Ostem Implant, which holds significant influence in the domestic implant market, is staggering due to an embezzlement scandal. The company’s internal control system and accounting management have revealed vulnerabilities, leading to a decline in trust. Even though the embezzlement incident does not directly impact product quality significantly, a considerable ripple effect is expected within the implant market as latecomers are closing in rapidly. In the domestic implant market, the top five companies?including Ostem Implant, Dentium, Dio, Neobiotech, and Megagen Implant?occupy more than 90% of the market share. Since the quality differences among implant products are not substantial, price, brand awareness, and sales capabilities greatly influence product selection. While Ostem Implant struggles to address the embezzlement case and tighten internal controls, competitors are likely to expand their market share through aggressive sales strategies. Asia Economy analyzes Dentis and Dio’s business structures and current status to assess their growth potential.

[Asia Economy Reporter Park So-yeon] Founded in 2005, Dentis focuses primarily on dental implant products and also produces and sells dental medical devices including prosthetics and surgical instruments, biomaterials, and dental 3D printers. Entering the domestic implant market as a latecomer, Dentis has concentrated on pioneering overseas markets rather than the highly competitive domestic market, exporting to over 70 countries worldwide. Its main sales regions are the United States, Iran, and China. Since the year before last, Dentis has aggressively increased domestic implant market sales by appointing trot singer Lim Young-woong as an advertising model. Implant sales account for 76% of total sales, while medical lighting products, which hold the number one domestic market share, make up about 17% of sales. Recently, Dentis has entered the rapidly growing digital clear aligner market and is showing promising results.

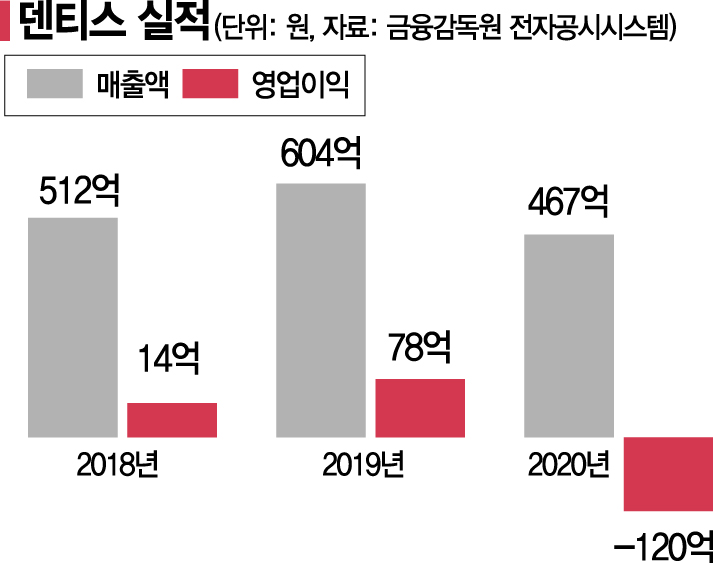

According to the Financial Supervisory Service’s electronic disclosure system on the 10th, Dentis has consistently maintained sales between 40 billion and 60 billion KRW from 2016 to 2020. From 2016 to 2019, operating profits ranged from 1.4 billion to 7.8 billion KRW, but in 2020, due to the global COVID-19 pandemic, the company posted an operating loss of 12 billion KRW.

In 2021, Dentis returned to profitability in the first half but slipped back into losses in the third quarter. Operating profit margins fluctuated significantly: 12.55% in 2016, 4.2% in 2017, 2.74% in 2018, 12.94% in 2019, and -25.63% in 2020. As of the end of 2020, interest-bearing debt stood at approximately 43 billion KRW, and the debt ratio rose to 484.67% in 2017 before falling to 227.67% by the end of 2020.

Currently, Dentis generates three-quarters of its sales from the implant business, but its new digital clear aligner business is expected to become a cash cow in the future. Digital clear aligners are orthodontic devices shaped like mouthpieces. Compared to traditional orthodontic appliances, they are noted for profitability and aesthetics and are expected to grow rapidly. The global clear aligner market is projected to grow from 3 trillion KRW in 2016 to 9 trillion KRW by 2025.

Global Clear Aligner Market Expected to Reach 9 Trillion KRW by 2025

Integrated Platform Launched from Diagnosis to Supply

Prices Reduced by 30%, Delivery Within 10 Days

Last year, Dentis launched ‘Seraphin,’ a clear aligner platform that integrates the entire process from diagnosis to supply. With proprietary software and a 3D printer-based production system, Dentis can reduce prices by more than 30% compared to competitors. Customized orthodontic products take about 7 to 10 days for delivery, which is an advantage over competitors who require about a month. The sales target for the clear aligner segment is 10,000 cases worth 12 billion KRW in 2022 and 20,000 cases worth 24 billion KRW in 2023. This year, Dentis also plans to expand into Southeast Asia.

Dentis’s return on equity (ROE) was 4.98% in 2018, 1.70% in 2019, and -43.01% in 2020, effectively maintaining a deficit status. However, since April last year, the performance of Dentis’s digital clear aligner solution business has been reflected, and although the fourth-quarter results have not yet been announced, ROE is expected to improve in 2021. Kim Jang-yeol, a researcher at Sangsangin Securities, said, “Looking at the company’s major history and management, it is clear that continuous growth has been driven by marketing, mergers and acquisitions, and bold new business initiatives. The entry into the highly promising digital clear aligner business is expected to quickly reduce typical discount factors.”

Last year, Dentis issued convertible bonds worth 20 billion KRW to secure investment funds. The company plans to use the secured funds for investments such as modernizing production facilities and expanding production capacity. Dentis’s capital expenditure (CAPEX) was 2.4 billion KRW in 2018, 1.7 billion KRW in 2019, and 5 billion KRW in 2020. The largest shareholder is founder and CEO Shim Ki-bong, holding a 24.7% personal stake. Including his wife Jeong Sook-kyung (0.3%) and other related parties, the total stake is 25.6%. When adding key executives such as Choi Sang-yong, Shim Hyung, Kim Tae-won, and Kim Sa-hong, the total ownership reaches 25.7%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)