Delinquency Rate of Small Multiple Debtors at Savings Banks 10.3%

Delinquency Rate of Large Multiple Debtors Lower at 6.5%

Proportion of Multiple Debtors Increasing Annually, Reaching 66%

"Risk of Livelihood Multiple Debts Turning into Malignant Debt"

[Asia Economy Reporter Song Seung-seop] Among multiple debtors who borrowed money from three or more financial institutions, those with smaller debts were found to be less able to repay their loans. It is a paradox that the loan receivables of secondary financial multiple debtors who borrowed tens of millions of won are of good quality. Analysts suggest that low-income and low-credit borrowers who hastily borrowed money here and there due to the impact of COVID-19 have started to collapse more quickly.

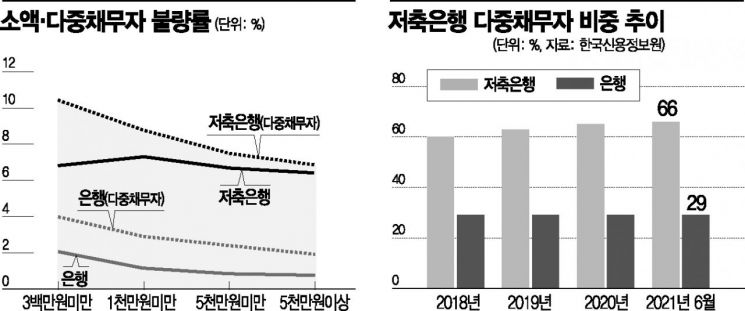

According to the data titled “Analysis and Implications of Savings Bank Credit Loan Borrower Characteristics” published by the Credit Information Service on the 30th, the “default rate” of savings bank multiple debtors who borrowed 3 million won or less recorded 10.3%. This is 3.5 percentage points higher than the overall default rate of 6.8% for borrowers who borrowed the same amount from savings banks. Compared to the default rate of multiple debtors in the banking sector under 3 million won (4.0%) or the overall borrower default rate (2.1%), the difference is even more pronounced.

The default rate refers to the proportion of borrowers who have failed to repay their loans for more than 90 days within one year. It is estimated based on information reported to credit rating agencies when principal and interest payments are not made for a certain period.

Even among multiple debtors, the default rate of borrowers with larger loan amounts decreased. The default rate of savings bank multiple debtors who borrowed between 10 million won and less than 50 million won was 7.4%. This is close to the overall borrower default rate of 6.7% in that range. For high-value loans of 50 million won or more, the difference narrows further to 6.5% and 6.8%, respectively.

Continuously Increasing Multiple Debtors... "Risk of Becoming Malignant Debt"

The default rate was higher among multiple debtors who mainly used savings banks. The default rate of borrowers who had multiple debts only at savings banks was 9.4%. This is about 2 to 3 percentage points higher than borrowers who took loans from both first-tier financial institutions and savings banks (7.1%) or those who also used other secondary financial institutions (6.7%).

The problem is that the number of multiple debtors using savings banks is increasing. The proportion of multiple debtors at savings banks, which was 60% in 2018, rose to 66% as of the first half of this year. This contrasts with the banking sector, which has maintained a steady 29% annually. In particular, the proportion of small credit loan borrowers (under 3 million won) is 10%, three times that of the banking sector (3%), highlighting the need for special risk management.

Also, the proportion of customers in their 20s and 30s, classified as the youth generation, was 41%, higher than the 32% in the banking sector. The 20-30 age group typically has little credit transaction history and low economic participation as they are early in their careers. The report also pointed out that precise credit evaluation is difficult for these “thin filers” (those with insufficient financial transaction history), and most are assigned a middle-level credit rating of 4 to 5.

Professor Lee Jeong-hee of the Department of Economics at Chung-Ang University analyzed, “Multiple debtors with small amounts are mostly for living expenses rather than investment or business purposes,” adding, “Since their credit scores are low, their credit limits are small, and they tend to borrow money little by little.” She warned, “Although the debt problem is currently below the surface, there is a high risk that the living-type multiple debts increased due to COVID-19 will turn into malignant debt.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.