ETF Market Cap at 2.6% of Stock Market... Greater Growth Potential than US and Japan

ETN Indicator Value Hits Record High Since Market Launch in 2014

[Asia Economy Reporter Gong Byung-sun] The domestic Exchange-Traded Fund (ETF) market size exceeded 70 trillion won this year. The global ETF average daily trading volume also ranked third, following the United States and Japan.

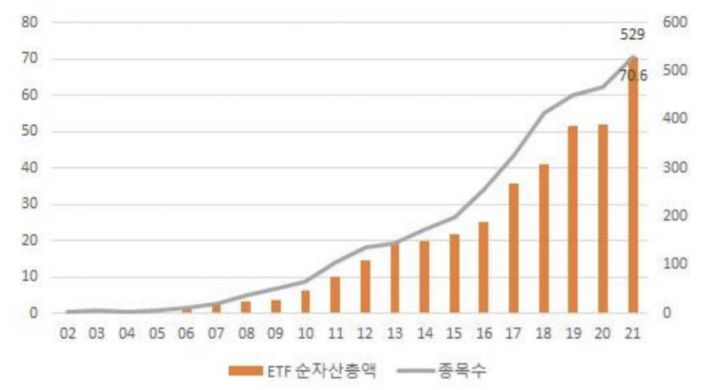

According to the Korea Exchange on the 15th, as of the 10th, the total net assets of ETFs reached 70.6 trillion won, a 35.5% increase compared to the end of last year. The total net assets of ETFs surpassed 70 trillion won in November this year.

The market capitalization also increased significantly compared to last year. The market capitalization of ETFs accounted for about 2.6% of the KOSPI and KOSDAQ, up 0.4 percentage points from 2.2% at the end of last year. However, it remains lower than the ETF net asset ratio relative to the U.S. market capitalization (13.1%) and Japan (9.7%), indicating significant growth potential going forward.

There are 20 ETFs with net assets exceeding 1 trillion won, an increase of 8 from the previous year. The ETF with the largest net assets is ‘KODEX 200’ with 4.9756 trillion won. Following are TIGER China Electric Vehicle SOLACTIVE (3.1202 trillion won), KODEX 200 Futures Inverse 2X (2.4006 trillion won), TIGER 200 (2.0893 trillion won), and KODEX Short-term Bond (1.9443 trillion won). Approximately 14.9 trillion won flowed in from January 1 to the 10th of this month. As interest in overseas ETFs increased, funds were mainly concentrated in overseas-themed and representative index ETFs.

The number of listed ETFs reached 529, an increase of 61 from the previous year. 80 ETFs were newly listed, and 19 were delisted. The addition of theme ETFs in sectors with high future growth potential such as renewable energy, future cars, and metaverse, as well as overseas ETFs, expanded the variety of products. Additionally, equity active ETFs pursuing excess returns compared to benchmark indices were actively introduced starting this year. A total of 21 active ETFs were listed this year alone.

The average daily trading volume of ETFs from January 1 to the 10th of this month was 2.9889 trillion won, a 221% decrease compared to the previous year. This was due to reduced trading in leveraged and inverse ETFs. However, excluding leveraged and inverse ETFs, the average daily trading volume was 1.25 trillion won, an increase of 250 billion won compared to the previous year.

From January to October, the global trading volume was 2.579 billion dollars (approximately 3.0605 trillion won), ranking third after the United States and Japan. Among this, the institutional trading ratio increased by 6 percentage points compared to the previous year, while the foreign trading ratio decreased by 7 percentage points. As a result, the trading volume distribution was 44% for individuals, 25.2% for institutions, and 30.8% for foreigners. This is relatively more evenly distributed compared to the KOSPI trading volume, where 63.2% was concentrated among individuals.

Investment through pension accounts also expanded. Since 2019, pension ETF investments utilizing the advantages of pension accounts, which allow income deduction and tax deferral, as well as diversification and transparency, have continuously increased. The scale of ETF investments through pension accounts grew from 471.7 billion won in 2019 to 2.9613 trillion won in the first quarter and 4.5 trillion won in the second quarter of this year.

The average ETF return from January 1 to the 10th of this month was 6.28%. There were 314 ETFs with gains, outnumbering the 135 ETFs that declined. The average return of domestic equity ETFs was 7.47%, exceeding the KOSPI’s 4.76% by 2.71 percentage points. The top cumulative return this year was ‘KINDEX Bloomberg Vietnam VN30 Futures Leverage,’ which recorded a return of 75.01%.

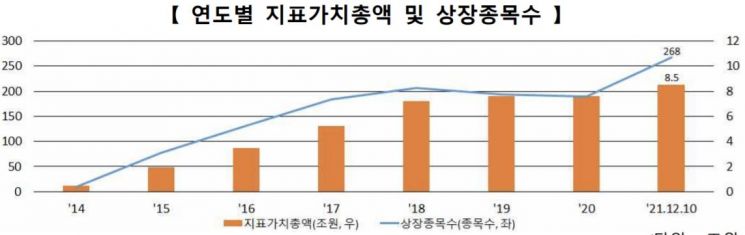

Exchange-Traded Notes (ETNs) also saw significant growth this year. As of the 10th of this month, the total indicative value of ETNs was 8.5 trillion won, and the number of listed ETNs was 268, achieving the highest performance since the market opened in 2014. On the 9th of last month, the indicative value reached a record high of 9.04 trillion won.

The average daily trading volume from January 1 to the 10th of this month was 44.9 billion won, a decrease of about 52% compared to the previous year. However, excluding the volatile period of crude oil ETNs from March to June last year, the level is similar. Trading volume has been increasing since August this year as many commodity and representative index products with high market demand were listed. In particular, with the listing of representative index products such as KOSPI 200 and KOSDAQ 150, the average daily trading volume surged to about 68.9 billion won in the fourth quarter.

Regarding returns, the overall average return of ETNs during the same period was about 4.44%. Among these, domestic equity ETNs showed an average return of 6.46%, outperforming the KOSPI by 1.70 percentage points.

A Korea Exchange official stated, “We will list various products that meet investor demand next year and promote institutional improvements to introduce innovative active products. With the quantitative growth of the ETF and ETN markets, we will strengthen market monitoring and communication channels and also focus on investor protection.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.