Carefully Read the Core Manual

Separate Management Required for Retirement Benefits and Additional Contributions

[Asia Economy Reporter Park Sunmi]#. Mr. A joined an IRP last year thinking only about the year-end tax deduction benefits, but when he terminated the IRP this year to purchase a vehicle, he was taxed on other income at a higher amount than the deduction. The mistake was not properly reading the key explanation document when signing up for the IRP.

#. Mr. B, who received severance pay into an IRP account from his previous job, has been making additional annual contributions to the same account for year-end tax settlement. Later, when he tried to withdraw some funds due to an emergency, he found that partial withdrawals are not allowed from an IRP account, so he had no choice but to terminate the entire account and bear the tax disadvantages. The mistake was not managing severance pay and additional contributions in separate IRP accounts.

On the 7th, the Financial Supervisory Service provided useful financial information (financial tips) that the public should know in everyday financial transactions, including precautions to check before joining a personal retirement pension (IRP).

An IRP refers to a retirement pension account where a worker receives severance pay upon retirement or makes voluntary contributions for year-end tax deductions. Contributions to an IRP account are eligible for tax credit benefits up to 7 million KRW annually (13.2~16.5%). Products that can be included in an IRP account are diverse, including deposits, funds, ETFs, and REITs.

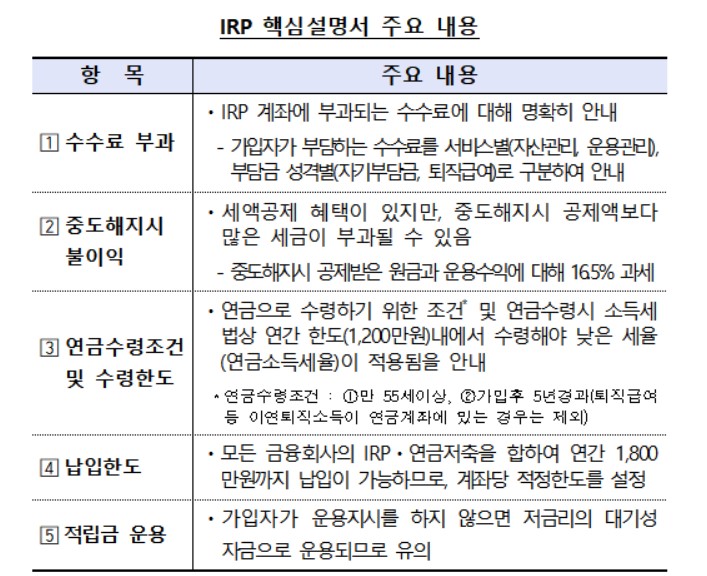

It is advisable to carefully read the key explanation document provided when joining an IRP and confirm whether there are any disadvantages related to early termination before signing up. This is because there have been cases where people hastily joined thinking only about tax credits at year-end settlement and later regretted upon learning about the disadvantages of termination. If an IRP is terminated early, a 16.5% other income tax is imposed on the contributions that received tax credits and the investment gains.

It is more advantageous to manage severance pay and additional contributions separately rather than integrating them into a single IRP account. Since partial withdrawals from IRP funds are generally not allowed and early termination requires full withdrawal, which may cause tax disadvantages on the entire amount, it is necessary to separate and manage the severance pay account and the additional contribution account. By managing IRP accounts separately, in case of urgent financial needs, only one account can be selectively terminated, minimizing tax disadvantages, while the non-terminated account can be maintained as a pension asset.

IRP fees should be carefully considered before joining. Since IRP accounts are maintained for a long period from retirement until the end of pension receipt, fees significantly affect returns. It is advantageous to open an IRP account with a financial company that charges low fees, so it is necessary to compare fee rates of financial companies before opening an account.

Recently, more financial companies are waiving retirement pension fees for online IRP accounts, but there are additional points to check even in such cases. IRP accounts can include ‘severance pay’ received at retirement and ‘self-contributions’ made by workers for year-end tax settlement, and most financial companies apply different fee rates depending on the nature of the contributions and the subscription route.

If you have already joined an IRP, you may consider using the pension account transfer system to move your IRP to a financial company with lower fees. However, if the products such as deposits included in the IRP account have not matured at the time of transfer, early termination rates lower than the maturity rate may apply, so it is necessary to adjust the timing of the transfer accordingly.

Additionally, since the types of financial products offered vary by financial company, you should first confirm whether the company can provide products suitable for your investment preferences before opening an IRP account. If you want to operate principal-guaranteed products such as deposits in your IRP account, you can use the ‘Interest Rate Comparison Disclosure’ on the Integrated Pension Portal.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)