Full Implementation from 4 PM on the 5th

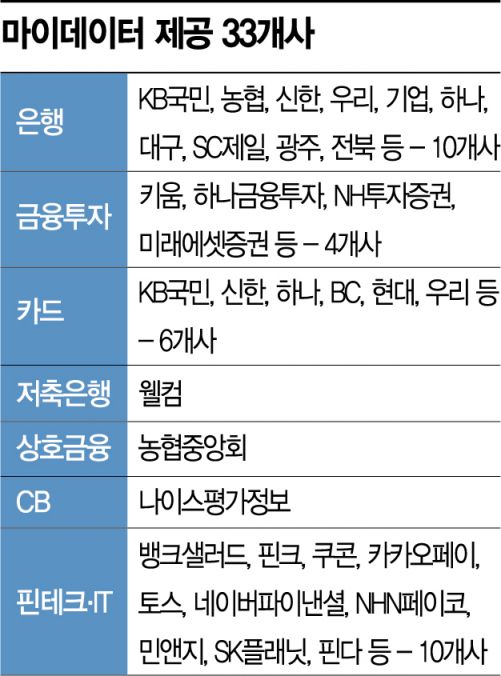

MyData Services Provided by 33 Companies

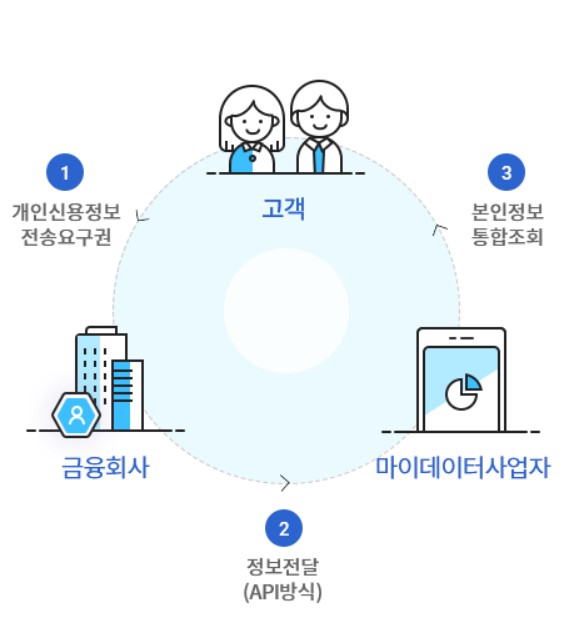

[Asia Economy Reporter Park Sun-mi] On the 5th, the standardized Application Programming Interface (API) method for Personal Credit Information Management Service (MyData) was fully implemented. From this day forward, consumers will be able to access and manage their financial information more safely and quickly. Financial authorities are currently negotiating to expand the provision of information not only from financial companies and big tech but also from public sources, which is expected to further upgrade the customized financial services provided to consumers.

According to financial authorities, 33 companies are providing MyData services using the API method starting today. These include 10 banks such as KB Kookmin, Shinhan, Woori, Hana, and NH Nonghyup, 10 big tech and fintech companies including Kakao Pay, Naver Financial, and Bank Salad, 6 card companies, and 4 securities firms.

Many providers have already been conducting MyData pilot services since last month. It is expected that consumers may not immediately notice significant changes. However, the complete ban on the scraping method, which involved extracting personal information displayed on screens when collecting customer information from other financial companies, the stricter information protection and security system reviews, and the approximately tenfold increase in integrated information inquiry speed are changes that consumers will be able to feel.

The amount of information provided will also increase. Information from 417 regulated financial companies, excluding some loan companies, will be shared. The average number of information providers connected to each MyData operator, including financial institutions and telecommunications companies, is around 100. Among banks, Daegu Bank (183) and Industrial Bank of Korea (151) have the most connections, while BC Card leads the card industry with 196 connections. There are also many with over 100 connections, such as Mirae Asset Securities (174), Kiwoom Securities (131), Fink (183), and Finda (123).

Previously, only information from some major financial sectors was accessible, but from today, integrated inquiries can be made for information from most financial companies, telecommunications, public, and e-commerce transaction details. Additionally, information transmission requests can be made using private certificates instead of the old public certificates, simplifying the identity verification process.

There are still many challenges to overcome for the full implementation of the MyData service to be more effective. More unreflected information needs to be opened to enhance consumer convenience. Currently, financial authorities are in discussions because public information such as national and local tax payment details, customs payment details, health insurance, civil servant pension, and national pension premium payment details are not provided, except for the National Tax Service’s tax payment certification. They also see the need to expand access to financial information such as retirement pensions (DB·DC), insurance information where the contract holder and insured are different, and card billing forecast information.

The financial industry agrees that with the full implementation of MyData and more active information exchange, more customized financial services for consumers can be developed. A bank official said, "More financial information needs to be shared," adding, "From the bank’s perspective, it will be possible to provide comprehensive asset management consulting based on consumers’ financial information."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.