Authorities Aim to Lower Household Loan Growth Rate Target

Savings Banks, 21.1→14.8%...Stricter DSR Regulations by Borrower Type

[Asia Economy Reporter Kwangho Lee] It is expected to become increasingly difficult for low-income and low-to-medium credit borrowers to obtain loans next year. Although banks have announced plans to expand mid-interest rate loans, the threshold for first-tier financial institutions remains high, which is likely to tighten household loans in the second-tier financial sector, mainly used by low-income and low-credit borrowers.

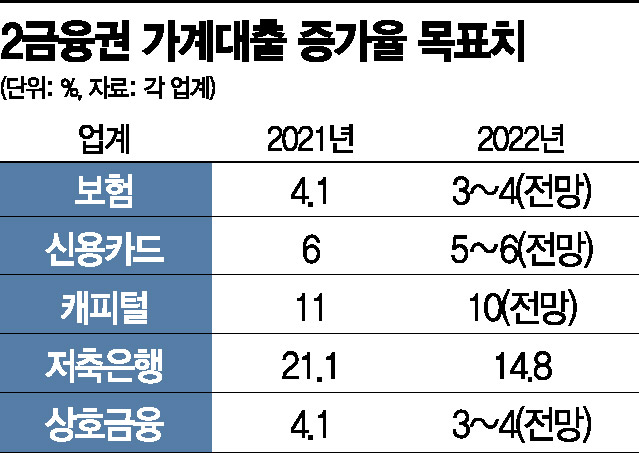

According to financial authorities and related industries on the 20th, the Financial Supervisory Service is currently setting the target growth rate for household loans in the financial sector for next year. Both banks and second-tier financial institutions are showing a trend of lowering their targets compared to this year.

The insurance and mutual finance industries are expected to set their growth rates slightly lower than this year's 4.1%. The card (6%) and capital industries (11%) are also discussing targets below this year's recommended growth rates. In particular, the representative community finance institution, savings banks, have significantly reduced their target growth rate for household loans next year. The recommended rate, which was 21.1% this year, has dropped to 14.8%.

Recently, Financial Services Commission Chairman Seungbeom Ko stated that he would consider excluding loans to low-to-medium credit borrowers from the total volume control (4-5%) limit next year, raising expectations for some relief. However, the general view is that this is merely an incentive for certain sectors.

The card and capital industries are considering a plan to exclude 10% of the increase in loan balances for low-to-medium credit borrowers from the total loan volume next year. The savings bank industry has decided to maintain a relatively high level compared to other sectors rather than providing separate incentives. For savings banks, 60-70% of loans are to low-to-medium credit borrowers. On the other hand, the insurance and mutual finance industries reportedly have no related incentive discussions, as the balance of unsecured loans to low-to-medium credit borrowers is relatively small.

The debt service ratio (DSR) regulation per borrower is also a factor raising the loan threshold. From January next year, if total loans exceed 200 million KRW, the borrower-level DSR regulation will apply, limiting the annual principal and interest repayment amount to no more than 40% of annual income for first-tier financial institutions. The DSR for second-tier financial institutions will be 50%, a 10 percentage point reduction.

Card loans, which low-income people mainly used for debt rollover, will also be included in borrower-level DSR calculations starting January next year. Even if loans are obtained, the maximum contract maturity is expected to be limited to three years.

The savings bank industry will see the standard adjusted from 90% to 65%, meaning the amount of money that can be lent to a single customer will decrease.

An industry insider said, "Given that the household loan growth rate limit will be significantly reduced compared to this year and DSR regulations will be strengthened, unlike banks, the loan cliff in the second-tier financial sector will continue for some time," adding, "It will not be easy to handle new loans until clear measures from financial authorities are announced."

Professor Tae-yoon Sung of Yonsei University’s Department of Economics advised, "As long as total volume regulations continue, damage to low-to-medium credit borrowers is inevitable, and even if the total household loan volume appears to decrease, it could further increase risks present in the financial market," urging, "More proactive and meticulous management by financial authorities is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)