Discussion on Improvement Measures for Washing Prevention System

Need to Establish Goals and Develop Mid- to Long-Term Strategies

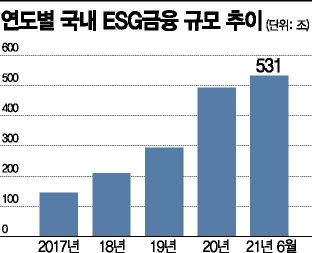

[Asia Economy Reporter Kiho Sung] The scale of domestic ESG (Environmental, Social, and Governance) finance surged by 242% from 2017 to 492 trillion won last year, but there are calls for the establishment of an ESG finance ecosystem to achieve qualitative growth. In particular, the Financial Services Commission's ‘2021 Green Finance Promotion Plan’ is seen as short-term and unable to cover the entire ESG finance sector, highlighting the necessity for a mid- to long-term strategic plan.

On the 7th, Kim Tae-han, Senior Researcher at the Korea Socially Responsible Investment Forum, made this claim during a presentation titled ‘Analysis of ESG Finance Status and Institutional Implications’ at the ‘ESG Finance Activation and Improvement Measures for Washing Prevention’ forum hosted by Rep. Lee Yong-woo of the Democratic Party at the National Assembly. This forum was based on the ESG Finance White Paper policy report, the first of its kind published domestically by Rep. Lee and the Korea Socially Responsible Investment Forum.

Domestic ESG finance has rapidly grown from 144 trillion won in 2017 to 492 trillion won last year, reaching 531 trillion won by June this year. Notably, ESG investments and ESG bond issuances have grown more than sixfold and thirteenfold respectively compared to 2017.

However, there is criticism that the standards for ESG finance goals vary, making it urgent to establish consistent criteria for goal setting. Researcher Kim explained, "Thirty-two financial institutions (27 private, 5 public) report their ESG finance goals, but the criteria for goal setting differ by institution, making it difficult to grasp future investment scales and compare goal levels." He added, "To understand the flow of funds for a sustainable economy and prevent ‘ESG washing’ (greenwashing), clear standards for setting ESG finance goals must be presented."

Kim also pointed out the need for ▲ rapid introduction of social classification systems ▲ strengthening standards for green classification systems ▲ and the introduction of financial product ESG information disclosure systems to activate ESG finance.

He stated, "The social (S) area, which accounts for the largest portion of domestic financial institutions' ESG finance, has yet to even mention the introduction of classification systems. Alongside this, it is necessary to establish definitions and disclosure standards for financial products to guarantee financial consumers' right to know and choice."

Meanwhile, the presentations at the forum included Kim Tae-han, Park Sung-han, Vice President of Shinhan Financial Group, with ‘Shinhan Group ESG Management Strategy,’ and Shim Jae-hwan, Executive Director in charge of equity and bond management at Korea Investment Management, with ‘KIM ESG Asset Management Strategy.’ The discussion was chaired by Ryu Young-jae, CEO of Sustainvest, with panelists including Kim Kyung-min, Team Leader of ESG New Deal Planning at Korea Development Bank; Park Kwon-il, Head of ESG Office at DB Insurance; Hwang Sun-gu, Head of Corporate Support Department at Korea Exchange; Kwon Mi-yeop, ESG Platform Partner at Samil Accounting Corporation; Cho Hyun-soo, Director of Green Transition Policy Division at the Ministry of Environment; and Jeon Su-han, Director of New Deal Finance Division at the Financial Services Commission.

Rep. Lee said, "During the publication process of the policy report, it became clear that standards for domestic ESG finance are not well defined, highlighting the need for institutional improvements to prevent washing issues. Through this forum, I hope clear standards for ESG finance will be established, leading to the sound activation of ESG finance and the establishment of washing prevention systems in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.