Explicit Declaration of Rare Earth Weaponization... Blocking Capital Following Mining, Refining, and Export Restrictions

China Allows 100% Foreign Ownership in Auto Industry, Likely Insurance Against Future Western Sanctions Including the US

[Asia Economy Beijing=Special Correspondent Jo Young-shin] China has completely banned foreign investment in the rare earth-related industry. Previously, China had given final approval for the merger of three companies related to rare earth mines and minerals. The merger of these three companies reflects the Chinese authorities' intention to further strengthen their market dominance through a giant single rare earth enterprise.

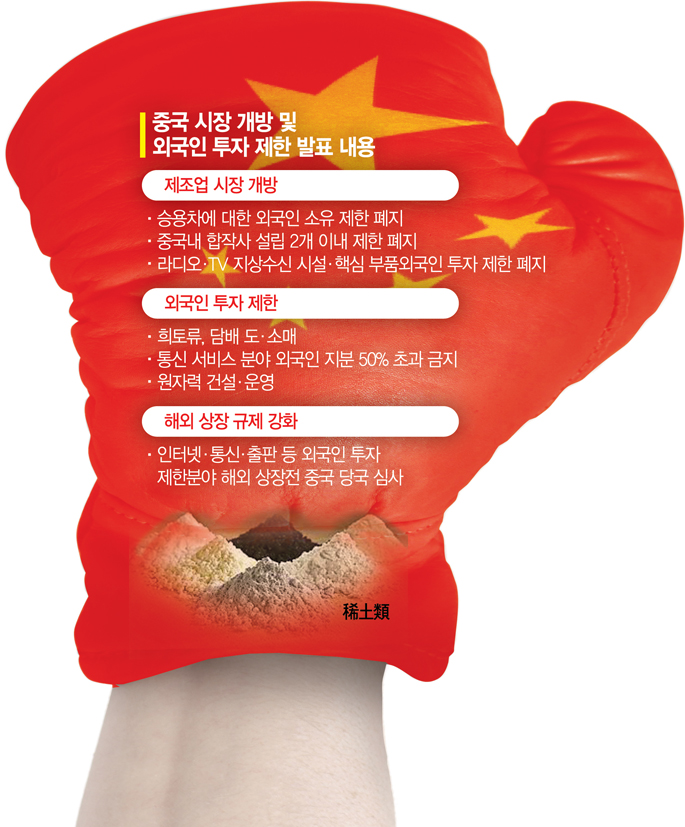

According to Chinese media including the state-run Global Times on the 28th, China's Ministry of Commerce and the National Development and Reform Commission (NDRC) announced under the title "Special Management Measures for Foreign Investment Access" that from January 1 next year, foreign investment in the rare earth and other mineral industries will be prohibited.

The Chinese government also completely blocked foreign access to domestic rare earth-related information, including banning foreign investors from collecting rare earth-related data and samples and from accessing production processes.

The Global Times reported that this restriction on foreign investment in rare earths is a measure to protect and develop rare earth resources and will lead to technological innovation in rare earths and other rare minerals.

In this regard, some in China analyze that the Chinese government has openly expressed the weaponization of rare earths and other rare minerals. This move is regarded as the finishing touch in China's weaponization of rare earths.

China's National People's Congress (NPC) passed the Export Control Law last October to protect national interests and security by restricting or banning the export of military and other goods. Rare earths are included in the substances covered by the Export Control Law. Subsequently, on the 22nd, the Chinese government approved the asset merger of China Minmetals Corporation, Aluminum Corporation of China Limited (Chalco), and Ganzhou Rare Earth Group, allowing the birth of the giant China Rare Earth Group. China Rare Earth Group holds a 70% share of the global heavy rare earth market. It is literally a giant company that can manipulate international market prices. While Chinese IT companies face antitrust sanctions, rare earths have been an exception.

The ban on foreign capital inflow into the rare earth industry is effectively the final chapter in the weaponization of rare earth resources. The dominant analysis is that all channels have been blocked to prevent overseas capital from poking into the domestic rare earth industry. With this measure, the entire rare earth industry process?from mining to production (refining), export, and capital?is under the control of the Chinese government.

China claims the valuable resources have been inefficiently managed so far, causing side effects such as environmental destruction, and uses this as a justification for rare earth management. However, reports suggesting the real purpose is weaponization are emerging everywhere. In fact, the Global Times cited a report from the U.S. think tank Center for Strategic and International Studies (CSIS), emphasizing that China supplies 85% of the world's rare earths and holds market decision-making power. It also stated that rare earths will serve as a stern warning against Western attempts, including by the U.S., to contain China.

Rare earths are raw materials applied in cutting-edge technologies such as motors (permanent magnets) and batteries for electric vehicles. If China uses the card of restricting rare earth production and exports, the damage to South Korea will also be considerable.

Meanwhile, the Chinese government has decided to allow 100% foreign ownership in the Chinese passenger car manufacturing sector starting next year. Chinese media evaluated that this 100% foreign investment allowance enables global automakers such as U.S. Tesla, German Volkswagen, and Japanese Toyota to operate autonomously. The sale of a 25% stake in Dongfeng Yueda Kia by China's Dongfeng Motor Group is also due to the expansion of foreign investment shares.

However, there is also an assessment that if the Western bloc, including the U.S., imposes sanctions on key electric vehicle components such as automotive semiconductor chips, the damage will fall entirely on domestic companies, making this share expansion a form of insurance by the Chinese government.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)