Renewal Period for Over 5,000 Locations Next Year

Competition to Attract Franchise Owners from Rival Companies

[Asia Economy Reporter Lim Chun-han] The convenience store industry has unveiled the largest-ever win-win plan to attract franchise owners.

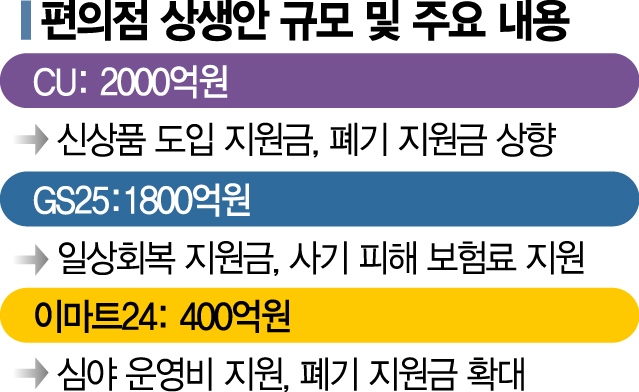

On the 16th, CU announced a 200 billion KRW-scale win-win plan, including an increase in waste support funds and the establishment of support funds for introducing new products. The waste support funds, which had been applied only to lunch boxes and ready-to-eat foods, were expanded to 41 categories such as fruits, vegetables, and refrigerated side dishes, and the waste support funds were increased up to 400,000 KRW per month. Franchise stores that actively introduce new products will receive support funds of up to 150,000 KRW per month. Stores accounting for 40% of the total, evaluated on cleanliness and service, will also receive incentives of up to 1 million KRW twice a year.

Earlier, GS25 announced a win-win plan worth 180 billion KRW. As a disaster relief fund due to the COVID-19 pandemic, all stores will receive a daily recovery win-win support fund of 200,000 KRW. In the first half of next year, the headquarters will introduce a system to support insurance premiums for fraud compensation to help franchise stores prepare against voice phishing damage related to securities products such as Google gift cards. They will also strengthen investments in new concept stores such as fresh-enhanced stores and caf?-type stores, along with health checkups and increased contract renewal support funds for long-term franchise owners with 10 years of operation.

Emart24 has also launched a 40 billion KRW-scale win-win support. They established a win-win support program to support stores wishing to expand late-night operations targeting 24-hour non-contracted franchise stores. For lunch box and sandwich product groups, in addition to the existing 20% waste support fund, new products will receive an additional 30% support for one week after launch, covering a total of 50% of the waste amount.

According to the convenience store industry, about 5,000 convenience stores are up for contract renewal next year. This accounts for about 10% of all convenience stores in the country. Due to difficulties in opening new stores under the convenience store voluntary regulations, headquarters of convenience stores have no choice but to compete to attract franchise owners from rival companies.

The market landscape could change depending on the results of this franchise owner recruitment. The number of convenience store outlets is a key indicator directly linked to economies of scale and sales. As of the end of last year, CU and GS25 are competing for the top spot in the industry with 14,923 and 14,688 stores respectively. They are followed by Seven Eleven with 10,501 stores, Emart24 with 5,169 stores, and Ministop with 2,603 stores.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.