[Asia Economy Reporter Lee Seon-ae] With this year's dividend amount and dividend yield expected to decrease compared to last year, year-end (December) dividend investments are also unlikely to be as satisfactory as anticipated.

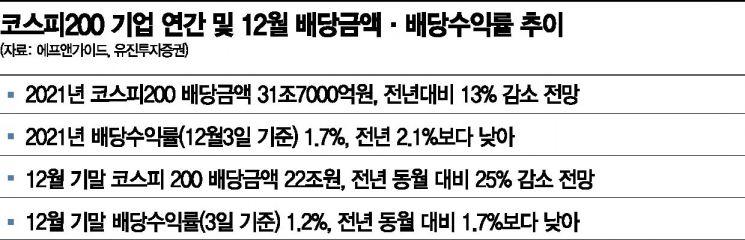

According to financial information firms FnGuide and Eugene Investment & Securities on the 8th, the annual cash dividends of KOSPI 200 companies this year are expected to decrease by 13% from last year to 31.7 trillion KRW. The year-end dividends in December are expected to be 22 trillion KRW, a 25% decrease compared to December last year. Considering only December dividends, the year-end dividend yield as of last weekend is slightly below 1.2%, lower than last year's year-end yield of 1.7%.

The significant drop in dividends compared to last year is due to Samsung Electronics' special dividend of 9.4 trillion KRW in December last year. Excluding Samsung Electronics' special dividend from last year's KOSPI 200 annual dividend amount (36.6 trillion KRW), this year's KOSPI 200 annual cash dividends would actually increase by about 18% compared to last year. The dividend yield, calculated by dividing annual dividends by market capitalization (as of the first week of December, the 3rd), stands at 1.7%, lower than last year's 2.1% at year-end.

Besides Samsung Electronics' special dividend, the expectation of program buying inflows is not high, which also reduces the attractiveness of dividend investments. Typically, from October to December every year, there is a significant inflow of program buying aimed at dividends. In particular, domestic institutions, especially securities (financial investment) firms, show prominent year-end stock purchases. However, this year, the expectation for program buying inflows for year-end dividends is not high. Assuming no Samsung Electronics special dividend in December, year-end dividends will decrease significantly compared to last year. Considering dividends, the futures spread prices traded in the market until last weekend are lower than theoretical values, which is not a favorable condition for arbitrage inflows.

Researcher Kang Song-cheol of Eugene Investment & Securities explained, "Except for the September maturity this year, futures spread prices on recent simultaneous maturity dates have mostly declined. This is believed to be influenced by the significant increase in the market capitalization of leveraged inverse ETFs (which yield double profits when the index falls) since March last year and the consequent increase in spread selling by trust funds." He added, "This maturity may also see trust fund selling exert downward pressure on futures spread prices, and the fact that securities firms had large stock purchases in October and November this year also lowers expectations for dividend arbitrage inflows."

However, from a mid- to long-term perspective, dividend amounts are expected to continue increasing. Although KOSPI 200 annual dividends decreased in 2019 compared to the previous year, they have been steadily increasing since 2014 (excluding Samsung Electronics' special dividend in 2020). The dividend payout ratio exceeded 30% for the first time last year (2019 saw an increase due to a sharp drop in profits), and it is expected to exceed 30% again this year. Companies' cash holdings continue to record all-time highs, so the trend of increasing dividends is expected to continue in the mid- to long-term.

Meanwhile, an analysis by FnGuide of listed companies with dividend estimates from three or more securities firms showed that as of the first week of December, the stock with the highest dividend yield was Samsung Securities (8.10%). It was followed by Hyundai Heavy Industries Holdings (7.31%), NH Investment & Securities (7.27%), Woori Financial Group (7.10%), and Hana Financial Group (6.85%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)