Sustained Surge in Prices of Key Raw Materials for Secondary Batteries

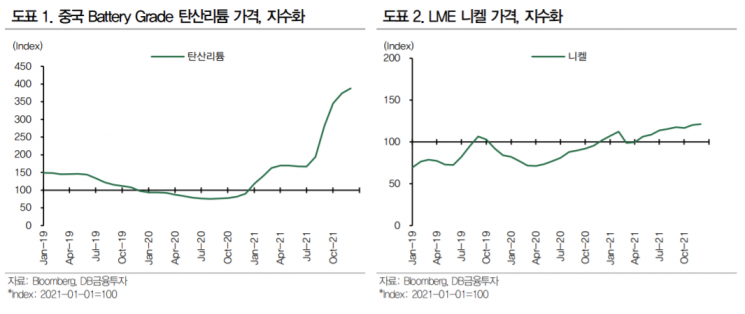

Lithium Carbonate and Nickel Up 21% and 290% Since Early Year

Domestic Cathode Material Companies Unable to Reflect Metal Price Increases in Product Prices

"Price Increases to Continue After Q4, Expecting Growth in Revenue and Profitability"

[Asia Economy Reporter Minji Lee] The prices of metals that serve as key raw materials for secondary battery materials such as lithium carbonate and nickel continue to surge. Lithium carbonate, which showed the highest price increase, rose about 290% compared to the beginning of the year, while nickel prices also increased by approximately 21% year-to-date.

The rise in metal prices is due to a combination of several complex factors, including reduced supply capacity caused by external circumstances. Jaehun Jung, a researcher at DB Financial Investment, stated, “The sudden surge in demand is the most significant factor,” adding, “This trend is expected to continue next year due to the rapidly increasing demand for electric vehicle batteries, and there will be no concerns about a sharp drop in metal prices as seen in the past.” According to SNE Research, as of last October, the cumulative amount of cathode materials installed reached 438,000 tons, significantly exceeding the annual installation volume of 290,000 tons in 2020.

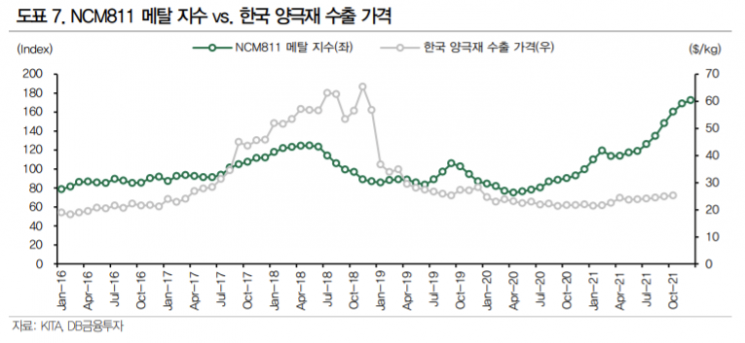

Due to the rise in raw material prices, cathode material prices are also showing a steep upward trend. The spot price of NCM811 cathode material in China rose about 29%, from 210,000 yuan/ton in July to 270,000 yuan/ton this month. Similarly, NCM622 cathode material increased approximately 30%, from 193,000 yuan/ton in July to 250,000 yuan/ton.

However, South Korea’s cathode material export prices have not reflected this trend. Korean cathode materials rose only about 5%, from $24.1 per kg in July to $25.2 per kg in October.

Researcher Jung said, “With the rise in metal prices, it is expected that South Korea’s cathode material export prices will also show an upward trend,” adding, “The export prices of cathode materials from Daegu and Cheongju, where high-nickel cathode material exports are mainly conducted, increased by only 6% and 8%, respectively.”

In the past, when metal prices surged sharply in 2017 and 2018, South Korea’s cathode material export prices rose with about a three-month lag relative to metal prices. However, this year, despite the steep price surge, export prices have only slightly increased, showing a different trend from the past. Researcher Jung explained, “The rate at which cathode material companies raise their prices is not keeping pace with the speed of metal price increases,” adding, “Price hikes for cathode materials are expected to continue after the fourth quarter.”

In the third quarter, EcoPro BM and L&F, South Korea’s largest high-nickel cathode material companies, posted better-than-expected strong results despite the pace of sales price increases not keeping up with cost increases. Researcher Jung said, “While the recent sharp rise in metal prices has somewhat stabilized, price increases for cathode materials are expected to continue after the fourth quarter,” adding, “This is a phase where cathode material companies are achieving further scale expansion and profitability improvement.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)