The semiconductor market is enjoying a boom due to accelerated digital transformation caused by COVID-19. Semiconductors are broadly divided into memory and non-memory types. Memory semiconductors serve the role of storing data, while non-memory semiconductors, also called system semiconductors, have information processing functions such as computation and control. Among these, system semiconductors are gaining attention as a field accelerated by the 4th industrial revolution, including artificial intelligence (AI), autonomous driving, and the Internet of Things (IoT). According to the Export-Import Bank of Korea, the system semiconductor market is growing at an average annual rate of 7.6% and is expected to reach $338.9 billion by 2025. However, Korea’s global market share in system semiconductors remains modest at 3.2% as of 2019, unlike its world-leading position in memory semiconductors. Nevertheless, there are companies achieving results within this sector. Asia Economy analyzes the business status and growth potential of domestic system semiconductor companies ‘Above Semiconductor’ and ‘Pixelplus.’

[Asia Economy Reporter Hyunseok Yoo] Pixelplus is emerging from a long tunnel of stagnation and achieving performance improvements. Globally, due to supply instability in automotive semiconductors, a supplier-driven market has developed, leading to improvements in sales and operating profit.

Pixelplus is a fabless company specializing in the design of CMOS Image Sensors (CIS). Established in 2000, it entered the KOSDAQ market in June 2015. Image sensors convert light signals entering through a lens into electrical signals, undergo image signal processing (ISP), and then store the data in storage devices or display the images on screens. They are image capturing components.

The main products include CIS and peripheral components for automotive cameras, CIS and peripheral components for security cameras, CIS for medical devices such as endoscopic cameras, special-purpose CIS, and camera system-on-chips (SoC).

Pixelplus was once listed on the U.S. NASDAQ market in 2005 based on its mobile phone image sensors. However, with the emergence of large corporate competitors and delays in new product development, its performance deteriorated, leading to delisting in 2009. Even after entering the KOSDAQ market in 2015, the outlook was not bright. From 2016 to 2019, it continued to post losses and was designated as a management target company.

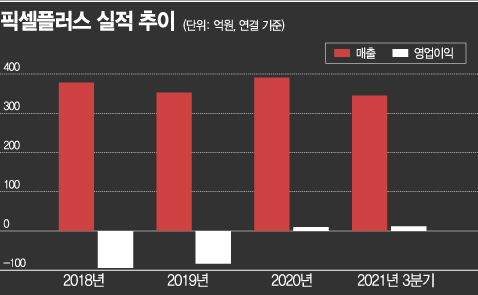

In 2015, it recorded sales of KRW 106.215 billion and operating profit of KRW 9.436 billion. In 2016, sales dropped by 30.85% year-on-year to KRW 73.4 billion, and it posted an operating loss of KRW 7.4 billion, turning to a deficit. Subsequently, losses of KRW 10.7 billion, KRW 9.4 billion, and KRW 8.3 billion were recorded in 2017, 2018, and 2019, respectively. Sales remained in the KRW 35 billion to 39 billion range from 2018 onward.

The biggest reason was poor performance in the Chinese market. China began fostering its domestic semiconductor industry, known as the ‘Semiconductor Rise.’ As Chinese companies aggressively captured the market with low prices, Pixelplus faced difficulties.

In 2020, it succeeded in a performance rebound. Last year, sales reached KRW 39.1 billion with an operating profit of KRW 900 million. Sales increased by 10.56% compared to the previous year, and operating profit turned positive. It was also removed from the management target list. The focus on improving profitability through cost reduction was effective. Selling and administrative expenses (SG&A) were KRW 19 billion and KRW 17.8 billion in 2018 and 2019, respectively, but sharply decreased to KRW 10.2 billion in 2020, enabling a turnaround to profitability.

Performance improvement continued last year as well. As of the third quarter cumulative basis, sales and operating profit reached KRW 34.5 billion and KRW 1.2 billion, respectively, up 31.33% and 151.07% year-on-year.

A notable area is the growth of CMOS image sensors for automotive cameras. Pixelplus began developing automotive image sensors in 2012 and strengthened its business by acquiring related companies or business units. As a result, since 2016, more than half of total sales have come from automotive semiconductors.

The share of automotive image sensors, which accounted for 39% of total sales in 2015, grew to 83.8% by the third quarter of last year. Especially, sales of automotive image sensors are expected to increase for some time. According to Korea Investment & Securities, the average selling price of analog image sensors in the third quarter of last year rose 26% year-on-year, and the operating profit margin reached 12%.

Recently, supply opportunities have increased in the before-market stage of vehicle assembly, and the regions are diversifying, which is a positive factor. As of the third quarter of last year, 82.9% of Pixelplus’s total sales were generated through exports.

Among these, China accounted for 70.72%, mostly in the aftermarket, which is the replacement parts market. However, in August last year, Pixelplus signed a supply contract worth KRW 4.5 billion for automotive image sensors with a major Japanese automotive electronics company. This accounts for 11.5% of last year’s sales. Kyungtae Kang, a researcher at Korea Investment & Securities, explained, "This is a contract with a major Japanese automotive electronics company, and after the initial delivery of KRW 4.5 billion is completed, further supply discussions are expected."

Especially, since the fourth quarter of last year was the peak season, performance is expected to improve. Korea Investment & Securities forecasted that Pixelplus’s annual sales last year would be around KRW 50 billion, an increase of about 30% compared to the previous year. Researcher Kang said, "Considering the growing demand for automotive semiconductors, sales in the peak fourth quarter are expected to continue increasing," adding, "Supported by demand for automotive image sensors to enhance driver convenience and safety features and to realize autonomous driving, sales are expected to gradually trend upward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.