Loan Regulations Slow Down Buying Demand Among 2030 Generation

Area Size Differences More Pronounced in Gangnam District

[Asia Economy Reporter Ryu Tae-min] Signs of a full-fledged decoupling are emerging in the Seoul housing market as well. While prices are weakening mainly in mid-to-low-priced complexes in the outskirts, the mid-to-large-sized market centered around Gangnam continues to show strength. This appears to be due to the government's loan regulations and the increased comprehensive real estate tax burden on multi-homeowners, which has highlighted the preference for a ‘smart single property,’ while the loan restrictions have dampened the buying momentum of the ‘2030 Yeonggeuljok’ (young buyers who stretch their loans to the limit).

According to the KB Real Estate monthly housing price trend time series statistics on the 8th, the sale price of large apartments exceeding 135㎡ (exclusive area) in Seoul rose by 0.39% compared to the previous week (as of the 29th last month). This is the highest increase among major size categories. In contrast, prices of small apartments under 60㎡ rose by only 0.06% compared to the previous week, recording the lowest increase. This is about one-sixth of the increase rate of large apartments and less than half compared to the 0.14% increase of mid-small apartments between 60㎡ and 85㎡, known as the ‘national standard size.’

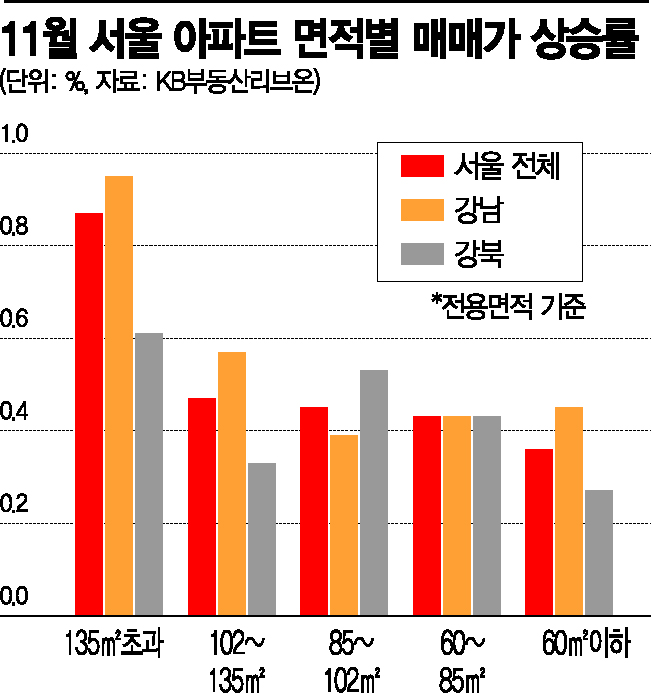

The monthly trend shows a similar pattern. Large apartments rose by 0.87% in one month, approaching 1%, while small apartments increased by only 0.36%. During the same period, mid-large (over 102㎡ up to 135㎡) rose by 0.47%, mid-size (over 85㎡ up to 102㎡) by 0.45%, and mid-small by 0.43%.

This phenomenon is interpreted as the buying momentum of the 2030 Yeonggeuljok, who had been flocking to relatively affordable small apartments, slowing down due to the recent strengthening of government loan regulations. On the other hand, as the holding tax burden on multi-homeowners has surged, the preference for mid-to-large-sized apartments in Gangnam, known as ‘smart single properties,’ seems to be intensifying.

The gap between large and small apartments is even more pronounced in the 11 districts south of the Han River, including the Gangnam 3 districts. In the fifth week of November, large apartments soared by 0.46%, while small apartments increased by only 0.08%. The monthly change last month also showed large apartments rising by 0.95%, whereas small apartments recorded 0.45%, less than half of the large apartments.

The 14 districts north of the Han River show a similar trend. As of the fifth week of November, the sale price increase rate for large apartments was 0.17%, while small apartments were only 0.05%. Looking at the entire month of November, large apartments rose by 0.61%, more than twice the 0.27% increase of small apartments.

Seo Jin-hyung, president of the Korea Real Estate Society (professor at Gyeongin Women's University), explained, “As the comprehensive real estate tax has recently been strengthened, the burden on multi-homeowners has increased, causing those with multiple homes to sell smaller units and move to larger apartments, widening the price increase gap. If the government continues its current policy stance, these phenomena are bound to persist.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.