[Asia Economy Reporter Lee Seon-ae] It is expected that differentiation among holding company stocks will intensify further this year.

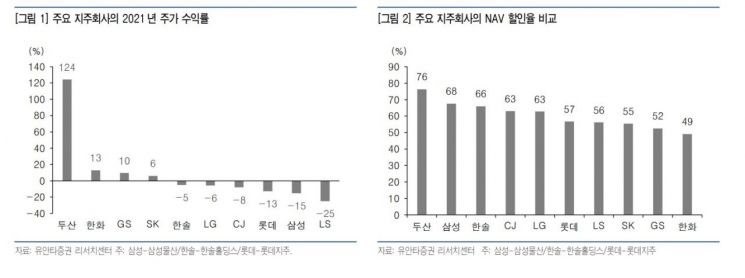

According to Yuanta Securities on the 1st, the average stock return of holding companies in 2021 was 8%, and the average discount rate compared to the measured net asset value reached 61%. Only a very few companies, such as Doosan, recorded positive stock returns.

Of course, the stock prices of the holding sector were not sluggish throughout the year. During January to February and April to June 2021, when the index hit new highs, investors' interest in the value of subsidiaries of holding companies led to favorable returns. Nevertheless, the continuous stock price decline throughout the year and the discount rate reaching 60% compared to NAV acted as factors that drove investors away, and the situation has yet to improve.

Meanwhile, as investors' interest in ESG (Environmental, Social, and Governance) has expanded, investor trust in the governance of holding companies and, more broadly, large conglomerates led by Korean chaebols has begun to decline. Ideas that were once considered natural or those that sought to secure investment returns by riding such trends are losing strength. Facts that were previously overlooked are now acting as discount factors for chaebol companies.

At the same time, investors' expectations for holding companies are rising. While the popularity of simple management-type holding companies has practically bottomed out, interest in holding companies that clearly define their roles and have management that fairly considers the interests of minority shareholders is expanding.

Choi Nam-gon, a researcher at Yuanta Securities, said, "Overcoming the discount rate of Korean large corporations will not be easy," adding, "the most critical indicator that can affect a company's discount rate in the future will be the degree of trust that management can promise to multiple stakeholders." He continued, "The common characteristics of companies expected to lead revaluation this year are ① companies with outstanding management, ② companies where the interests of major shareholders and minority shareholders align, and ③ companies that actively execute portfolio management."

He named SK as the top pick in the holding sector this year, followed by Naver and Kakao. Researcher Choi said, "Due to changes in the investment environment, it is sensed that investors no longer cling to static comparisons of investment targets as in the past," adding, "Now, it is difficult to achieve investment returns simply by comparing valuation multiples, so the gap in multiples between holding companies with management that actively implements dynamic changes and establishes fair governance and those without will widen significantly this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.