US Stock Market Slumps in First Week of New Year

Fed's Hawkish Stance Shakes Global Markets, Raising Tensions

Korean Monetary Policy Committee May Also Feel the Pressure

[Asia Economy Reporter Minwoo Lee] As the tightening moves by the U.S. Federal Reserve (Fed) have caused both domestic and international stock markets to shrink, there is an analysis that this trend may continue for some time.

On the 7th (local time) at the New York Stock Exchange, the S&P 500 index closed at 4,677.03, down 0.41% from the previous day, and the tech-heavy Nasdaq index ended the session at 14,935.90, down 0.96%. The Dow Jones Industrial Average closed at 36,231.66, down 0.01% during the same period.

Thus, the U.S. stock market ended the first week of the new year on a weak note. During this period, the S&P 500 index fell about 1.9%, marking the worst weekly decline since 2016. The Nasdaq index dropped more than 4.5%, and the Dow Jones Industrial Average fell 0.29%. This is attributed to the Fed’s release of the Federal Open Market Committee (FOMC) minutes in December last year, which revealed a more hawkish stance than expected. Concerns over early tightening emerged, and the sharp rise in U.S. Treasury yields dampened investor sentiment.

Kiwoom Securities expects the financial market to respond more sensitively to the Fed’s moves next week as well. Since the Fed confirmed its intention to normalize monetary policy more quickly after the release of the December FOMC minutes, the sensitivity of the financial market to inflation indicators and Fed officials’ remarks may increase.

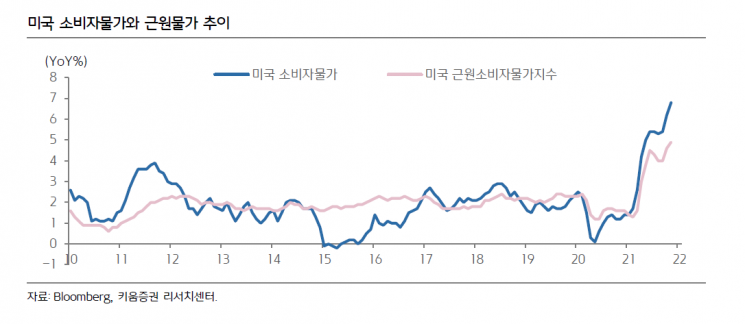

First, the U.S. consumer price index for December is scheduled to be released next week. The market consensus forecast is a 0.4% increase month-over-month, slowing from 0.8% in November, but on a year-over-year basis, it is expected to rise further to 7.1% from 6.8% in November. Accordingly, there is an analysis that concerns about inflation could be reignited.

However, if the results meet market expectations, the negative impact may be limited, as was the case with the inflation data released in November last year. Additionally, recent data from the Institute for Supply Management (ISM) manufacturing index for December showed that inflation-related components such as the prices paid index and supplier delivery index appear to have peaked. This suggests that concerns about cost inflation related to supply disruptions among manufacturing companies are gradually easing. Also, the global supply chain disruption index released by the New York Federal Reserve remains high but shows a slight decline.

Nevertheless, if the U.S. consumer price index rises further year-over-year, it could trigger concerns about early tightening by the Fed. Yumi Kim, an economist at Kiwoom Securities, explained, "In the December FOMC minutes, there were many arguments not only about the timing of interest rate hikes but also about quantitative tightening through balance sheet reduction in response to inflation." She added, "Especially since many Fed officials are scheduled to speak next week, considering the hawkish tone in the FOMC minutes, Fed officials may focus more on faster normalization of monetary policy."

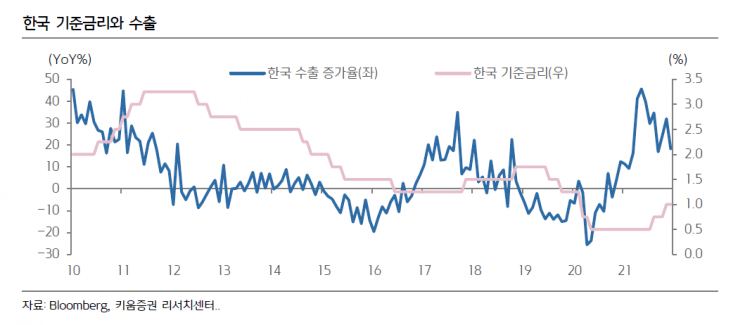

The scheduled meeting of the Bank of Korea’s Monetary Policy Committee is also a burden. The base interest rate is expected to be raised by an additional 25 basis points (bp) to 1.25%. Economist Kim said, "The focus will be on whether the Bank of Korea will raise rates further. Considering the recent strengthening of the Fed’s hawkish stance and Korea’s favorable export performance in December, the Bank of Korea governor’s remarks are likely to leave the door open for additional rate hikes." She analyzed, "This could act as a factor increasing upward pressure on Korean interest rates alongside U.S. Treasury yields."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)