[Asia Economy Reporter Jeong Hyunjin] It has been argued that major shareholders under domestic law should be excluded from the scope of secondary tax liability, as the secondary tax liability for major shareholders is defined too broadly and is a uniquely Korean regulation not found in other countries, thereby hindering companies.

The Korea Economic Research Institute (KERI), under the Federation of Korean Industries, stated this on the 8th in a report titled "International Comparison and Implications of Secondary Tax Liability - Focusing on Major Shareholders." KERI explained, "Foreign secondary tax liability systems are clearly legally justified and designed to minimize infringement on third parties' property rights, but in Korea, secondary tax liability is imposed even when there is no fault or tax avoidance concern, resulting in relatively heavy tax burdens."

According to KERI, the United States and Germany do not have provisions imposing secondary tax liability on investors (major shareholders) as in domestic regulations, and even for other secondary tax liabilities, they impose them restrictively only when there is intentional or gross negligence or culpable reasons such as fraudulent transfer. Japan also excludes major shareholders from the scope of secondary tax liability and, in other cases, imposes secondary tax liability only to the extent of illegal acts or received benefits. Deputy Research Fellow Lim Dongwon of KERI asserted, "Korea is the only country that has a system imposing excessive secondary tax liability on major shareholders."

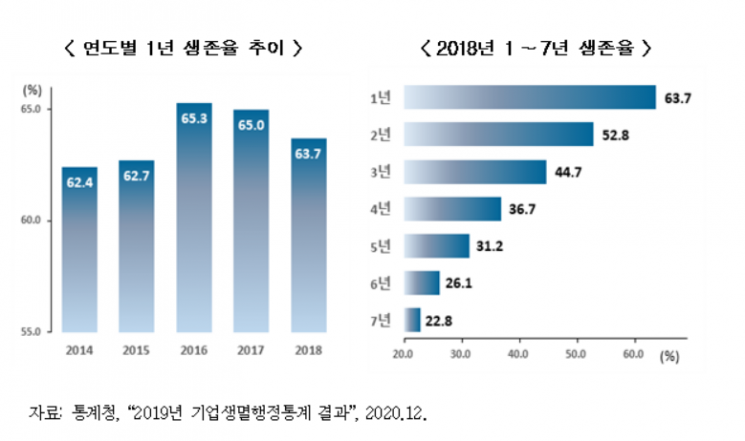

KERI views that due to the excessive secondary tax liability on major shareholders, it may be difficult to restart a business after closure if one operates a small unlisted company and holds most of the issued shares. According to the report, as of 2018, the one-year survival rate of startups was 63.7%, and the five-year survival rate was 31.2%, showing a declining trend. 68.8% of startups close within five years, and 36.3% close within one year. Furthermore, most companies close while having unpaid taxes, and the unpaid taxes incur late payment surcharges (additional charges) of 3% upon default, plus 0.025% daily for up to 60 months (9.125% annually), increasing the unpaid tax amount by up to 48%, resulting in a maximum burden of 148% of the unpaid tax amount.

Deputy Research Fellow Lim pointed out, "The secondary tax liability system for major shareholders violates the principle of limited shareholder liability and raises concerns about infringement on shareholders' property rights, so liability should only be imposed when legal justification is established." He emphasized that cases justifying imposing secondary tax liability on major shareholders require actual illegal acts such as the corporation unlawfully distributing profits to major shareholders, and the secondary tax liability should be limited to the amount of those benefits.

He added, "Under the current system, the scope of major shareholders who exercise dominant influence over corporate management should be specifically defined in the enforcement decree to enhance taxpayers' predictability and legal stability. Also, since taxpayers suffer mental and financial damage due to formalistic and administratively convenient proof actions by tax authorities, sufficient burden of proof should be imposed on the tax authorities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.