Many Forecasts Predict Increase in Jeonse and Monthly Rent Prices

[Asia Economy Reporter Kim Min-young] A survey forecasting this year's housing market transaction prices showed a close split between opinions of decline and rise. This reflects the current real estate market's foggy state, where negative and positive factors coexist, such as the presidential election, interest rate hikes, supply shortages, and easing of reconstruction regulations.

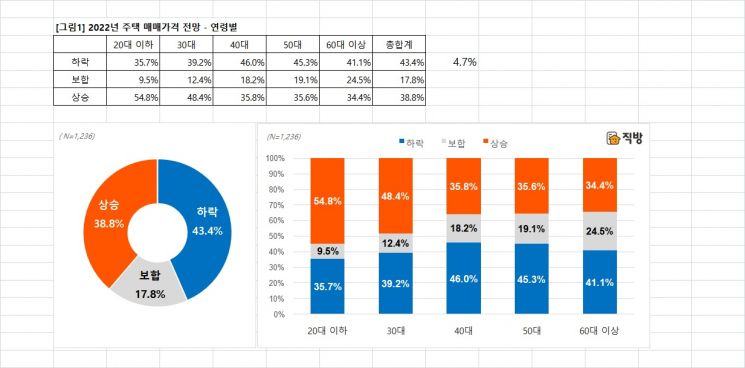

On the 3rd, Zigbang conducted a survey targeting application users asking, "How do you expect housing transaction prices in your residential area this year?" Among the total respondents (,236 people), 43.4% (537 people) answered that prices would decline. Those who expected prices to rise accounted for 38.8% (479 people), showing a tight difference within 5% between opinions of decline and rise.

These results showed differences by age group: those aged 40 and above had a higher proportion expecting a decline, whereas those aged 30 and below had a higher proportion expecting housing transaction prices to rise.

A Zigbang official explained, "Since the difference between opinions expecting rise and decline is within 5%, this year’s housing transaction prices are expected to be difficult to predict," adding, "The housing transaction market is expected to be fluid depending on policy variables such as the new issues of the presidential and local elections."

By region, the proportion of respondents expecting a decline was higher in Seoul, provinces, and the five major metropolitan cities in the provinces.

In Seoul, 47.6% expected a decline, 33.8% expected a rise, and 18.6% expected prices to remain stable. In the provinces, 45.8% expected a decline, 37.3% expected a rise, and 16.9% expected stability. Conversely, in Gyeonggi Province, 42.8% expected a rise, which was higher than the 41.5% expecting a decline, and in Incheon, 43.0% expected a rise, also higher than the 38.3% expecting a decline.

Regarding homeownership, homeowners had a higher proportion expecting housing transaction prices to rise this year, whereas non-homeowners had more opinions expecting a decline.

The most common reason for expecting housing transaction prices to decline was the perception that "current price levels are high," at 32.6%. This was followed by △burden from interest rate hikes (24.2%), △burden from strengthened real estate loan regulations (18.8%), △continued economic instability due to COVID-19 (6.5%), and △promises related to the presidential and local elections (6.1%).

On the other hand, among the 479 respondents expecting prices to rise, 22.5% cited "shortage of new supply" as the biggest factor. This was followed by △purchase switching due to rising monthly rent and jeonse (long-term deposit lease) prices (18.8%), △development benefits such as transportation and maintenance projects (14.2%), and △promises related to the presidential and local elections (11.3%).

Regarding housing jeonse prices, 46.0% of all respondents expected them to rise. Meanwhile, 30.6% expected a decline, and 23.4% expected stability. All age groups showed a higher proportion expecting a rise, especially those in their 30s and 40s.

The main reason for expecting jeonse price increases was "shortage of jeonse supply (listings)" at 37.3%, followed by △increased demand for jeonse due to burden from rising transaction prices (22.0%), and △concerns about rent increases as listings using the right to request contract renewal are released (17.9%).

More than half of the respondents expecting a rise anticipated that jeonse prices would increase this year due to a shortage of jeonse listings and increased demand caused by rising transaction prices.

Regarding monthly rent prices, more than half of all respondents (51.4%) expected them to rise. A Zigbang official said, "We also need to watch how properties that had their contracts extended by two years using the right to request contract renewal will affect the market when they come out in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.