Since April Last Year, 963.5 Billion KRW of Principal Debt Has Been Deferred

Extension of 'Enhanced Support Measures for Vulnerable Individual Debtors' Until the End of This Year

[Asia Economy Reporter Park Sun-mi] Individual debtors experiencing difficulties due to reduced income from COVID-19 can apply for a principal repayment deferral on household loans until the end of June next year.

On the 7th, the Financial Services Commission announced that considering the repayment burden on low-income and vulnerable groups caused by the impact of COVID-19, the application period for the "Enhanced Support Measures for Vulnerable Individual Debtors," originally set to end this year, will be extended by six months.

Since April last year, financial authorities have been implementing the "Enhanced Support Measures for Vulnerable Individual Debtors" for those whose income has decreased due to unpaid leave, loss of work, etc., caused by COVID-19, making it difficult to repay household loans. So far, through two extensions of the application period, this has contributed to reducing the repayment burden on vulnerable groups such as low-credit and multiple debtors. From April last year to the 19th of this month, the principal amount of deferred repayments for individual debtors is approximately 963.5 billion KRW, covering about 36,000 cases.

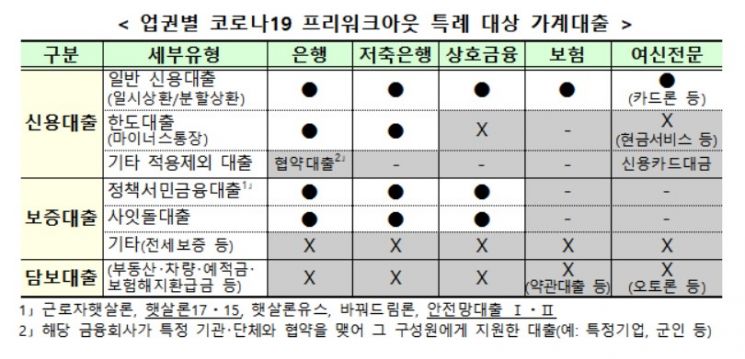

First, the application deadline for the special pre-workout program by financial companies will be extended by six months until the end of June next year. The support targets individual debtors who have difficulty repaying household loans such as unsecured loans (excluding secured loans and guaranteed loans), government-backed policy loans for low-income earners, and Saetdol loans due to income reduction after the COVID-19 outbreak, with concerns about delinquency.

To receive benefits, applicants must prove that their income has decreased due to unemployment, unpaid leave, loss of work, etc., since February last year when the COVID-19 outbreak began. The monthly income after deducting living expenses must be less than the monthly debt repayment amount owed to the financial company, and the application applies to those who are either just before delinquency or have short-term delinquency of less than three months.

Principal repayment can be deferred for up to one year, while interest must be paid normally. Debtors who have already deferred repayment for one year through the special pre-workout program can reapply starting from the 1st of next month. Since financial authorities have indicated a policy direction to provide sufficient limits and incentives for mid- to low-credit loans and policy loans for low-income earners in next year's household loan volume management, the repayment deferral under this measure may be considered in future volume management.

It is also possible to adjust multiple debts at once through debt adjustment by the Credit Recovery Committee, in which all financial sectors participate as agreement institutions. This applies to individual debtors who have difficulty repaying unsecured loans due to income reduction after the COVID-19 outbreak and have concerns about delinquency. In case of delinquency concerns, principal repayment can be deferred for up to one year, and if delinquency prolongs, debt adjustment support such as principal reduction will be strengthened.

Additionally, financial authorities will extend the application period of the Personal Delinquent Debt Purchase Fund (KAMCO) by six months until the end of June next year to prevent the possibility of excessive collection by loan companies due to the sale of personal delinquent debts caused by COVID-19 damage. The scope of purchased debts will also be expanded to delinquent debts from February 2020 to June 2022. If financial companies find it unavoidable to sell delinquent debts for soundness management, they must prioritize selling to KAMCO.

A Financial Services Commission official said, "We will continue to provide sufficient financial support to vulnerable sectors with slow recovery until COVID-19 is completely overcome," and added, "Under the basic principle of preparing for orderly normalization, we will continue to review additional support measures as necessary to reduce the repayment burden on vulnerable individual debtors and provide prompt recovery support."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.