Medium-sized Enterprises Business Outlook Index at 93.3 in Q1 Next Year, Down 1.9p from Previous Quarter

Four Consecutive Quarters of Growth Until Q3 This Year... COVID-19 Halts Growth in Q4

Both Domestic and Export Outlooks Worsen... 'Raw Material Procurement' Tops Economic Uncertainty Factors

Export Boom, Busy Busan Port

Export Boom, Busy Busan Port(Busan=Yonhap News) Reporter Kang Deok-cheol = On the 13th, container unloading operations are underway at Sinsundae and Gammam Piers in Busan Port. Since December began, export amounts have increased by more than 20% compared to the same period last year through the 10th. On the 13th, the Korea Customs Service announced that export value (provisional clearance basis) from the 1st to the 10th reached 19.5 billion dollars, a 20.4% (3.3 billion dollars) increase compared to the same period last year. 2021.12.13

kangdcc@yna.co.kr

(End)

<Copyright(c) Yonhap News Agency, Unauthorized reproduction and redistribution prohibited>

[Asia Economy Reporter Junhyung Lee] Due to the prolonged impact of COVID-19, the business outlook for mid-sized companies in the first quarter of next year has somewhat contracted.

The Korea Federation of Mid-sized Enterprises announced on the 29th that, based on a survey conducted from the 14th of last month to the 8th of this month targeting 500 mid-sized companies, the business outlook index for mid-sized companies in the first quarter of 2021 was 93.3, a decrease of 1.9 points compared to 95.2 in the fourth quarter of this year. A business outlook index above 100 indicates that more companies have a positive outlook on the economy than those who do not. Below 100 indicates the opposite.

The business outlook index for mid-sized companies has declined for two consecutive quarters after recording 98.3 in the third quarter of this year. Previously, the index had risen for four consecutive quarters until the third quarter of this year, but growth slowed in the fourth quarter due to the spread of COVID-19. A representative from the Federation stated, "Positive expectations for next year's economy have decreased," adding, "It appears that worsening supply difficulties for raw materials and parts due to the prolonged pandemic have had an impact."

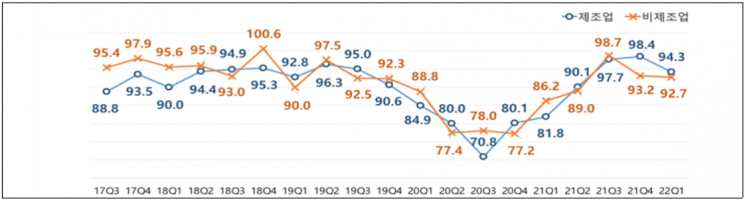

Trends in the Business Outlook Index by Industry for Mid-sized Companies.

Trends in the Business Outlook Index by Industry for Mid-sized Companies. [Photo by Korea Federation of Mid-sized Enterprises]

By industry, most sectors except manufacturing and food and beverage, which recorded record highs in the previous quarter's business outlook survey, showed a downward trend. The manufacturing business outlook index for the first quarter of next year was 94.3, down 4.1 points from the previous quarter. The non-manufacturing business outlook index also decreased by 0.5 points from the previous quarter to 92.7. The real estate and rental sector rose 11.5 points from the previous quarter to 100, but the publishing, telecommunications, and information services sector fell 18.1 points to 85.2.

The domestic demand outlook index was 96.6, down 0.9 points from the fourth quarter of this year. Within manufacturing, only the food and beverage sector showed an upward trend. The domestic demand outlook index for the food and beverage sector rose 8.5 points from the previous quarter to 105.6. In contrast, the automobile sector (90.9) and chemical sector (96.7) decreased by 22.1 points and 6.3 points, respectively, compared to the previous quarter.

The export outlook index was confirmed at 96.3, down 4.4 points from the previous quarter. The export outlook index for the food and beverage sector rose sharply by 22.7 points to 90.9. However, the automobile sector dropped 16.7 points from the previous quarter to 100.

The operating profit outlook index was 92.2, showing a decline in both manufacturing and non-manufacturing sectors. Manufacturing (92.4) and non-manufacturing (92) fell by 7.1 points and 2 points, respectively, compared to the previous quarter. The financial condition outlook index also decreased by 0.4 points from the previous quarter to 96.3.

The manufacturing production outlook index was confirmed at 102.1. This is 3.9 points lower than the previous quarter, which set a record high. However, positive outlooks were maintained across all sectors except for the automobile and chemical industries. The manufacturing facility operation rate outlook index increased by 1.1 percentage points from the previous quarter to 78.3%.

Among mid-sized companies, 37.5% cited 'raw material procurement' as the factor increasing management uncertainty for next year. This was followed by 'economic slowdown in major advanced countries (23.4%)' and 'rising logistics costs (19.3%).'

Regarding government policy support for the continuous growth of mid-sized companies, 'securing liquidity (35%)' was ranked first. This was followed by 'hiring and retaining personnel (23.6%)' and 'export and overseas expansion (14.0%).'

Won-ik Ban, Executive Vice Chairman of the Federation, said, "We must accelerate securing the stability of legal and institutional environments and policy innovation that meets field needs so as not to erode the vitality of companies that are barely recovering."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)