[Asia Economy Reporter Ji Yeon-jin] K-Auction, an art auction company, is entering the KOSDAQ market. The market expects stable growth for K-Auction as online auctions expand mainly among the 'MZ generation' in their 20s and 30s, and the global market is growing.

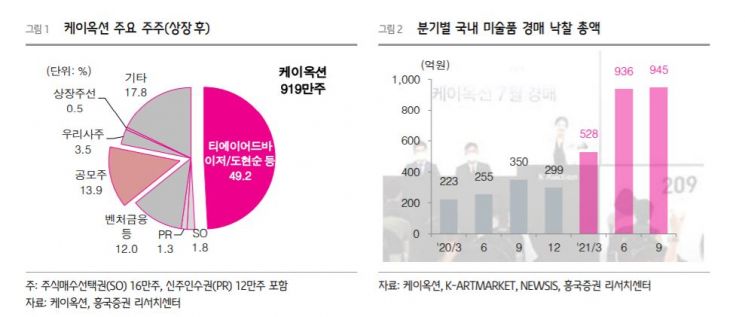

According to the financial investment industry on the 9th, K-Auction plans to list on KOSDAQ on the 14th of this month after subscription on the 12th and 13th. The total number of public offering shares is 1.6 million, and the proposed price band is 17,000 KRW to 20,000 KRW. The total public offering amount is approximately 27.2 billion to 32 billion KRW. The lead underwriter is Shin Young Securities.

K-Auction is a specialized company in consignment sales and self-sales of artworks, primarily engaged in art auction (brokerage) and sales. Established in 2005, it started the industry's first online art auction the following year. Since 2015, it has continuously secured diversified customers and new trading clients through operating various art trading platforms, including the introduction of a comprehensive art management system (K-Office).

Based on sales in the third quarter of last year (January to September), art auction (brokerage) accounted for 77% (17.5 billion KRW), and art sales accounted for 20% (4.6 billion KRW) of total sales.

The company is the leading auction platform in the domestic auction market by auction sales, recording 11,993 lots submitted and a total winning bid amount of 50.6 billion KRW in 2020 (domestic art auction total winning bid amount approximately 112.7 billion KRW). Especially after introducing the innovative comprehensive art management system K-Office, it succeeded in auction efficiency and standardization of art distribution management, securing an overwhelming share of the online auction market.

Through operating auction platforms based on various price ranges, schedules, and auction methods such as premium online auctions and weekly online auctions, it is continuously expanding its customer base.

The domestic art auction market surged from a total winning bid amount of 113.9 billion KRW in 2020 to a cumulative 296.8 billion KRW as of November last year. Due to entry barriers in art acquisition, logistics, and distribution, only about 10 auction companies operate domestically, and the top two companies, including K-Auction, hold more than 80% market share, making it a de facto oligopoly market.

Choi Jong-kyung, a researcher at Heungkuk Securities, said, "Online auctions are expanding mainly among the MZ generation, and the global market is continuing to grow," adding, "K-Auction is expected to maintain a stable growth trend with its overwhelming position in the online auction market, continuous increase in auction commission sales and profitability, and expansion of facilities and operating funds through KOSDAQ listing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.