Germany delays approval of direct Russia gas pipeline "Not possible until first half of next year"

Netherlands TTF natural gas price hits record high...7 times higher than early this year

US LNG exports shifting toward Europe...Concerns over ripple effects in Asia too

[Asia Economy Reporter Hyunwoo Lee] As military tensions between Russia and Ukraine escalate, European natural gas prices have soared to unprecedented levels, raising concerns that natural gas supply and demand issues could expand globally. With European Union (EU) countries expected to reduce their dependence on Russia by increasing imports from the United States and the Middle East, there are worries that gas supply in Asian countries may also face difficulties in the medium to long term.

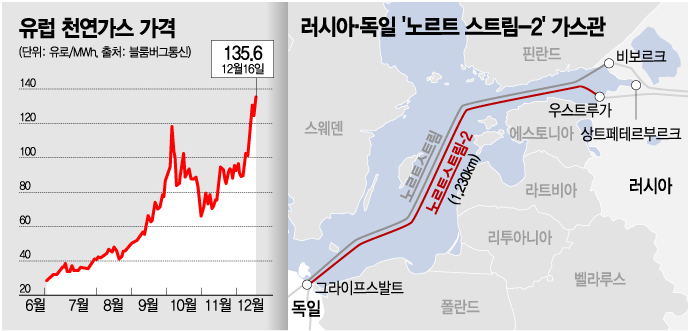

On the 16th (local time), the natural gas futures price at the Netherlands TTF exchange, a major European natural gas price indicator, surged to 135.60 euros per megawatt-hour (MWh), setting a new all-time high. This marks a more than sevenfold increase compared to the 17.94 euros at the beginning of the year.

On the same day, the German government announced it would withhold approval for the operation of the Nord Stream 2 pipeline, a direct gas pipeline with Russia, highlighting the natural gas supply crisis. According to Bloomberg News, Jochen Homann, head of the German Federal Network Agency, stated at a press conference, "Approval for the operation of Nord Stream 2 will not be granted until the first half of next year," adding that "legal requirements have not been met."

The day before, the EU also announced new regulations aimed at reducing gas dependence on Russia. According to the Associated Press, the European Commission unveiled a revision to gas market regulations that bans long-term natural gas contracts with non-EU countries after 2049. This legislation is interpreted as a measure to reduce long-term contract supplies from Russia in preparation for the weaponization of Russian natural gas.

Concerns are growing that the supply of Russian natural gas will become more difficult in the future, causing European natural gas prices to continue their sharp rise. Currently, European countries rely on Russia for 43% of their natural gas consumption. Compressed natural gas (CNG) has been supplied directly through pipelines connecting Russia and European countries. If a full-scale war breaks out between Russia and Ukraine, European natural gas prices are expected to surge even further.

Asian countries, which mainly import U.S. liquefied natural gas (LNG), have not yet been directly affected by the European natural gas crisis. However, if Europe’s demand for alternative natural gas shifts toward the U.S., medium to long-term supply concerns may arise.

According to natural gas information provider Natural Gas Intelligence (NGI), since the beginning of this month, the arbitrage profit from transactions between U.S. LNG exporters and the European region averaged $37 per MMBtu (one million British thermal units), higher than the $30 arbitrage profit in the Asian region. As a result, U.S. LNG exporters are reportedly favoring exports to Europe over Asia.

NGI analyzed, "The price gap between natural gas in the U.S. and Europe has widened more than tenfold, and with mild winter weather expected in Asia and the U.S., demand is anticipated to decrease, prompting LNG companies to shift their focus heavily toward exports to Europe."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.