Apartment Sales Transactions Until October

Down 19% Compared to Last Year

Outsider Purchase Ratio Hits All-Time High

[Asia Economy Reporters Kangwook Cho, Minyoung Kim] Due to the spread of peak price perception caused by the rapid rise in housing prices, combined with loan regulations and interest rate hikes, both the volume and total amount of apartment transactions this year have decreased compared to last year. However, as investment demand surged into non-regulated areas in the provinces due to the government's regulatory balloon effect, the proportion of outsider purchases of apartments nationwide reached an all-time high.

◆Policy Effect? Sharp Drop in Transaction Volume and Total Amount= According to Zigbang on the 20th, the nationwide apartment sales transaction volume from the beginning of this year to October was 597,000 cases, down 19.1% compared to the same period last year (738,000 cases). In particular, the metropolitan area including Seoul, Gyeonggi, and Incheon recorded 254,000 cases, a sharp decrease of more than 110,000 transactions compared to the same period last year. In contrast, the provinces recorded 343,000 cases during the same period, with a decrease of only 27,000 cases.

Regarding metropolitan area housing prices, Gyeonggi and Incheon were analyzed to have significantly outperformed Seoul. According to the Korea Real Estate Board, the average apartment sales price nationwide rose by 13.7% until November. Among cities and provinces, Incheon recorded the highest increase at 23.9%. Gyeonggi also rose by 22.1%, ranking second among metropolitan cities and provinces nationwide. This is nearly three times the 7.8% increase seen in Seoul. As Seoul housing prices soared to unprecedented levels, demand appeared to concentrate in the relatively affordable Incheon and Gyeonggi areas.

In the provinces, Jeju, Daejeon, and Busan showed notable housing price increases. Jeju rose by 17.9%, the largest increase among provinces, while Daejeon and Busan rose by 14.4% and 14.0%, respectively. A Zigbang official analyzed, "This year's apartment prices are record-breaking, surpassing last year," but added, "However, since November, the rate of increase has significantly slowed, showing a pause."

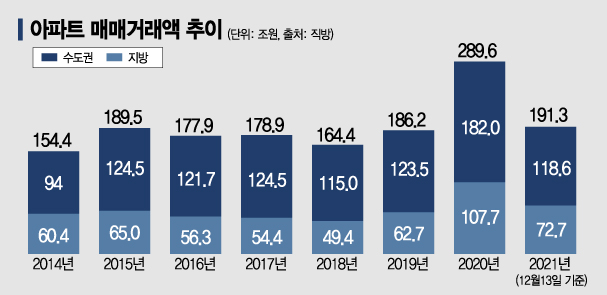

As transactions contracted, the total amount of apartment sales transactions (as of the 13th) also shrank. By the end of October, the total was 191.3 trillion KRW, about two-thirds of last year's 289.6 trillion KRW. The metropolitan area accounted for 118.6 trillion KRW, and the provinces 72.7 trillion KRW. However, except for last year, the provinces recorded the highest transaction amount since related statistics began to be compiled. This is because demand concentrated in the provinces, which are relatively less regulated.

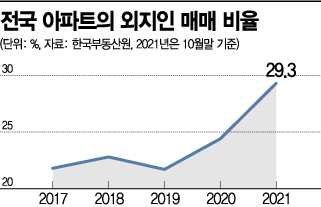

◆Hot Out-of-Town Investment... Outsider Purchase Ratio Hits All-Time High= Although transactions contracted, the trend of out-of-town investment remained strong. According to the Real Estate Board, the proportion of outsider purchases of apartments nationwide steadily increased from 21.8% in 2017, surpassed 24% last year, and exceeded 29% this year. This is the highest ratio ever recorded.

The areas with the strongest out-of-town investment were the Chungcheong region, Gangwon, and Sejong. Chungnam and Chungbuk reached 42.9% and 39.4%, respectively. This means that 4 out of 10 houses were purchased by residents from other regions. Gangwon and Sejong also had high outsider purchase ratios of 39.7% and 38.4%, respectively. In contrast, Busan and Daegu had the lowest ratios nationwide at 18.3% and 17.3%, respectively.

The market views that as regulations expanded throughout the metropolitan area, investment demand shifted to non-regulated areas nearby such as Chungcheong and Gangwon. In particular, in the Chungcheong region, when Cheongju and Cheonan were regulated, demand moved to nearby areas like Eumseong and Jincheon. The increase in outsider purchase ratio in Ulsan is also analyzed to be due to metropolitan demand inflow into non-regulated areas such as Dong-gu and Ulju-gun.

Kwon Il, head of the research team at Real Estate Info, said, "As housing prices in Daejeon rose significantly, the number of investors choosing Sejong instead increased, and Incheon is also steadily attracting demand from Seoul as an undervalued area in the metropolitan region."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.