farmers, fishermen, and disabled people who are unfamiliar with digital finance are becoming increasingly difficult. With ATMs rapidly decreasing, there is an urgent need for clear alternatives and concrete implementation plans.

According to the banking sector, Shinhan Bank recently withdrew its plan to close the Wolgye-dong branch in Nowon-gu, Seoul, next month and merge it with the nearby Jangwi-dong branch. This was due to strong opposition from residents, especially the elderly unfamiliar with digital devices.

This is the first case where rapid bank closures were halted due to local residents’ opposition. Not only local residents but also internal dissatisfaction within banks is strong. Bank unions are protesting that repeated branch closures cause job losses due to staff reductions.

In response, banks argue that branch reduction is an essential survival strategy for efficient branch operation amid expanding digital finance. As non-face-to-face financial transactions settle in, they say it is inevitable to close inefficient branches.

The problem is that branch reduction is proceeding without appropriate policy alternatives. Last year, financial authorities established a ‘joint procedure for bank branch closures’ to prevent indiscriminate closures by banks. Although pre-impact assessments before closures were made mandatory, they were operated as formalities and failed to impose proper brakes.

As a desperate measure, the banking sector is preparing consumer inconvenience relief measures such as waiving ATM usage fees for the elderly from this year and expanding bank services through video services and devices in convenience stores. However, how effective these will be remains uncertain. According to the Korea Federation of Banks, about 8.6 million people aged 65 and older exist. Five out of ten elderly people visit bank counters to withdraw cash. Ultimately, branch reduction and ATM decrease lead to fewer cash withdrawal channels, causing inconvenience to cash users and the elderly.

The National Assembly Legislative Research Office pointed out, "The bank branch reduction policies announced by financial authorities do not present clear alternatives or concrete implementation plans, and the promotion of joint branch systems or joint ATMs is sluggish," adding, "Financial authorities and the industry must seek effective alternatives under the goal of minimizing financial exclusion."

Global trend of branch closures... "Measures needed for financially excluded groups"

The continuous decrease in bank branches is a global trend. Major countries worldwide are implementing various measures such as joint branch operations and financial education to prevent financial exclusion of certain groups.

According to the report ‘Challenges for Bank Branch Reduction and Protection of Financially Excluded Groups’ released by the National Assembly Legislative Research Office, the UK reduced bank branches from 11,365 in 2007 to 7,207 in 2017, a 37% decrease. Due to inconvenience in financial service use and public opposition, the UK operates joint branches by utilizing post office networks, hosting multiple banks within post offices.

In Japan, although opinions favor maintaining branches to keep customer contact, environmental factors such as population decline, aging, prolonged low interest rates, increased cashless payments, and technological advances have made branch network reorganization a financial issue. Accordingly, regional banks have signed agreements to operate joint branches, reduce branch functions to reallocate staff, or separate branches by function to convert them into specialized branches.

In New Zealand, six banks have been operating joint automated teller machines (ATMs) on a pilot basis since 2020 through community partners such as pharmacies, tourism organizations, and local councils in small rural towns until November last year. Efforts are also underway to enhance convenience for the elderly using joint ATMs by deploying auxiliary staff.

Domestic experts agree that branch reduction is inevitable amid the expansion of financial services by big tech (large IT companies) and fintech (financial technology companies) and the restructuring of the financial environment toward non-face-to-face transactions. However, they emphasize that if financial exclusion caused by branch reduction is neglected, some groups may be left behind, leading to social problems, thus requiring policy consideration by financial authorities.

Professor Daejong Kim of the Department of Business Administration at Sejong University said, "Branch reduction is an unavoidable global trend and one of the survival strategies banks must choose." He added, "South Korea has the highest smartphone penetration rate and well-developed communication infrastructure, which led to the emergence of internet banks with strong competitiveness, forcing commercial banks to compete. Although financial authorities try to prevent rapid reduction, it is difficult to stop the trend completely." He also noted, "The elderly may be particularly inconvenienced, so the government should implement policies such as smartphone education and device distribution. The smartphone penetration rate among people in their 60s and 70s is also at an all-time high. Continuous implementation can significantly mitigate side effects."

Researcher Kuhyun Lee of the National Assembly Legislative Research Office emphasized, "Fundamentally, considering changes in the financial environment, it is necessary to provide transaction methods designed for easy use by the elderly and disabled, conduct appropriate financial education, and help financially excluded groups not be left behind in the changing financial market." He added, "Examples include building elderly- and disabled-friendly user interfaces (UI) currently under study, strengthening customized services by user groups, and enhancing guidance for the elderly and disabled at counters. Tailored services and continuous guidance procedures should be established for users struggling with financial environment changes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.