[Asia Economy Reporter Ji Yeon-jin] Ahead of the year-end ex-dividend date, selling pressure from individual investors is expected to intensify. The ex-dividend date refers to the date after which shareholders no longer have the right to receive dividends; investors holding stocks on the ex-dividend date receive the dividends. However, the ex-dividend date also serves as the point at which major shareholders subject to capital gains tax are determined, leading individual investors to sell their stocks annually to avoid capital gains tax.

According to Hana Financial Investment on the 22nd, on last year's ex-dividend date, December 28, individual investors recorded net sales close to 1 trillion KRW each on the KOSPI (946 billion KRW) and KOSDAQ (903 billion KRW). In 2019, net sales on the ex-dividend date were 467 billion KRW and 544 billion KRW, respectively. Individual investors holding more than 1 billion KRW in a single stock are classified as major shareholders and must pay 20-25% tax on capital gains from stock transfers; to avoid this, many sold their stocks before the major shareholder determination date, which influenced these figures.

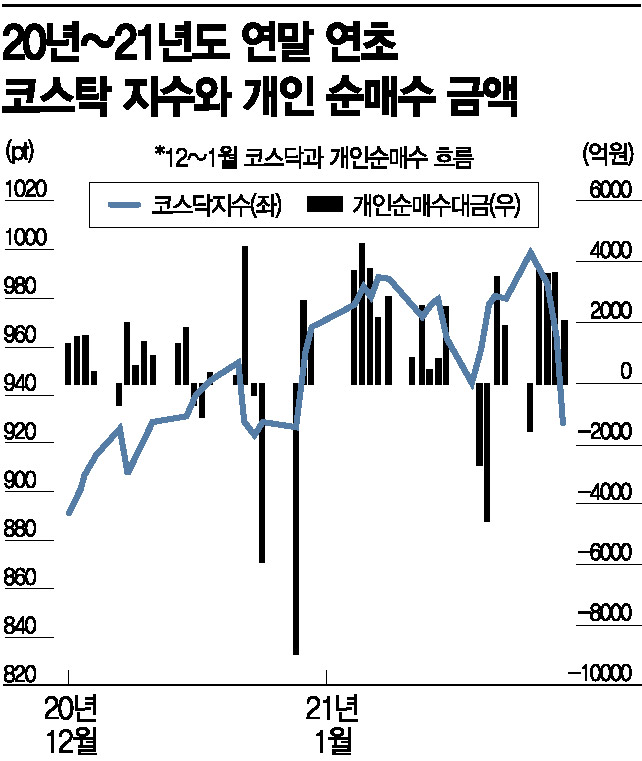

Because of this, the KOSDAQ index, where individual investors have significant influence, showed signs of bottoming out just before the ex-dividend date. Lee Kyung-soo, a researcher at Hana Financial Investment, said, "Some interpret the year-end major shareholder avoidance volume as a buy signal at the bottom and take advantage of it," adding, "In the past three years, buying at the index bottom caused by major shareholder avoidance volume at the end of December has yielded profits based on the average index in January of the following year."

Since the selling trend typically starts two days before the ex-dividend date and expands, this year, individual selling is expected to concentrate from the 24th for the purpose of avoiding capital gains tax. Last year, individuals net bought 47 trillion KRW on the KOSPI and 16 trillion KRW on the KOSDAQ. This year, the figures are 68 trillion KRW for the KOSPI and 12 trillion KRW for the KOSDAQ, indicating an increase in net buying on the KOSPI and a decrease on the KOSDAQ.

While the KOSPI yielded 33% and the KOSDAQ 60% last year, as of the closing price on the 21st this year, the KOSPI is up 12% and the KOSDAQ 13%, showing weaker performance compared to last year. Therefore, it is expected that the volume of major shareholder capital gains tax-related sales will be smaller than last year. The researcher explained, "Last year, due to very high returns, there were many capital gains from stocks, resulting in net sales close to 1 trillion KRW on the ex-dividend date alone. However, this year, since returns are lower, capital gains are not as significant, so the need to sell is expected to be less."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.