Expected November CPI Increase of 6.8%... Spring Rate Hike Forecast for Next Year

Global Stocks Fall and Emerging Markets Raise Rates Amid US Early Tightening Moves

[Asia Economy Reporters Byunghee Park and Jihwan Park] While the number of new unemployment claims in the U.S. hit the lowest level in 52 years, there are forecasts that the U.S. inflation rate will reach its highest level in 40 years. As employment conditions improve significantly and inflation continues its steep rise, there are expectations that the Federal Reserve's (Fed) tightening measures could accelerate. Following the New York Stock Exchange, Asian markets including South Korea showed a simultaneous downward trend.

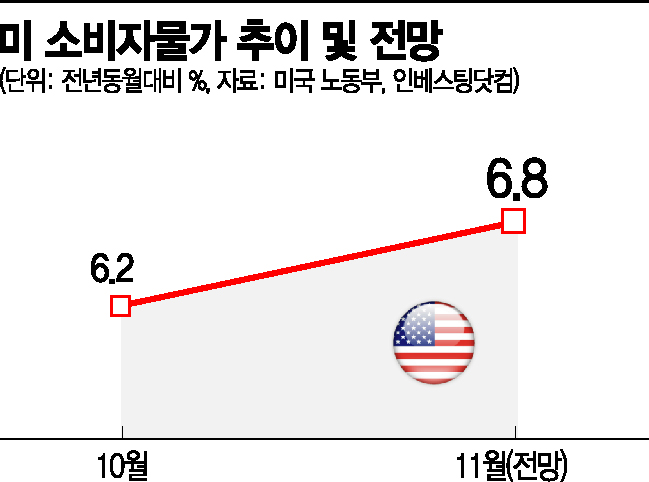

On the 9th (local time), Bloomberg reported that the U.S. Consumer Price Index (CPI) inflation rate for November, to be released on the 10th, is expected to reach 6.8%.

U.S. Inflation Hits Highest in 40 Years

The 6.8% figure is the highest since June 1982, when it recorded 7.1%. Considering that recent U.S. inflation rates have often exceeded market expectations, the possibility that the November CPI inflation rate could jump into the 7% range cannot be ruled out. The October CPI inflation rate was 6.2%, while the market expectation at that time was 5.9%.

Given the improving employment conditions, there is room for inflation to rise further.

The Department of Labor announced on the 9th that new unemployment claims reached the lowest level in 52 years. The Department reported that new unemployment claims for the week of November 28 to December 4 totaled 184,000, the lowest since the first week of September 1969.

With inflation accelerating and employment conditions improving, there are expectations that the Fed's tightening measures could speed up. The Fed will hold its final Federal Open Market Committee (FOMC) meeting of the year on December 14-15.

The Fed began tapering (reducing asset purchases) at the end of last month, aiming to cut $15 billion per month. Since the Fed's monthly asset purchases total $120 billion, tapering is expected to conclude around June next year if the current plan continues.

However, with inflation accelerating, there are forecasts that the Fed may increase the tapering amount to $30 billion per month at this month's FOMC, potentially ending tapering by March next year. With an earlier tapering end date, there are even expectations that the Fed could raise the benchmark interest rate in the spring of next year.

The Fed will also release its forecasts for economic growth, inflation, and unemployment rates at this FOMC meeting. The key focus is how much the Fed will revise upward its inflation forecast. The Fed releases inflation forecasts based on the Personal Consumption Expenditures (PCE) index. This year, the Fed has steadily raised its core PCE index forecasts. At the March FOMC, the median forecast for this year's core PCE inflation was 1.8%, which was raised to 3.0% in June and 3.7% in September. In contrast, the forecast for next year's core PCE inflation was not raised sharply, moving from 1.9% in March to 2.1% and then 2.3%. This reflects the view that inflation will stabilize next year.

However, recently Fed Chair Jerome Powell changed his view on inflation. Powell withdrew his previous stance that inflation would stabilize next year and stated that he cannot guarantee inflation stability in the coming year.

Global Stock Markets Turn Downward

Amid concerns that the pace of tightening could accelerate, global stock markets turned downward on the day. On the 9th, the S&P 500 index fell 0.72%, and the Nasdaq index dropped 1.71% in New York. In Tokyo, the Nikkei 225 index opened 0.49% lower compared to the previous trading day.

South Korean stock markets also struggled on the morning of the 10th. As of 10:22 a.m., the KOSPI stood at 3,008.94, down 20.63 points (0.68%) from the previous trading day. At the same time, the KOSDAQ was at 1,016.75, down 6.12 points (0.60%).

Domestic market experts analyze that the early tightening moves by the U.S. have already been somewhat priced into the market, so the impact will be limited. They explain that China, which has the greatest influence on the domestic market alongside the U.S., is playing a buffering role by increasing liquidity supply amid recent concerns about economic slowdown, unlike the U.S. Ewungchan Lee, a researcher at Hi Investment & Securities, said, "The recent positive trend in the KOSPI is largely due to China's monetary policy moving in a more accommodative direction. Even if the U.S. accelerates tapering, the buffering effect from China means the market shock will likely be less severe than in the U.S."

Emerging Markets Raise Interest Rates in Chain Reaction Amid Capital Outflow Concerns

As the Fed tightens monetary policy and dollar liquidity decreases, foreign capital is flowing out of emerging markets.

According to statistics from the Institute of International Finance (IIF), as of the end of November, foreign capital flows in emerging markets (excluding China) in both stock and bond markets recorded negative figures. This indicates that foreign capital is leaving emerging markets. This is the first time since the COVID-19 pandemic began in March last year that foreign capital has exited emerging markets.

When dollar funds flow out, the dollar's value rises, and the relative value of emerging market currencies falls, increasing inflation risks in emerging countries.

Many emerging countries are already facing severe inflation crises and are rapidly raising benchmark interest rates. On the 9th, Peru raised its benchmark rate from 2% to 2.5%. Ukraine also increased its rate from 8.5% to 9%. The day before, Poland raised its rate from 1.25% to 1.75%, and Brazil increased its rate by 1.5 percentage points from 7.75% to 9.25%. Elvira Nabiullina, Governor of the Bank of Russia, also announced that the central bank could raise the benchmark rate by up to 1 percentage point at its final monetary policy meeting on the 17th.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.