[Asia Economy Reporter Park Byung-hee] The U.S. central bank, the Federal Reserve (Fed), is highly likely to begin quantitative tightening within this year.

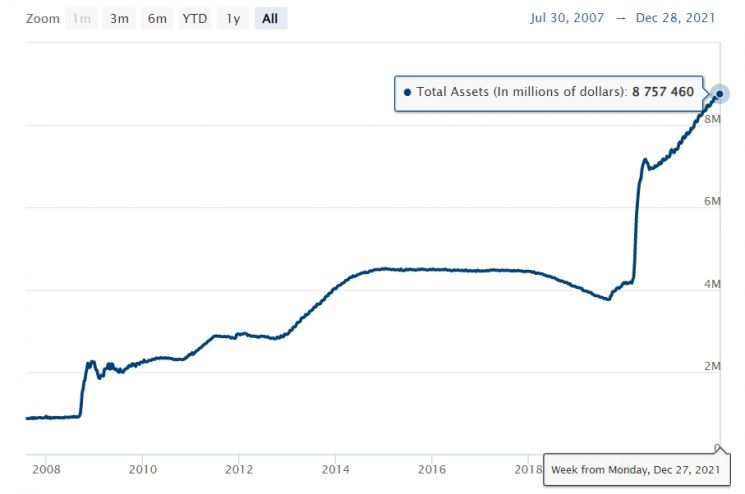

Quantitative tightening is the opposite concept of quantitative easing, referring to the Fed selling bonds it purchased through quantitative easing to withdraw liquidity previously injected into the market. The Wall Street Journal (WSJ) explained that while the Fed can maintain the size of its assets by reinvesting the proceeds from maturing bonds into new bonds, it can reduce the asset size on its balance sheet and decrease market liquidity by redeeming the principal of maturing bonds.

In the minutes released that day, the Fed stated that various topics were discussed and indicated that discussions on the appropriate size and composition of the assets held by the Fed in the long term had taken place, implying the start of talks on quantitative tightening. The minutes from last month’s FOMC meeting noted, "Almost all participants agreed that it would be appropriate to begin balance sheet reduction at some point after the first interest rate hike."

In the past, the Fed maintained a three-year gap between ending quantitative easing and starting quantitative tightening, but this gap is expected to be significantly shortened this time due to the severe inflationary trend. The minutes stated, "Participants mentioned that the appropriate pace of balance sheet reduction is likely to be faster than in previous normalization cases."

After ending the third round of quantitative easing in October 2014, the Fed maintained the asset size for three years before starting quantitative tightening in October 2017. At that time, the Fed began quantitative tightening with a goal of reducing assets by $10 billion per quarter, increasing the reduction amount by $10 billion each quarter. By the fourth quarter of 2018, the scale of quantitative tightening had increased to $50 billion. However, Wall Street expressed concerns that the Fed was reducing liquidity too much, and the Fed halted quantitative tightening in 2019. In 2018, then-President Donald Trump and Fed Chair Jerome Powell even debated whether quantitative tightening was the cause of the U.S. economic slowdown.

The Fed’s minutes revealed that some monetary policy committee members expressed concerns about the impact of asset reduction on financial markets and emphasized appropriate communication with the market.

The Fed’s holdings doubled over two years following the COVID-19 pandemic, reaching $8.7575 trillion as of the 27th of last month. The Fed’s asset reduction could serve as a means to curb inflation by reducing market liquidity.

Given that the U.S. inflation rate has surged to the highest level in 40 years, the Fed is highly likely to start quantitative tightening quickly. The possibility of quantitative tightening occurring simultaneously with interest rate hikes this year cannot be ruled out.

Fed Governor Christopher Waller said, "There is no reason to delay asset reduction," adding, "If we start reducing assets to some extent around summer, the Fed can lessen its burden." James Bullard, President of the Federal Reserve Bank of St. Louis, also expressed support last November for reducing assets immediately after the Fed ended quantitative easing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)