[Asia Economy Reporter Lee Seon-ae] The curtain has risen on the M&A market for the new year, starting with MBK Partners, the largest private equity fund (PEF) operator in Korea, completing the package acquisition of Dongjin Textile and Gyeongjin Textile. The M&A market has been lively from the beginning of the year, including the signing of a stock purchase agreement for the sale of controlling shares of Star Vision by PEF operator VIG Partners. Amid numerous trillion-won scale deals anticipated in the market, companies that have secured ammunition to take the lead in the changes brought by the 4th Industrial Revolution and ESG (Environmental, Social, and Governance) are also moving swiftly, making this year’s M&A fever expected to be intense.

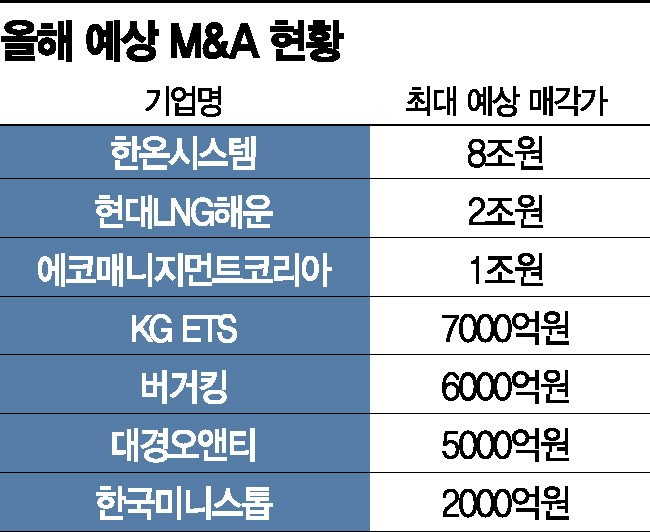

According to the investment banking (IB) industry on the 4th, M&A activities have been vigorous from the start of the year, with package acquisitions worth around 780 billion won and stock purchase agreements worth around 700 billion won. Trillion-won scale deals are expected to appear soon. The most notable target is Hanon Systems, an auto parts company currently being sold by Hahn & Company. The sale is being led by Morgan Stanley and Evercore, and the market price being discussed exceeds up to 8 trillion won. The sale price of Hyundai LNG Shipping, held by IMM Private Equity (PE) and IMM Investment, is also rumored to reach up to 2 trillion won. The IMM consortium, the largest shareholder holding 100% of Hyundai LNG Shipping shares, acquired Hyundai LNG Shipping from HMM in 2014 for about 1 trillion won.

One of the sectors attracting attention in this year’s M&A market is waste treatment. Due to difficulties in obtaining new permits, the value of related companies is skyrocketing. Eco Management Korea (EMK), the second-largest waste treatment company owned by IMM Investment, is valued at around 1 trillion won. IMM Investment acquired EMK from JP Morgan in 2017 for 390 billion won. Recently, IMM Investment circulated teaser letters to potential buyers and is expected to concretize the sale soon. KG ETS, which is on the market, is also rumored to be worth up to 700 billion won.

The market value of Daekyung O&T, a producer of animal and vegetable oils that has selected qualified bidders (shortlist) including two major oil refiners, IMM Investment, Eugene PE, and Mirae Asset Venture Investment’s private equity (PE) division, is reported to be about 500 billion won. The sale target includes 100% of Daekyung O&T shares, comprising 70% held by Stick Investment through its fund and 19.72% held by former Daekyung O&T CEO Kim Chang-yoon.

The distribution sector is also a focus. Burger King and Ministop are looking for new owners. Affinity Equity Partners recently selected Goldman Sachs as the sale advisor for the sale of Burger King shares. They plan to distribute investment brochures to potential buyers soon and conduct a public competitive bidding. The sale target is 100% of the shares of Burger King Korea and Japan held by Affinity. Burger King’s valuation is estimated at around 600 billion won.

Affinity Equity Partners acquired 100% of Burger King Korea shares from VIG Partners in 2016 for 210 billion won. A year later, in 2017, they signed a master franchise agreement with Canada’s Restaurant Brands International (RBI), the global owner of the Burger King brand, to oversee the opening, management, and product development of Burger King stores in Japan. At that time, they also purchased all Burger King shares in Japan held by Lotte GRS for about 10 billion won.

Korea Ministop, the fifth-largest convenience store chain in Korea, has come back on the market after three years. Japan Ministop, a subsidiary of Japan’s AEON Group, conducted a preliminary bidding for the 100% sale of Korea Ministop shares at the end of last year. Several PEFs including Anchor Equity Partners, Unison Capital, Nepstone Holdings, and Emart24 participated. PwC Samil, the sale advisor, has shortlisted candidates and is conducting due diligence, with the main bidding expected to take place this month. However, the valuation, which was around 400 billion won in 2018, has dropped to about 200 billion won due to difficulties in store openings caused by various regulations.

The unusual movements of large corporations with abundant ammunition (cash assets) are also a driving force predicting a bountiful M&A market this year. Samsung Group, with Vice Chairman Lee Jae-yong taking the lead in management, is expected to present significant deals this year as its investment clock speeds up. LG Group and SK Group are also expected to maintain their vigorous appetite this year, according to business circles.

Lee Eun-taek, senior research fellow at KB Securities, predicted, "With companies having secured sufficient cash, this year will be the inaugural year of a boom in M&A and strategic alliance investments." M&A among small and medium-sized enterprises is also a point to watch, especially in the bio industry, which is receiving high expectations. Ha In-hwan, a researcher at KB Securities, said, "Bino has the richest cash assets," and forecasted, "Investment activities in biotech companies are expected to accelerate this year." Companies such as Seegene, Samsung Biologics, SD Biosensor, and Hanmi Pharmaceutical are expected to aggressively carry out M&A.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)