The Biggest Factor Affecting the Financial Industry is Interest Rate Hikes

[Asia Economy Reporter Park Sun-mi] Domestic and international credit rating agencies are optimistic that the banking industry will maintain stable profitability and creditworthiness next year. However, they expressed concerns that Korea’s entry into a period of interest rate hikes?being the first among the Group of Twenty (G20) countries to raise the benchmark interest rate since COVID-19?could lead to a deterioration in corporate debt repayment capacity, threatening banks’ soundness.

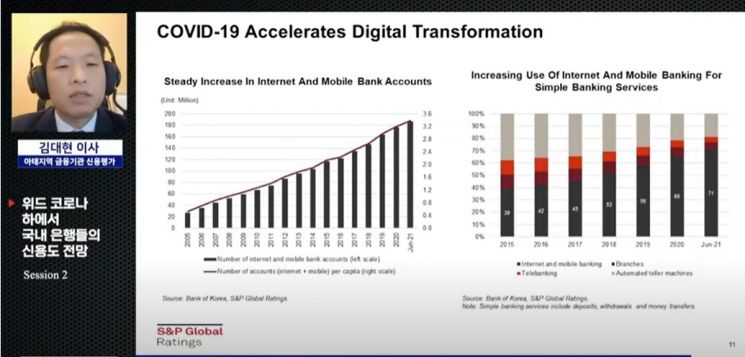

On the 9th, Standard & Poor’s (S&P) and NICE Credit Rating projected at the ‘Financial Industry and Corporate Sector Credit Risk Outlook’ seminar that domestic banks will maintain stable credit ratings next year. Kim Dae-hyun, Director at S&P, stated, "While some European banking systems continue to experience low profitability due to COVID-19, domestic banks are expected to maintain stable creditworthiness through improved profitability, sound asset quality, and controlled loan loss expenses."

Director Kim added, "We anticipate improvements in both the average Return on Average Assets (ROAA) and Net Interest Margin (NIM) of domestic banks this year and next. The ROAA is expected to approach 0.6%, which is higher than that of France, the UK, Germany, and Japan, and the non-performing loan ratio relative to total loans will remain below 1%, indicating sound asset quality."

Lee Hyuk-jun, Executive Director at NICE Credit Rating, also assessed the credit rating outlook for eight financial sectors, including banks, as ‘stable,’ noting, "The rising benchmark interest rate environment is expected to improve profitability in the banking and insurance industries through margin expansion."

He mentioned that the current trend of interest rate hikes this year and next is similar to the sharp increases seen during the economic recovery period of 2010?2011, stating, "During the 2010?2011 interest rate hike period, banks and insurance companies experienced significant increases in net income." The Bank of Korea raised the benchmark interest rate twice in the second half of this year, and an additional two to three hikes are expected next year.

However, he reminded that the potential non-performing loan ratio within total bank loans, especially the combined portion of loans under watch and below, including maturity extensions and repayment deferrals, reached 5.8% as of the first half of this year, cautioning, "We must remain open to the possibility that accumulated potential non-performing loans may materialize after financial support ends."

Currently, asset quality is being maintained through policies such as loan extensions and principal and interest repayment deferrals, but the variable of rising interest rates means that the future soundness of bank assets cannot be guaranteed?this is a common concern raised by both domestic and international credit rating agencies.

Ok Tae-jong, Senior Analyst at global rating agency Moody’s, also pointed out at the recent ‘Korea Credit Outlook Conference,’ "Even after government support and regulatory easing normalize next year, it is necessary to monitor whether banks maintain robust asset quality and stable profitability. While banking sector profitability is expected to remain stable due to NIM expansion from rising market interest rates, the onset of an interest rate hike period amid rapidly increasing debt ratios raises the repayment burden on households and corporations, which could become a key credit risk for the banking sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.