[Asia Economy Reporter Park Byung-hee] Goldman Sachs predicted that the U.S. central bank, the Federal Reserve (Fed), will raise the benchmark interest rate four times this year and begin quantitative tightening in July, Bloomberg reported on the 9th (local time).

Goldman Sachs economist Jan Hatzius analyzed that the minutes of the Federal Open Market Committee (FOMC) meeting held on the 14th-15th of last month confirmed rapid progress in the labor market and hawkish signals, indicating a faster normalization of monetary policy.

In a report released that day, economist Hatzius forecasted, "The Fed will advance the start of quantitative tightening, which reduces the size of its asset holdings, from December to July this year," adding, "It could happen even sooner."

He also expected that even in July, when quantitative tightening is anticipated to begin, the inflation rate will significantly exceed the Fed's monetary policy target.

Furthermore, he stated, "Quantitative tightening is no longer seen as a substitute for quarterly interest rate hikes," predicting that quantitative tightening and interest rate increases will proceed simultaneously. Hatzius identified March, June, September, and December as the expected months for the four interest rate hikes.

The minutes of the December FOMC released last week revealed that the Fed discussed quantitative tightening at the FOMC meeting last month. Quantitative tightening is the opposite of quantitative easing and refers to a policy that absorbs market liquidity by selling bonds increased through quantitative easing after the COVID-19 pandemic. Since the COVID-19 pandemic, the Fed's asset holdings have doubled, currently approaching $7.8 trillion.

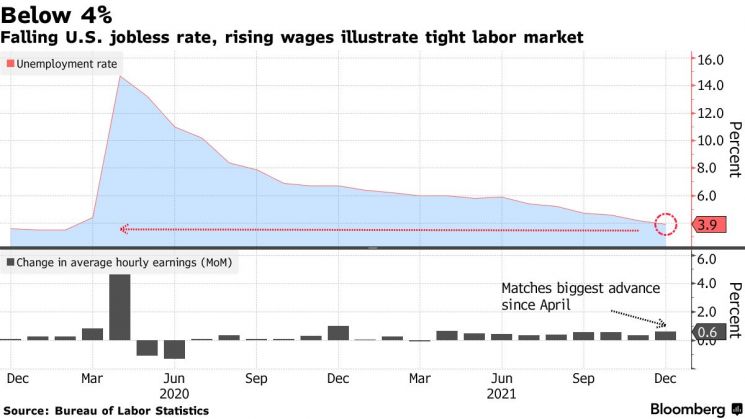

With the U.S. Department of Labor reporting on the 7th that the U.S. unemployment rate fell to 3.9% last month, the Fed's tightening stance is expected to gain further momentum. The December unemployment rate was below the market expectation of 4.1%, reaffirming progress in the labor market.

Economist Hatzius maintained his previous forecast that even if the Fed accelerates the pace of interest rate hikes, the long-term trend of U.S. benchmark interest rate increases will conclude at around 2.5?2.75%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)