KOSDAQ Falls Below 1000, Showing Weakness with Over 1% Decline

[Asia Economy Reporter Gong Byung-sun] As the U.S. Federal Reserve (Fed) showed a hawkish stance, the domestic stock market has been shaken along with the U.S. stock market. The KOSPI showed a slight decline, while the KOSDAQ fell below the 1000 mark, experiencing a drop of over 1%.

At 10:43 a.m. on the 6th, the KOSPI recorded 2,948.33, down 0.19% (5.64 points) from the previous day. It started the day at 2,925.40, down 0.97%, but the decline is narrowing.

The decline in the U.S. stock market appears to be negatively affecting the domestic market as well. On the 5th (local time) at the New York Stock Exchange, the Dow Jones Industrial Average closed at 36,407.11, down 1.07% (392.54 points) from the previous day. The S&P 500 index fell 1.94% (92.96 points) to 4,700.58, and the tech-heavy Nasdaq closed down 3.34% (522.55 points) at 15,100.17.

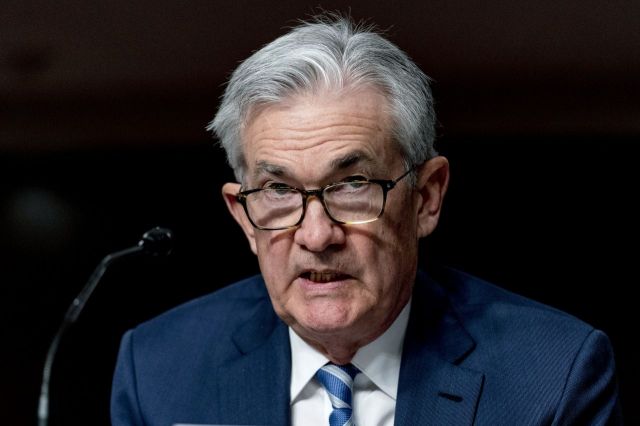

The Fed’s more hawkish stance than expected acted as a negative factor for global stock markets. On the same day, the Fed released the minutes of the Federal Open Market Committee (FOMC) meeting held in December last year. Most members anticipated that the conditions for raising interest rates could be met quickly, and some members argued that interest rates should be raised immediately after the end of asset purchase tapering.

Seo Sang-young, a researcher at Mirae Asset Securities, explained, “The emergence of selling pressure centered on tech stocks in the U.S. stock market is a burden on the domestic market,” adding, “The growth of companies that showed clear sales growth during the COVID-19 pandemic has been highlighted as potentially slowing down after economic normalization.”

Meanwhile, individual investors are selling heavily in the KOSPI. Individuals sold a net 106.3 billion KRW. Foreigners and institutions bought net 91.9 billion KRW and 19.8 billion KRW, respectively.

Most sectors declined. The service sector had the largest drop at 2.41%, followed by medical precision (-1.69%), pharmaceuticals (-1.47%), textiles and apparel (-0.99%), and securities (-0.94%). On the other hand, transportation equipment (2.00%), steel and metals (1.31%), construction (1.24%), and insurance (0.11%) rose.

The top 10 market capitalization stocks showed mixed results. Kakao had the largest decline at 5.21%, followed by NAVER (-2.82%), Samsung Biologics (-0.46%), and Samsung Electronics (-0.26%). POSCO (2.03%), Hyundai Motor (1.41%), Samsung SDI (1.08%), LG Chem (0.90%), and Kia (0.58%) rose. POSCO and KakaoBank are competing closely for the 10th place in market capitalization. SK Hynix remained flat.

The KOSDAQ recorded 996.21, down 1.33% (13.41 points) from the previous day. It even dropped to 989.17 at 10:13 a.m.

Foreigners and institutions are selling in the KOSDAQ. Foreigners and institutions sold a net 61.7 billion KRW and 90 billion KRW, respectively. Individuals bought a net 167.4 billion KRW.

Almost all sectors declined. Digital content had the largest drop at 6.14%, followed by IT S/W & SVC (-4.39%), entertainment and culture (-2.82%), software (-2.50%), and medical and precision instruments (-2.48%). Information devices (2.21%), telecommunications services (0.80%), construction (0.77%), and computer services (0.31%) rose.

All of the top 10 market capitalization stocks except L&F declined. Kakao Games had the largest drop at 10.65%, followed by Wemade (-5.81%), Pearl Abyss (-5.64%), Celltrion Pharm (-2.35%), HLB (-1.54%), Celltrion Healthcare (-1.44%), CJ ENM (-1.43%), Cheonbo (-1.04%), and EcoPro BM (-0.69%). L&F rose 0.45%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)